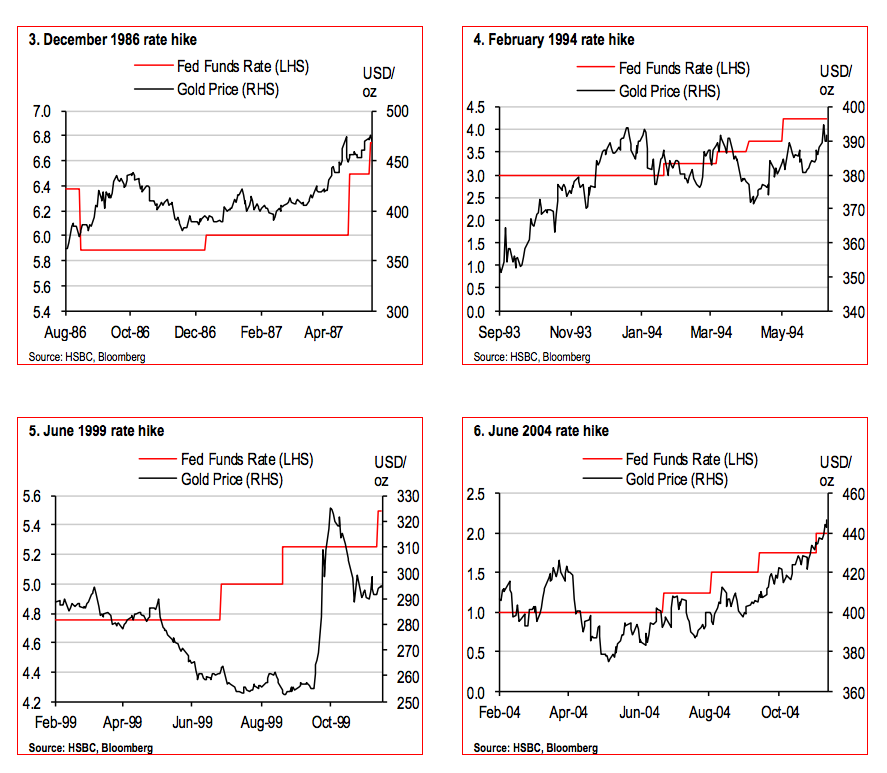

Interesting few examples from the past showing Gold benefitting from rate increases, as per a report by HSBC’s FX strategist, David Bloom.

A few caveats: Rate increases typically occurred during periods of elevated inflation, and during currency fluctuation, especially a weak dollar. At present, we have deflation, and the dollar is at 12 year highs. Traders are urged to be careful drawing any conclusions from any one single variable.

Except for 2004, it looks like the Fed follows gold, and not vice versa.

Source: Reformed Broker