Source: Flowing Data

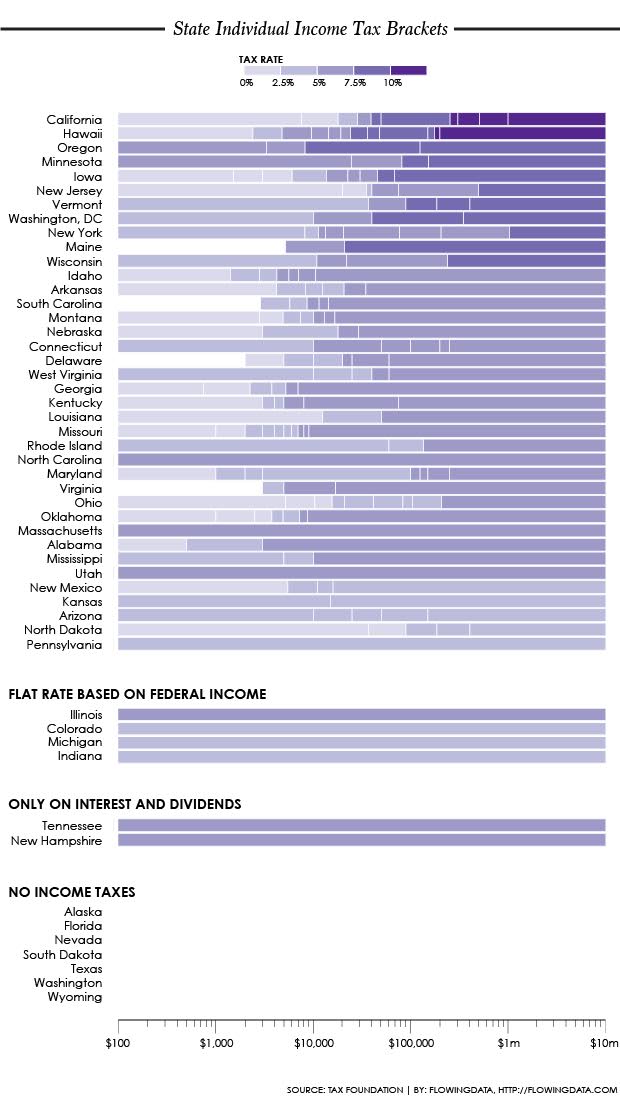

State Individual Income Tax Brackets

April 15, 2015 1:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Investor Friendly Tax Policy Both Parties Can Like

Got anything about overall tax burden per state (seeing as there are states that don’t have income tax, but still have other significant taxes)?

From personal experience, not having to file a state income tax is cool (I live in Texas), but from what I understand, Texas “makes up” for that with higher tax burdens in other areas (ie, property taxes).

When I moved from Oklahoma 15 years ago, my expenses went up. It was probably a function of moving to a large metro area (Dallas) from a smaller one (OKC). Not having an income tax is fine, but it’s not like we all have tons of disposable income because of it. I think it’s more of a boon for rich people than us plebes. My rent went up by $150 a month when I moved here, and not because I was living in a much nicer place. Auto insurance was quite a bit higher when I moved. Even gas is a little more than in OK. So just because there’s no income tax doesn’t mean we all enjoy an affordable living paradise down here, like Rick Perry always suggested.

So the no income tax thing here is kind of a wash, in terms of overall cost of living. And remember that Texas is represented by idiots like Ted Cruz and Louie Gohmert. I’d gladly pay income taxes if that could ensure that our congressional delegation (and most of our state legislature, plus the governor and lt. gov) wasn’t a bunch of tools.

So right you are. I was in Phoenix recently and they have a whopping 10.7% sales tax. So much for conservatism. And I see red states like TN. and N.H. penalize us investors. In so called liberal OR. there isn’t a sales tax, $50 car registration for 2 years, no tax on luxury items like boats, planes, and rv’s, very low property taxes ($1200 for my 3 bdrm house) but a high income tax. Of course if you don’t have an income (legally or illegally), that’s not a problem.