Source: Bianco Research

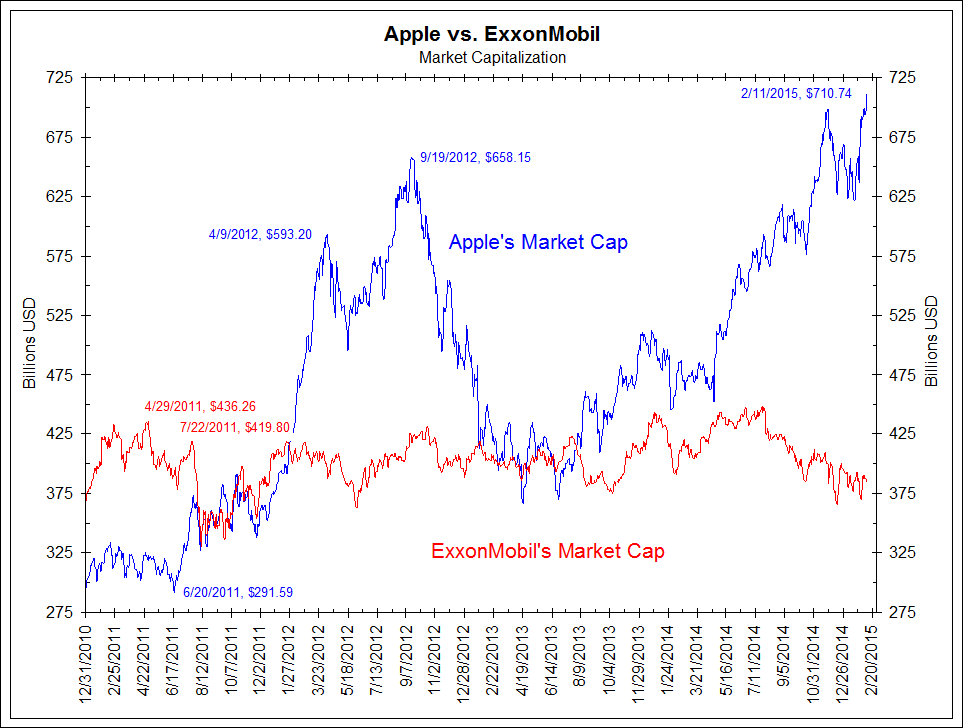

Apple vs. Exxon

February 18, 2015 4:00pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Masters in Business: Jim McCann, CEO 1-800 FlowersNext Post

Robots Are Walking

“Market valuation” is merely the ranking of stocks in a market popularity contest. To understand the order in which the entrants are ranked, one need to look at performance metrics, things like free cash flow, margins, revenue growth … how effectively each entrant generates profits.

That said, the rankings shown are fair representations of the market’s assessment of each of these companies along those lines.

Apple’s worth 20x next years earnings, or $183/shr

that is $1.1 trillion

My call: after successful launch of Apple Watch in April, expect a 50 billion one time dividend or buy back, around July, after Cook get’s to confirm demand & margin mix of the watch

I’m glad your crystal ball tells you what Apple is going to earn next year. Mine’s pretty foggy.

Correction, Apple is worth 20x next year’s estimated earnings, which almost always turn out to be lower than actual earnings.

Apple builds nice products. Exxon destroys the planet.

An iPhone uses more electricity than a refrigerator, due to all the cloud operations necessary for it to work every time you, for example, check the weather.

Exxon is no more responsible for the mileage of your car than Apple is for your phone electric use.

I compare the chart in crude with the nasdaq 1999/2000 chart. Both showed a parabolic rise, collapse, and failed counter trend rally that ultimately failed. Given the length of the topping process for crude, I feel the bottoming and basing will too take years to occur. The back of the envelope target I get, from looking at the inverted flag pattern on the monthly crude chart points to $20 a barrel. XOM chart looks like a very long topping process. Right now the voters are saying AAPL is still worth buying while XOM is not.