Its the weekend, and that means our longer-form, Brooklyn sourced, artisanal reads:

• How Wall Street captured Washington’s effort to rein in banks (Reuters) see also Can Bankers Behave?Government regulators begin to question whether financial institutions can be reformed at all. (The Atlantic)

• Apple Watch: An Overnight Multi-Billion Dollar Business (Carl Howe)

• Payday at the mill: How sophisticated financiers used a Maine investment program they devised to wring millions of dollars in risk-free returns at taxpayer expense (Portland Press Herald)

• Buzzfeed’s Ben Smith and Jonah Peretti: The Gawker Interview (Gawker)

• FBI admits flaws in hair analysis over decades (Washington Post)

• The United States of Legal Weed Here’s where pot is legal and semi-legal—and the next places it could go legit. (MoJo)

• Why the FDA doesn’t really know what’s in your food (Public Integrity)

• It’s Time for a Conversation: Breaking the communication barrier between dolphins and humans (National Geographic)

• Bill Withers: The Soul Man Who Walked Away (Rolling Stone)

• The Alphabet of Satire: Rube Goldberg was a laugh machine for seven decades. (City Journal)

Be sure to check out our Masters in Business interview this weekend with Liz Ann Sonders, Charles Schwab’s chief strategist.

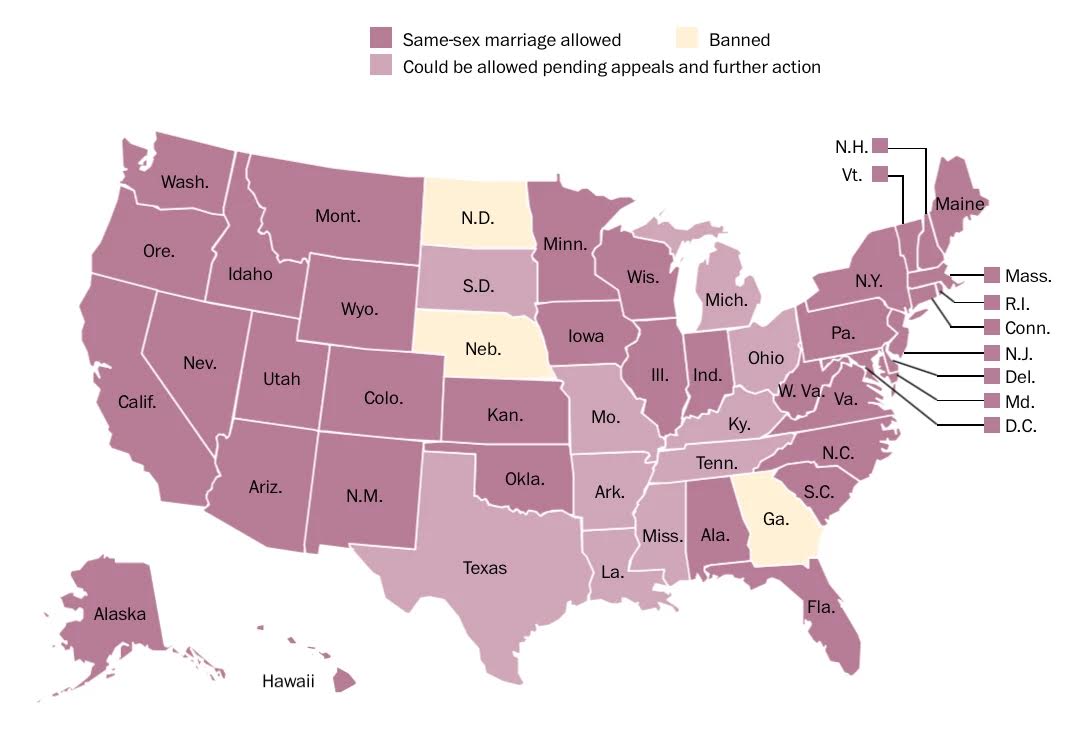

The Changing Landscape of Same-Sex Marriage

Source: Washington Post

Re: Can Bankers Behave?

Here is another example of “Bad Barrel” influence on market participants. The engineering and construction industry in Montreal has been rocked over the past 5 years by the Charbonneau Commission that has uncovered massive corruption and bid-rigging that has gone on for decades as just a normal part of business. Numerous politicians have also been implicated and have resigned. Corruption can occur anywhere where it is tolerated.

http://en.wikipedia.org/wiki/Charbonneau_Commission

This is why SEC and DoJ have completely and utterly missed the boat on resetting the norms by a total refusal to prosecute anything but insider trading which is a relatively minor part of the financial industry ethical and legal challenges. Nobody has gone to jail for clear rigging of markets (Libor is just one classic example) and fraud (pick just about any file from the subprime mortgage MBS collapse). The people in pinstripe suits don’t want to wear other types of stripes and don’t think they look good in orange jumpsuits. A strong message needs to be sent by the rest of society that their behavior over the past decade has been completely unacceptable.

Same-sex marriage is definitely allowed in Missouri. My wife will be performing one in a few weeks.

“…Can Bankers Behave?Government regulators begin to question whether financial institutions can be reformed at all…”

Business cycle worshipers may have to rethink the inevitability of frequent declines. It’s all about Bankers jumping on the bandwagon, the ultimate dumb money,

America’s preeminent climate deniers are sending “real scientists” to the Vatican to teach the Pope about global warming

“…The Koch-backed Heartland Institute will enlighten Pope Francis about our “Biblical duty” to destroy the planet…”

http://www.salon.com/2015/04/24/americas_preeminent_climate_deniers_are_sending_real_scientists_to_the_vatican_to_teach_the_pope_about_global_warming/

You’re you’re all talking about the the GOP fabricated “Clinton Cash” scandal

Republicans are definitely the party of manufacturing, of manufacturing nonsense to confuse people so they can be free to give tax cuts to the very rich,

Same sex marriage is banned in the Colorado Constitution.

Overruled by the courts.

But, the statute still exists as the legislature is too lazy to propose a repeal.

Weekly indicators: consumer breakout vs. hiring breakdown edition

This week modulated what has been the dominant theme of the last several months: poor coincident indicators with positive long and short leading indicators. There is a shallow industrial recession, but a resilient consumer economy. If there is one more good week in the Gallup consumer survey, I will be confident of an upside breakout in consumer spending. On the other hand, it looks like Oil patch weakness is affecting hiring.

listening to x_nax (nymag http://nym.ag/1I8Vw0C)

See C0ngress polarize over the past 60 years, in one beautiful chart (vox http://bit.ly/1E3K03y)

The Art of Staying Focused in a Distr_cting World (the atlantic http://theatln.tc/1PAraGx)

weird some word in that headline didn’t let me post. anyhoo, when i recently posted old links, i neglected to mention the most important thing: i discovered The Big Picture around 2007 BR was bearish and possibly short. then he turned bulling in the spring of 2009 right at the bottom. i’m sure he caught this hated bull all the way up. BR is money

never never gonna give you up (youtube http://bit.ly/1GulMDz) cake does rick astley who (i had no idea until last night) did barry white

Love the Bill Withers piece. A little Saturday morning soul. Bravo.