@TBPInvictus here.

AEI’s Peter Wallison recently described why America is in the midst of a “slow economic recovery,” which we have been, but not for the reason Mr. Wallison cites.

According to Mr. Wallison, “Dodd Frank has burdened small banks – and the businesses that rely on them – much more than large businesses that have access to capital markets.” The point Mr. Wallison drives home: “While larger firms have access to credit in the capital markets, millions of small firms, limited to borrowing from beleaguered community banks, are not getting the credit they need to grow and create jobs.”

Sadly, though completely unsurprisingly, Mr. Wallison’s claims do not withstand even a modicum of scrutiny. Barry took Mr. Wallison to task here: Don’t Blame Dodd-Frank for the Slow Recovery.

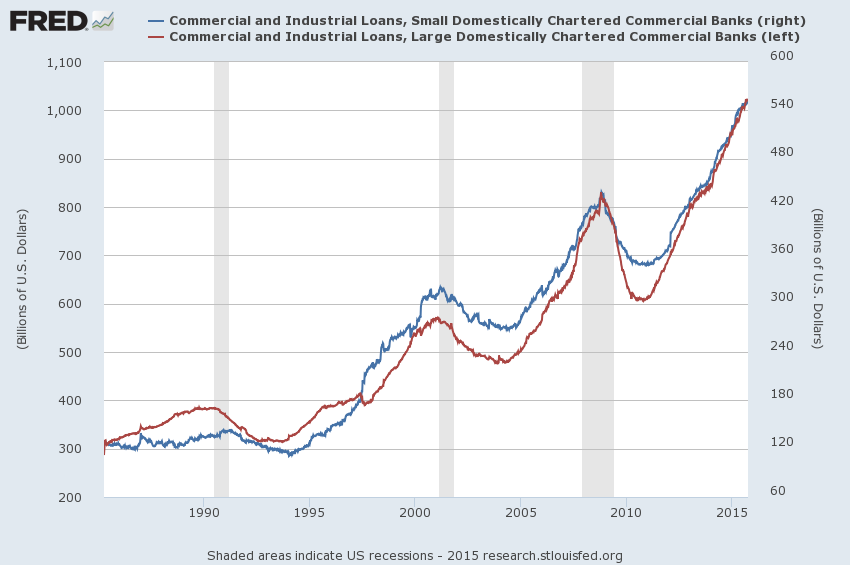

Below are Commercial and Industrial (C&I) Loans for both small (blue, right hand scale) and large (red, left hand scale) domestically chartered commercial banks. If there’s a meaningful difference to be seen in the recent pace of lending between the two, it’s lost on me. But the fact that both series are at all-time highs is not.

Beyond that, as fate would have it, the National Federation of Independent Business (NFIB) released its Small Business Economic Trends (SBET) report yesterday. As it relates to credit conditions, the SBET said this (my bold):

Two percent of owners reported that all their borrowing needs were not satisfied, a record low. Thirty percent reported all credit needs met, and 57 percent, a record high, explicitly said they did not want a loan.

Of course, Mr. Wallison could not have known a week or so ago what NFIB members were going to say in the most recent report. All he could have (and by all means should have) known when he published was what they said last month, which was this (my bold):

“Three percent of owners reported that all their borrowing needs were not satisfied, historically low. Thirty-three percent reported all credit needs met, and 49 percent explicitly said they did not want a loan. For most of the recovery, record numbers of firms have been on the “credit sidelines”, seeing no good reason to borrow. Only 1 percent reported that financing was their top business problem compared to 20 percent citing taxes. In the Great Recession, no more than 5 percent cited credit availability and interest rates as their top problem compared to as high as 37 percent in the Volcker era. Thirty-three percent of all owners reported borrowing on a regular basis, up 3 points. The average rate paid on short maturity loans rose 20 basis points to 5.4 percent. The net percent of owners expecting credit conditions to ease in the coming months was a negative 7 percent, down 2 points.”

The facts of the matter – supported by both the Federal Reserve’s H.8 and the NFIB – put the lie to Mr. Wallison’s claims.

Federal Reserve economists Bhutta and Ringo debunked his claim that the housing bubble of decade ago was caused by the Community Reinvestment Act of almost four decades ago (“…the current best evidence suggests that the CRA was not a significant contributor to the financial crisis.”)

AEI is no longer even trying to be a thoughtful, respectable thinktank with independent analysis and intelligent commentary. Instead, it has morphed into a showcase of discredited ideas, disproven myths, and empty-headed rhetoric.

AEI stands as a stark warning to other (so-called) think tanks what not to do: Don’t become some billionaire’s ideological bitch.

What's been said:

Discussions found on the web: