Welcome to the weekend. Pour yourself a mug of Guatemalan Antigua Valley coffee, settle in for our long form Saturday morning reads:

• At Kodak, Clinging to a Future Beyond Film (NYT)

• Stanford’s Most Popular Class Isn’t Computer Science—It’s Something Much More Important It’s Called “Designing Your Life,” A Course That’s Part Throwback, Part Foreshadowing Of Higher Education’s Future. (Fast Company)

• The Deadly Global War for Sand (Wired)

• How Chicago has used Financial Engineering to Paper over its Massive Budget Gap (Medium)

• The Brain’s Empathy Gap: Can mapping neural pathways help us make friends with our enemies? (NYT Magazine)

• Apple’s Tim Cook leads different (Fortune)

• Is Newark the Next Brooklyn? The “homeless billionaire,” a world-renowned architect and the future of Brick City. (Politico)

• ‘They Didn’t Believe the Camels Were Ours’: What a journalist’s seven-year walk around the world reveals about global policing. (Marshall Project)

• How one man’s utopian vision for the Internet conquered, and then warped, Silicon Valley (Washington Post)

• Death, Redesigned: A legendary design firm, a corporate executive, and a Buddhist-hospice director take on the end of life. (California Sunday) see also Who Lives and Who Dies: Who survives? (London Review of Books)

Be sure to check out our Masters in Business radio show with Charley Ellis, Chair of Yale Endowment, and author of Winning the Loser’s Game: Timeless Strategies for Successful Investing.

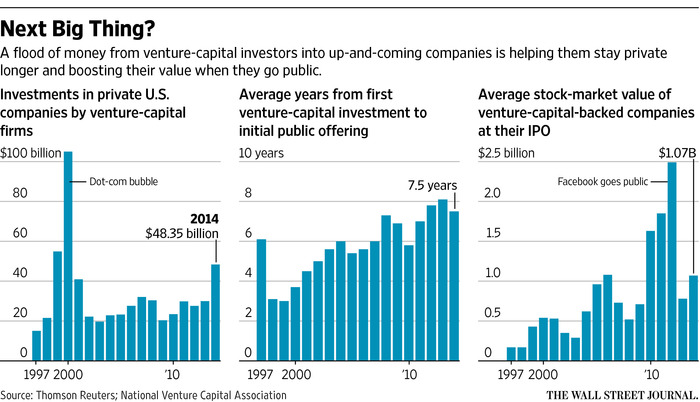

How Wall Street Middlemen Help Silicon Valley Employees Cash In Early

Source: WSJ

Re “Guatemalan Antigua Valley coffee”:

According to our tour guide in Panama, Geisha bean coffee is the world’s most expensive at $200 per pound. It is so desired because of it’s smooth, low caffeinated attributes it makes for the perfect after dinner ‘sipping coffee’. Well, this place, http://www.supergourmetcascoviejo.com/, had Janson Geisha Coffee of Panama for $12.99 per 3 ounce (an estimate) bag. It is very smooth and has very little caffeination affect. From the back of the packaging:

“From our farm to your cup: GEISHA is an arabica variety that has attained world wide recognition for Panama as the best and most expensive coffee. It is considered by many the “Champagne of coffees”. GEISHA has an extraordinary character with a rich aroma of floral and jasmine notes with citrus flavors and a touch of honey. The Janson Family is proud to offer this unique coffee hand selected and micro-roasted for your delight.

“Tour the Farm”

lagunasadventures.com

estatecafe.com

Email: jansoncafe@gmail.com

Telefax: (507) 771-4306/6867-3884″

An interesting post here about how value investors don’t end up with the value premium

http://www.researchaffiliates.com/Our%20Ideas/Insights/Fundamentals/Pages/365_Woe_Betide_the_Value_Investor.aspx

A couple of observations of my experience with value fund investing:

1. Many of the active value funds have higher turnover of their managers than their stocks. As they get a successful track record the managers seem to go off and run their own hedge funds. It is quite wearying trying to keep track of your fund in up and down markets, trying to figure out if the funds lack of performance is just a temporary lull or if the new manager is simply not as good as the old manager(s).

2. A number of the value funds that started out as a single fund end up being bought by a bigger fund group. The increased fund size that the additional marketing brings in often does seem to impact performance.

3. 401ks frequently switch management companies which bring in a whole new slew of funds that get remapped. Even if there is no new management firm, a lot of funds get remapped periodically. As a result, the value portion of my 401k portfolio has probably had a half-dozen different managers over the past dozen years.

4. Tired of the constant fund and manager changes for what is supposed to be a long-term, multi-decade strategy, I started to focus the active part of my portfolio (limited access to index funds in the 401k) on “team-managed” funds like American, Dodge & Cox etc. where manager turnover doesn’t play as large a role. They also seem to be funds that 401k firms will retain for much longer periods of time and will even be in the next 401k manager’s portfolio. These firms also tend to have relatively low expense ratios (I like Tweedy Browne but the expense ratios are too high to put much money in) as long as you don’t have to pay a front-end load or large transaction fee.

Sand. Who knew? Fascinating story.

When Peter Lynch was running Magellan, one of the types of companies he looked for was ones with quarries. They tend to own a lot of land and it is expensive to truck or ship heavy materials like sand and rock, so they have local monopolies.

The Invention of the Baby Carrot

Mar 27, 2015

The year is 1986, and you operate one of the largest carrot farms and processing plants in California. The weather is beautiful, your farm is vast, and business is good. Life is perfect except for one thing: every day, you need to throw out tons of the vegetables you worked so hard to grow, because they just aren’t pretty enough to sell.

Up to 400 tons of them, actually — up to 70% of each haul. That’s multiple blue whales’ weight in carrots, every single day. This is the position carrot farmer and producer Mike Yurosek found himself in.

It wasn’t that he was a poor farmer: most of that cull were perfectly nutritious, edible carrots. They were just too ugly by supermarket standards, so he couldn’t sell them. That really got to him, in fact it got to him enough that he came up with a solution much more revolutionary than even he realized — he could whittle the ugly full-sized carrots down into pretty, cute, small ones. In other words, Mike Yurosek invented the baby carrot, and carrots have never been the same.

….

http://priceonomics.com/the-invention-of-the-baby-carrot/

A Team of Biohackers Has Figured Out How to Inject Your Eyeballs With Night Vision

By Max Plenke

March 25, 2015

In “people becoming superhuman” news, a small independent research group has figured out how to give humans night vision, allowing them to see over 50 meters in the dark for a short time.

Science for the Masses, a group of biohackers based a couple hours north of Los Angeles in Tehachapi, California, theorized they could enhance healthy eyesight enough that it would induce night vision. To do this, the group used a kind of chlorophyll analog called Chlorin e6 (or Ce6), which is found in some deep-sea fish and is used as an occasional method to treat night blindness.

“Going off that research, we thought this would be something to move ahead with,” the lab’s medical officer, Jeffrey Tibbetts, told Mic. “There are a fair amount of papers talking about having it injected in models like rats, and it’s been used intravenously since the ’60s as a treatment for different cancers. After doing the research, you have to take the next step.”

To do so, team biochem researcher Gabriel Licina became a guinea pig.

…

http://mic.com/articles/113740/a-team-of-biohackers-has-figured-out-how-to-inject-your-eyeballs-with-night-vision

Top notch reads.

That “world’s greatest leaders” list is so stupid. Tim Cook the world’s greatest leader? Are we supposed to take that seriously?

Sounds like those “sexiest man/woman alive” type of lists, all bs.