My morning train kick back and enjoy the gorgeous weather reads:

• In Australia, Retirement Saving Done Right (Bloomberg) see also How Superannuation works (MoneySmart)

• Three investment lessons from the trees (USAT)

• Labor Department Wants to Tweak Your Retirement Plan (BV)

• The trickiest questions Apple will ask in a job interview (Business Insider)

• Regulatory Relief for Banks That Rarely Fail (NYT)

• Pesticides Linked to Honeybee Deaths Pose More Risks, European Group Says (NYT)

• What I Read (And Why) (Motley Fool)

• How the Bush Administration Pointlessly Screwed Over Student Borrowers (Slate)

• Rubio-backed insurance market covers 80 people: Obamacare, which Rubio wants to repeal, covers 1.6 million in Florida alone. (Politico)

• NRA Bans ‘Operational’ Guns At NRA Convention For Security Reasons (Incisity)

What are you reading?

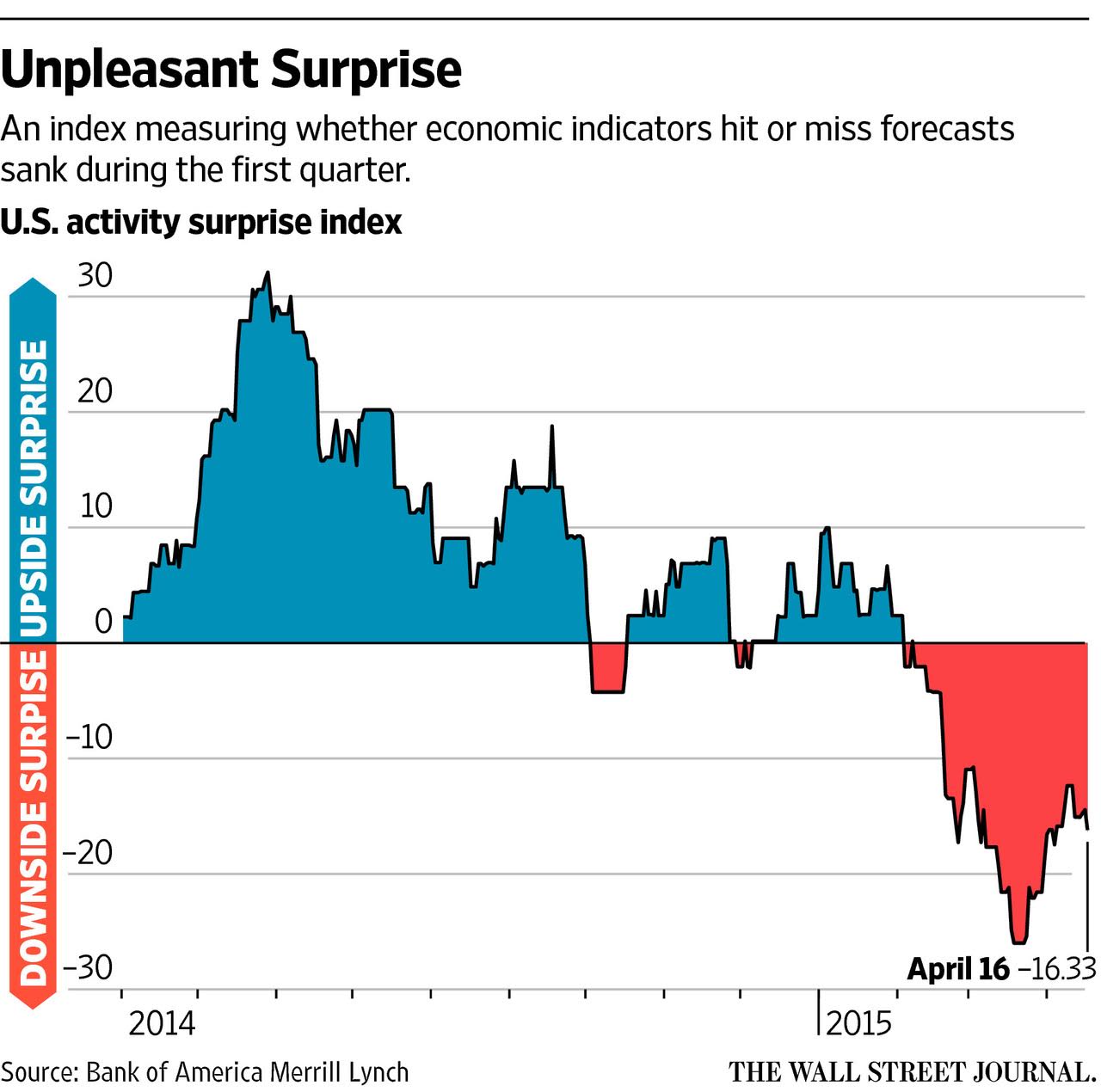

Unpleasant Surprise

Source: WSJ

So what was the leading cause of the financial crisis? Remember Buffett saying he had looked at a number of these MBS prospectus and he could not understand what was going on, this guy Furfine says it was done deliberately to hide critical facts about the MBS.

I can’t believe this guy Furfine (former FED and BIS economist, prof at Kellogg school of Management) , saying that the MBS were made deliberately complex to hide dubious “tranches”.

INSECURE SECURITIES

How deal complexity in commercial mortgage-backed securities contributed to the financial crisis.

http://news.morningstar.com/articlenet/SubmissionsArticle.aspx?submissionid=205820.xml

“What killed the economy? It’s a question that lingers nearly a decade since the global financial crisis that began in 2007. Craig Furfine, clinical professor of finance at the Kellogg School, proposes a different answer to that query than many analysts have offered: complexity.

“I saw commercial mortgage securitization deals becoming increasingly complex in the years leading up to the financial crisis, and I wanted to figure out why that was the case,” he says. “The question I wanted to answer was: Did underwriters [investment banks] use deal complexity as a way to make it easier to sell lower-quality loans?””

“A more benign way to state my research question would be: Were loans packaged into more complex deals of lower quality?” he says. “I’ve presented evidence consistent with that being true. But if that’s true, then how did those loans get there?”

“I linked the initial information about each loan when it was made to how it was performing in 2010, and I showed that after controlling for the observable characteristics of the loan, the likelihood of a loan becoming nonperforming is positively correlated with the number of AAA-rated tranches in the deal.”

“As further evidence for this, another empirical result of Furfine’s paper shows that the correlation between AAA tranches and likelihood of loan default exists only in a subset of CMBS deals: deals that contain loans originated by the same underwriter who structured the deal. “In those deals, the more complex the deal was, the more likely it is the loan is going to end up in default,” Furfine says. “For securitizations that are being put together by third parties, this result doesn’t exist. It’s the closest thing to a smoking gun I have in the paper.””

Morning train reads, yuck.

I’ve got a Forgers dark roast and well settle in to read in the morning sun instead. Hope the train can wait till tomorrow!!

~~~

ADMIN: Better make that BR’s kick back and enjoy the gorgeous weather reads:

“Bush Administration pointlessly….” could be used to start so many sentences.

So what is the size of the timber market? Will trees become the new housing market when every institutional investor, alternative mutual fund, bank, and hedge fund moves into timber investing and providing loans for timber investing? I can only assume that they will be all sophisticated investors who will be sure to evaluate all of the risks and will “stay the course” during those inevitable bumps in the returns.

However, I would suggest that if you ever read a story about David Swenson and GMO selling their timber holdings, strap on a rocket pack to get to the nearest exit before the timber investing stampeded reverses its direction.

@rd: I was having similar thoughts! I think the primary message though is that timber/lumber can be a useful tell on the direction the overall market is trending.

The photographer Sally Mann on her book “Immediate Family”, the shitstorm that created, her family, motherhood, art, etc.

http://www.nytimes.com/2015/04/19/magazine/the-cost-of-sally-manns-exposure.html

What seems to have been glossed over in the article about the Florida health care exchange is that over 100.000 people signed up on the ACA exchange without any subsidy, as against 80 on the state exchange. Supporters of the state exchange talked about the subsidy, but 100,000 to 80 is still pretty compelling, with no subsidy present.

Recession in Oil Patch Red States This Year?

“In the Oil Patch, probably yes–lost demand from the failure to expand Medicaid is likely to push them over the edge and into recession. Elsewhere it will be close, but probably not.”

http://www.portlandmercury.com/IAnonymousBlog/archives/2015/04/19/you-ruin-everything-you-ruiner

Bush admin / student borrowers – the way the conservatives have been operating for the last 30 years; make everyone the enemy of each other except for the wealthy. Same here in Illinois, divert the 1%obligation of the state from the Teachers pensions so you don’t have to raise taxes, then blame the teachers, who pay in 10%, for the deficit. Those nasty teachers and their pensions. Those evil college students. How dare they not land a good paying job after college.

Ted Cruz Raises $4 Million In His First Week Running For President

http://m.huffpost.com/us/entry/7075464

Ted Cruz Raises $31 Million In His First Week Running For President

http://www.washingtonpost.com/politics/groups-backing-ted-cruz-raise-31-million-in-a-single-week/2015/04/08/36defc18-de0c-11e4-a1b8-2ed88bc190d2_story.html

Are these the same guys who did the NFL bankruptcy stuff?

On bees, I’m glad this is getting more and more exposure because it has massive implications for planetary food supplies — and not just for we humans.

I would not be surprised to learn that products such as RoundUp or other so-called benign or safe pesticides are at the root of the problem. Whatever the causation, we better get to the bottom of it before the trend in bee colony collapse becomes irreversible.

Roundup (glyphosphate) is a herbicide that is biodegradable with a fairly short half-life. On the face of it, it appears to be benign. However, the GMO crops are designed to be resistant to its impact on plants and therefore it gets used very liberally and wipes out the other plants, many of which are the milkweed species that Monarch butterflies rely on as well as most flowering plants that the pollinators in general rely on. So its secondary effects are quite devastating when used on an industrial scale over thousands of square miles, even though it is benign for local use in backyards etc..

The pesticides are simply poisons. They directly target the insects and are often non-specific, wiping out many of the insect species in the vicinity, not just the ones doing the crop damage. Many of the pesticides also take a long time to break down and are residual in the eco-system long after the initial application. We do analytical testing on soils and there are some pesticides that show years after they were applied.

The reason the honeybee colony collapse disorder has been such a huge deal for agriculture is because industrial agriculture has been wiping out the pollinators in the vicinity of the fields that need ot be pollinated, requiring them to be imported. The almond crops in California are a classic examples of this where most of the native pollinators in the vicinity of the almond tree farms were largely wiped out.

More on bees:

From the UC Berkeley Urban Bee Lab:

When one thinks about bees, they typically think about the honey bee or bumble bee. These two bees actually represent only a very small fraction of the diversity of bees in the world. Locally, in California we have about 1,600 species of native bees, some social, but most are solitary.

http://www.helpabee.org/bees-how-diverse-can-they-be.html

NYC alone has more than 200 bee species.

On bees…there are of course, lots of folks studying this problem and it turns our mycology may hold the key to saving bees. In the end, we’re all connected.

http://permaculturenews.org/2014/11/27/paul-stamets-how-mushrooms-can-save-bees-our-food-supply-bioneers/

I caught > 7 errors in the Bloomie piece on AUS superannuation, which aren’t germane to the points below:

1) the retirement savings industry in this country is perhaps the world’s most expensive, in terms of fees and charges the hapless ‘saver’ is inflicted with [the single greatest factor in accumulating wealth over a lifetime is low fees]

2) The ‘Big 4’ banks are fundamentally & hopelessly conflicted with their armies of ‘advisors’, & the banks’ own proprietary platforms & products, which form the basis for the ‘advisors’ remuneration:

http://www.smh.com.au/business/senate-banks-inquiry-may-not-fix-advice-malaise-20150420-1mo717.html