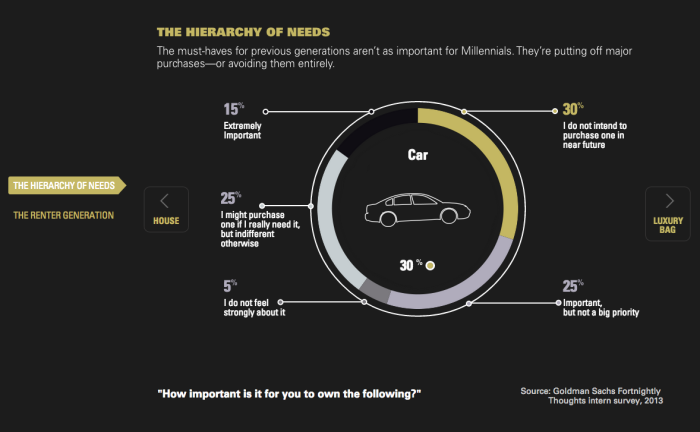

Click for an interactive graphic.

Source: Goldman Sachs

March 2, 2015 4:00pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

Previous Post

Masters in Business: Joe Saluzzi of Themis TradingNext Post

John Oliver on Infrastructure

Uber thx milliennials

As the parent of four millenials, I think it boils down to two fundamental questions:

1. Will they stay single and/or childless in their 30s?

2. Will they remain in the city center if they do have kids?

The answers to these questions will drive many of their future spending decisions.

What happens if the Government starts paying them to squeeze out another?

They already do. Dependent exemption, child tax credit, EITC, child and dependent care credit. Canada used to pay you money if you made babies.

The real question is the percentage that will have kids versus the percentage that won’t. Unless they are fairly well off my thought is that the poor public schools in the city centers in general will drive them to the suburbs if they have kids. (If they can afford private school, then it does not matter as much).

I’m a little bit amused that the millenials, who are massive enthusiasts about Apple products, claim that brand isn’t important, and that price is important….. Hmmmm…..

That being said, @rd, I have 3 millenials of my own, and one of the big things I’m wondering about is housing, which you allude to. We live in Silicon Valley, so we really need a whole bunch of millenials to buy our super-expensive houses from us. But one trend that I expect to pick up steam is the idea that you don’t need to live in SV in order to start up a successful business, because it is too friggin’ expensive for young people to live here. That will certainly disrupt my scheme to sell my house, move to Montana and become a dental floss tycoon.

(Warning, anecdotal evidence time) FWIW, of the handful of Millenials that I know, who have gainful employment, the first purchase they’ve made is a car, the next being a house. I’d say it’s a meaningful trend once all of them finally manage to get decent paying jobs, and that part of what we’re seeing is a generation that’s mostly broke or in debt at the moment.