Source: Bloomberg

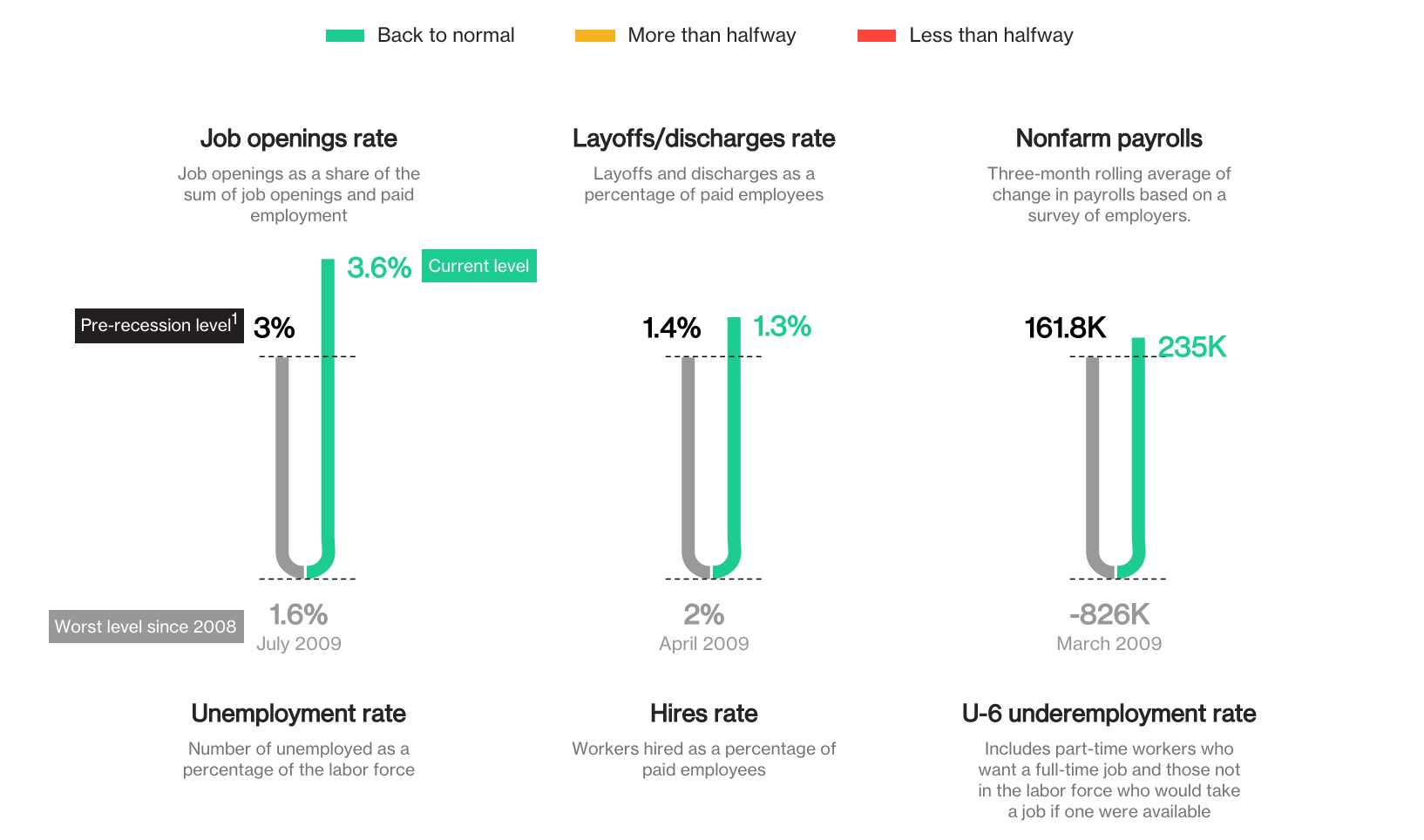

Yellen’s Labor Market Dashboard

August 14, 2015 9:00am by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

10 Friday AM ReadsNext Post

United Nations of Debt

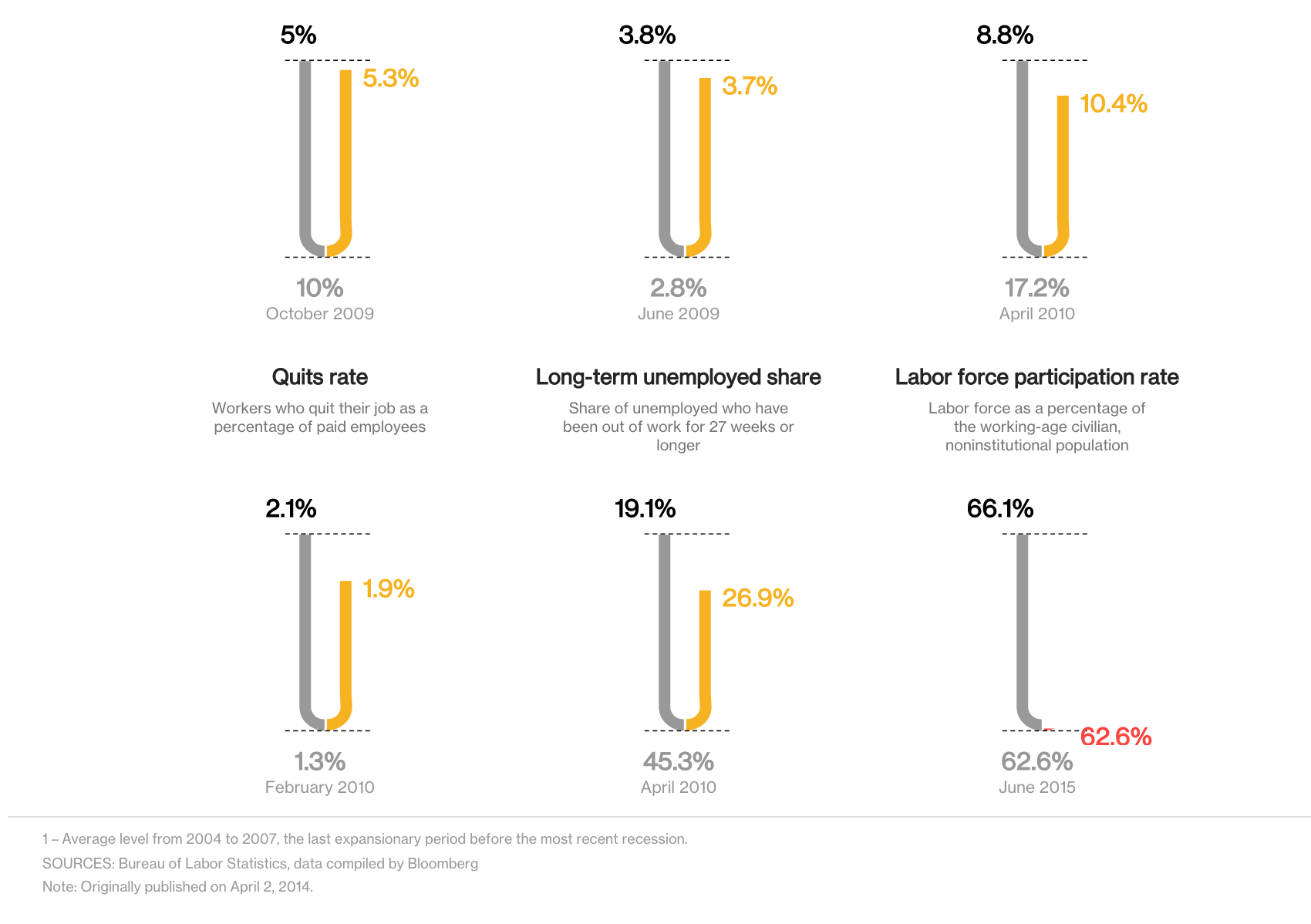

I love how the doom and gloomers shift from one number to the next to support their theory that everything is just horrible. Now that unemployment is looking decent, they move to labor participation rate.

Maybe there is a problem here, but do these people ever consider that maybe Americans are finally exiting the cult of work for early retirement or other long term time off?

Work is just another stupid status symbol in America, not unlike a luxury car or huge house. Many people that have vacation time don’t take it. Many people that can retire don’t retire. Many people answer emails at midnight, on the weekends, during what little vacation time they take. And brag about what martyrs they are as if they are doing something so important in discussing in an endless loop about what background color some stupid computer icon should have.

Maybe, just maybe, America is getting better and people have awoken to the stupidity of the cult of work.

I find it laughable that you don’t consider the possibility that many of the poor souls that went into “early retirement” didn’t do so on their own volition.

Given that the vast majority have little to nothing saved for retirement how do you suppose they live? The lucky ones scrape by on Social Security (barely); the rest are just screwed.

Anybody and their brother know that is demographic. Retirements are surging right now and 66.1% is not achievable in our lifetime again without another baby boom. Matter of fact, it should move down a bit more, closer to 61% before it gets a bit of a boost in the 2020’s. People that ignore the head and shoulders formation of that index are not being smart.

I had thought that the index did not include those past their retirement age, but you are right, it includes anyone over 16. Stupid me for assuming that “working age” didn’t include 105 year olds. Get to work great granddad! You’re making us look bad!

http://www.bls.gov/bls/cps_fact_sheets/lfp_mock.htm

http://www.factcheck.org/2015/03/declining-labor-participation-rates/

The Fed is supposed to balance maximum employment and inflation. Given that there’s no realistic prospect of inflation at or above the Fed’s 2% ceiling, why is there any need to tighten, no matter how healthy the labor market might be?

Not that the labor market is tight. If it were, we’d see more growth in compensation, which we don’t. Note that unemployment went under 4% under Greenspan, without inflation being a problem.

The spread between nominal treasuries and TIPS is very low, implying inflation rates from 1.3% at 5 years to 1.8% at 30 years. No apparent danger of hitting 2%.

When the Fed lowered rates to zero, the economy was in a freefall, GDP off nearly 10%,m Unemployment over 10%, and the stock market in a freefall. It was an EMERGENCY.

Why do you believe that we should continue this emergency footing?

None of those conditions currently exists.

The Fed’s legal mandate is maximum employment consistent with stable prices. The Fed currently interprets stable prices as 2% inflation (it was 4% for many years). Raising interest rates will lower employment at a time that it’s not necessary to do so in order to rein in inflation. That would seem inconsistent with the law governing the Fed.

The Fed’s monetary policy has long been to balance employment (and growth) against inflation. It acted to do so in the emergency (requiring cutting rates and, when it could not cut further, implementing QE), as it has before and since. Just because the crisis is over is no reason to abandon normal monetary policy. Normal policy is to strike a balance, not any specific rate level or action to get there.

You have to remember, the Fed goes by core inflation. It has not been so weak.

Core inflation only matters to those who neither eat nor drive.

I keep waiting for them to take rents out of core inflation.

Core CPI excludes the only things people absolutely need, food,

shelterand energy, It’s not an accurate measure of the cost of living.~~~

ADMIN: Fed’s definition of Core is Food and Energy

9 metrics … the first 8 deal exclusively with job counts, without regard for quality/income. The 9th, LFPR, paints a bleak picture of this recovery. Why isn’t median income up there, Barry? Show us how good that looks …

~~~

ADMIN: Do not ignore U6 Underemployment, more important than Labor Forece Participation Rate . . .