Don’t Blame Dodd-Frank for the Slow Recovery

The law isn’t perfect, but it hasn’t hurt small-business lending.

Bloomberg, October 7, 2015

Dodd-Frank has burdened small banks — and the businesses that rely on them — much more than large businesses that have access to capital markets. Is this why we’re experiencing the slowest recovery in two generations?

So asks Peter Wallison, a scholar at the American Enterprise Institute, a conservative think tank that advocates for free markets and views government regulation with suspicion.

Nonetheless, Wallison has raised a question worth asking — and answering — since he isn’t the only one who blames Dodd-Frank for the stubbornly slow recovery from the financial crisis. Just by way of background, Wallison was a member of the federal commission that studied the cause of the 2008 meltdown and was the lone member to lay almost all of the blame at the feet of the government-sponsored entities, Fannie Mae and Freddie Mac. Most scholars have concluded that the causes of the crisis were many — including deregulation of the sort Wallison has advocated — and his arguments have been widely disputed (see this, this or this).

But leaving that aside, let’s spend a few minutes examining the assertion that Dodd-Frank, adopted in 2010 to lower the odds of another financial crisis, is responsible for the slow economic recovery.

Wallison’s argument goes like this: Dodd-Frank’s new and expanded compliance requirements, while manageable for big banks, are an intolerable burden for small banks, defined as those that aren’t among the U.S.’s 25 biggest lenders. In turn, these small banks are hobbled in their ability to lend to small businesses, which lack access to the capital markets that bigger companies can tap. Small businesses are a critical engine of economic growth and thus the shortage of credit for small and fast-growing companies explains why the economic recovery is so disappointing.

Just as an aside: Let’s not even bother with the part of Wallison’s argument where he cites a study by economists Michael Bordo and Joseph Haubrich claiming “deep contractions breed strong recoveries.” This directly flies in the face of a much more broadly researched set of studies by economists Carmen Reinhart and Kenneth Rogoff that reached the opposite conclusion — that recoveries from financial crises, and not just regular recessions, are agonizingly slow. Most of the economic community has endorsed the Reinhart & Rogoff perspective.

Also, we’ll skip the part where Wallison says “studies of Dodd-Frank’s effect have shown that the regulatory burdens imposed by that law have been particularly harsh for community banks.” Although he does make this claim, he doesn’t cite any studies backing it up and I know of no credible research that would support this assertion.

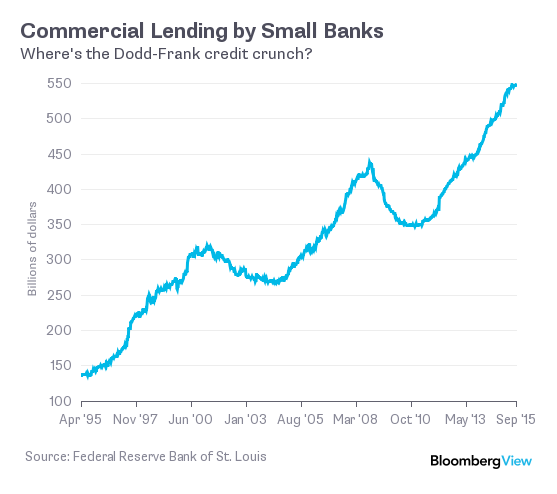

But let’s just stick with the core of Wallison’s argument: that Dodd-Frank has choked off lending by small banks to small businesses. This should be easy to verify. After all, the Federal Reserve keeps lots of data on commercial bank loans. If small-bank lending is in a funk it should show up in the numbers.

So please have a look at the chart below from the data service of Federal Reserve Bank of St. Louis. It shows that small banks, after seeing loan demand plummet following the 2008 financial crisis, now are sending so-called commercial and industrial lending — in other words, credit to small businesses — to record levels.

Furthermore, in the Fed’s most recent Senior Loan Officer Opinion Survey on Bank Lending Practices, loan officers noted: “Lending standards for smaller firms, with annual sales of less than $50 million, have been gradually loosening over the past few years, and in the current survey, the majority of domestic respondents that extend loans to such firms indicated that their standards were easier than or near the midpoints of the respective ranges over the past decade.”

In other words, lending to small businesses has been easing.

There are many reasons to criticize Dodd-Frank — it is too long, too complex, difficult to implement and probably doesn’t do enough to deal with the monumental problem of too-big-to-fail banks. But the claim that it has choked off credit to small businesses as the reason for the slow economic recovery just isn’t supported by the facts.

Originally: Don’t Blame Dodd-Frank for the Slow Recovery

There you go again, Barry…. trying to throw facts into the discussion….

There is no “slow recovery”. It is called the great boomer deleveraging. A long term unemployment rate of 10% is the same level as it was during Bill Clinton’s 1996 summer campaign. Failure to understand this, is what creates bubbles because financial efforts to expand credit become unsustainable. I would argue that contributed to the 00’s bubble when the deleveraging was in its prologue.

I would seriously doubt that a single regulation would make a significant difference in the recovery. This said in my view there are also serious cognitive issues with those who think that additional overhead on entrepreneurs in the way of tax hikes and regulations do not harm our economic potential. This is also cognitive dissonance http://www.simplypsychology.org/cognitive-dissonance.html

“So asks Peter Wallison, a scholar at the American Enterprise Institute, a conservative think tank that advocates for free markets and views government regulation with suspicion.”

Oh, well there’s the problem right there. This sentence contains 2 oxymorons, and 1 fanciful conception (i.e., not based in reality). No wonder Wallison’s conclusion is hosed. As is most of the “research” that comes out of AEI.

The Slow Recovery Is Due to Deficit Reduction

Pres. Obama and the GOP reduced the debt-to-GDP ratio 75% from FY2009 to FY2015. Such deficit reduction has never before been done during any recovery since WWII. Even Pres. Hoover increased the deficit from FY1931 through FY1933. In fact he quintupled it.

https://www.whitehouse.gov/omb/budget/historicals Table 1.1

Anti-Keynesian, austerity economic policy is a failure, simple and obvious.

Good takedown. Peter Walliston was also one of the clowns pushing the bogus argument that the CRA was a primary factor in the financial collapse. His main job description seems to be concocting plausible but ultimately bogus economic arguments in support of right-wing prejudices.

For those who want to get rid of Dodd-Frank there is nothing that isn’t its fault. Ingrown toenails, pedophilia, bad weather – its all because of Dodd-Frank.