During the show on Thursday, a guest suggested that the average down payment on homes were 3%; That turns out to be significantly off by an order of magnitude — its 14.8%.

Source: Housing Wire

During the show on Thursday, a guest suggested that the average down payment on homes were 3%; That turns out to be significantly off by an order of magnitude — its 14.8%.

Source: Housing Wire

Good gawd man, did it get qualfied for first time buyers only? For an upsize or down size from a previous house in an area with big time appreciation and some time in the property , ya gotta be lookin’ at 30-50% down on the new mortgage….

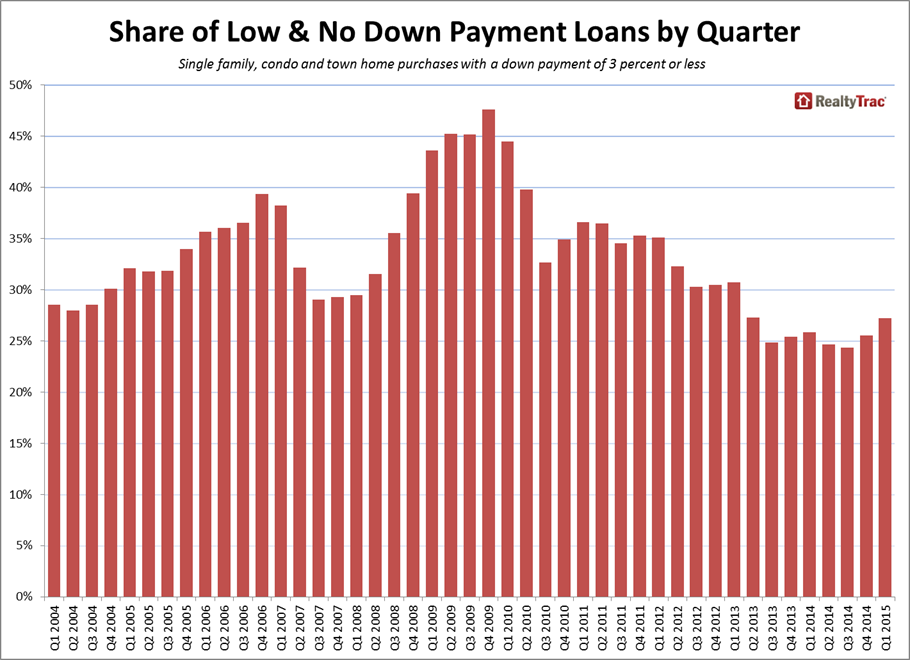

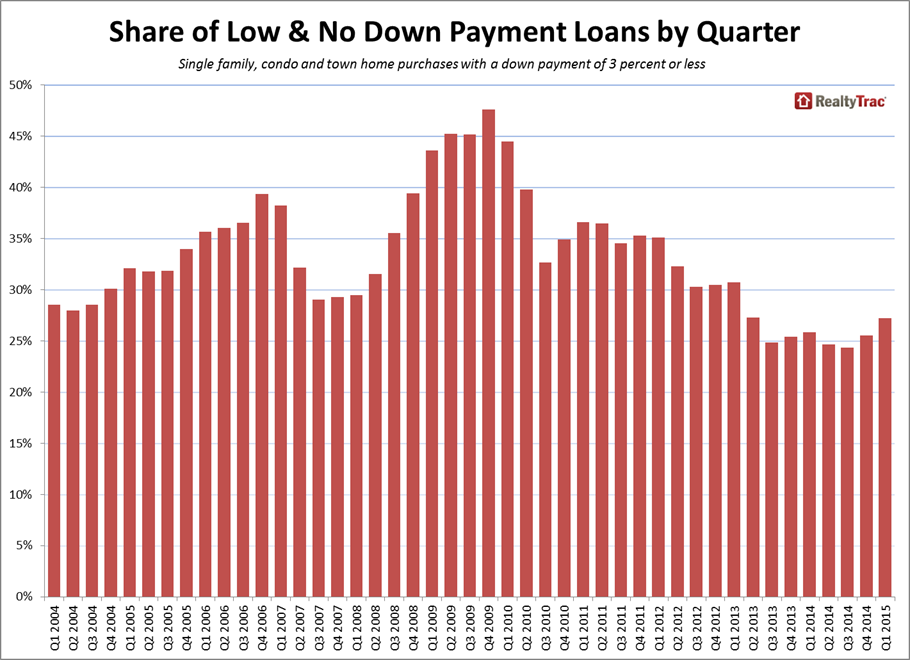

There are several government programs offering low-down mortages. VA is as little as 0% down, with no mortgage insurance. USDA offers “rural housing loans” at 0% down and I gather that some suburban properties qualify. FHA is 3.5% down. In Dec 2014, Fannie and Freddie announced a new program requiring as little as 3% at closing.

So, this chart seems to be telling us what percentage of all home sales were completed using government financing programs. Not surprising that the percentage was so high from Q4 2008 through Q1 2010 when traditional private mortgage financing was harder to come by and home sales were way off as a result.