Good Saturday morning; pour yourself a strong cup o joe, and settle i n for our longer form weekend reads:

• How rivalry propels creative genius (Aeon)

• Why Jack Dorsey Is Ready to Save Twitter (Re/code) see also Twitter’s Moment (Stratechery)

• How Cartrivision’s 1972 VCR Foresaw–And Forfeited–The Time-Shifted Future (Fast Company)

• Danny Meyer Is Eliminating All Tipping at His Restaurants (Eater)

• Bill Gates: ‘We Need an Energy Miracle’ (The Atlantic)

• Daily Fantasy: You’re Screwed, Because You’re Supposed to Be. On sites like DraftKings and FanDuel, the sharks circle and the deck is stacked against you from the start. But hey, welcome to America (Rolling Stone) see also Cash Drops and Keystrokes: The Dark Reality of Sports Betting and Daily Fantasy Games (NYT)

• Opting out: Inside corporate America’s push to ditch workers’ comp (ProPublica)

• If You’re Not Paranoid, You’re Crazy. As government agencies and tech companies develop more and more intrusive means of watching and influencing people, how can we live free lives? (The Atlantic)

• How To Shop For Pot In Denver (Priceonomics)

• The Amazing Inner Lives of Animals (NY Review of Books)

Be sure to check out our Masters in Business interview this weekend with Jeremy Siegel professor at University of Pennsylvania Wharton School and author of the classic book Stocks for the Long Run.

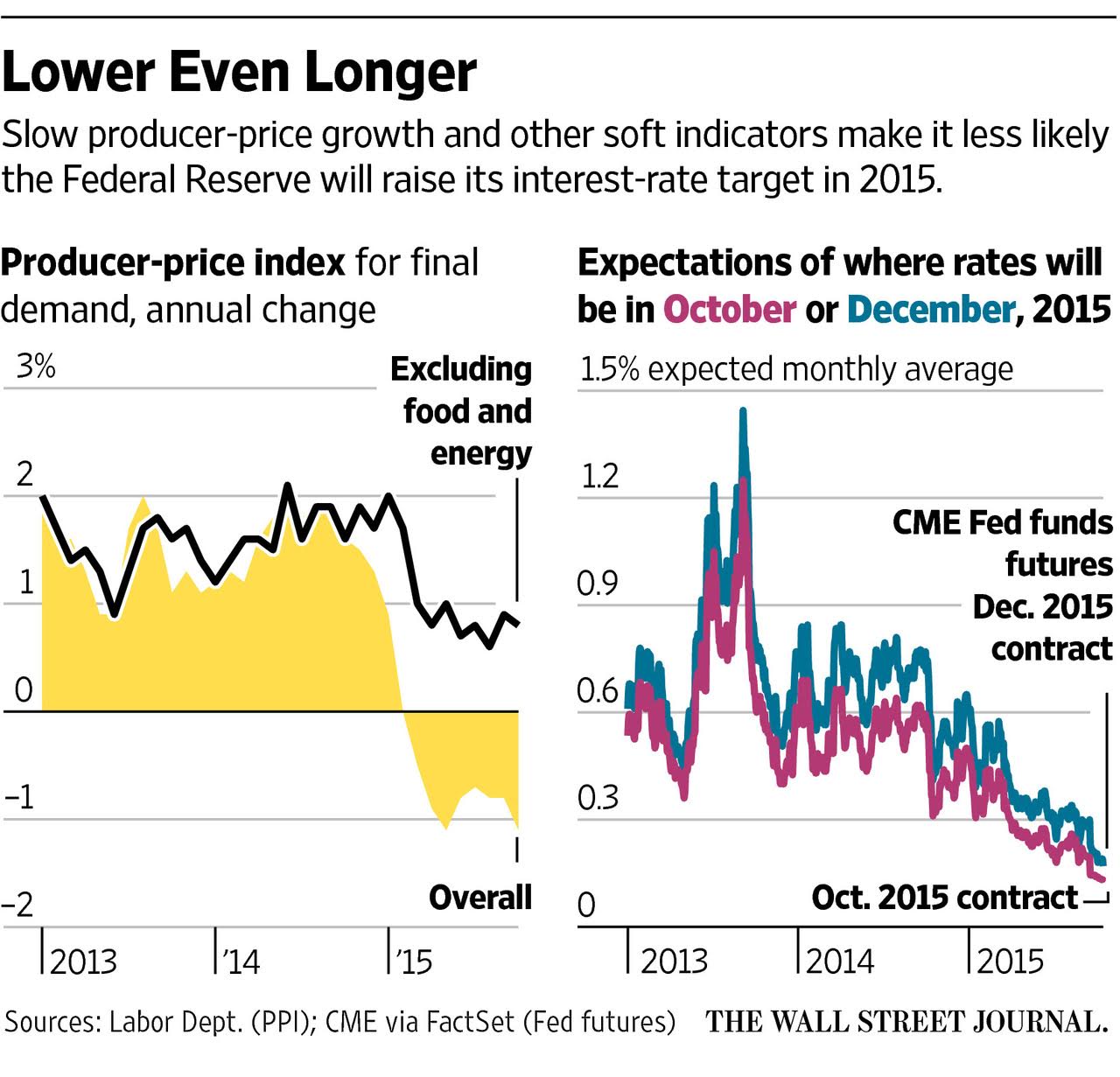

Less Likely the Federal Reserve Will Raise Its Interest Rate Target in 2015

Source: WSJ

Venture Capital and the Internet’s Impact

Much has been written of the difficulty in building “another Silicon Valley.” …

Moreover, one of the most important stories of the last several years is how the structure of Silicon Valley itself is changing, particularly when it comes to funding. Instead of traditional venture capital firms investing in startups …there are angel investors and seed rounds on one end and traditional public market investors investing in private unicorn rounds on the other, with venture capital firms somewhere in the middle. …

There’s a tendency …to view venture capitalists as the moneymen …. In truth, though, middlemen is just as appropriate: the actual money comes from limited partners …

I point this out to highlight the fact that at a basic level venture capitalists are arbitrageurs: they have access to more information than those with the capital, and access to more capital than those with information, and they profit by exploiting the mismatch. …

The primary problems with fantasy sports leagues, lotteries, and gambling in general do not arise from personal bankruptcies, loan sharks, or other social problems. No – the big problems arise when these activities are unlicensed and the government is unable to tax them adequately.

http://www.reviewjournal.com/business/casinos-gaming/nevada-gaming-regulators-ban-daily-fantasy-sports-the-state

Re: Paranoia

It turns out that you can’t rent from AirBnB if you don’t have enough social media presence. My spouse views this as an issue. I view it as success.

+1

The voodoo/austerian zombie shambles on, devouring brains right and left, as its cult worshipers ‘regretfully’ cram the poor, old and weak into its mindlessly champing jaws.

The budget deficit is way too low

New data from the Office of Management and Budget shows that the federal budget deficit for 2015 will be 2.5 percent of GDP, lower than the historical average and representing a sharp decline from where it was in Obama’s first year in office.

The White House is crowing about it.

But the question is why? …

NB: The economy is slowly recovering but there are still large demographic and regional segments of the country in distress to say nothing of the backlog in infrastructure R&R and social services. Mainstream macroeconomics was and remains clear on this subject: Fiscal austerity is strongly contraindicated in the presence of economic under-performance, output gap, underemployment and/or wage stagnation, low interest rates, low inflation or disinflation, etc; in this context a larger deficit is essential no matter the size of the debt.

And, as BR and others have pointed out, don’t forget the denominator: stronger fiscal support for social services, infrastructure, and the safety net means better money velocity, stronger economic performance and higher revenues so the deficit naturally shrinks bottom-up from growth; by the same token when you try to shrink it top-down from cutting then revenue shrinks and the deficit grows.

This assumes that the zombie hasn’t gotten to you yet of course.

Watch this samurai cut a 100 mph pitch in half

Joe DeMartino

Isao Machii is about as close to a modern-day samurai as you can get post-medieval Japan. He’s been known to cut all sorts of things in half, ranging from BB gun pellets to arrows. The man has serious skills and would be a huge asset in both accidental time travel and zombie apocalypse scenarios.

With that kind of resume, how do you think he fared when presented with the challenge of cutting a pitch traveling 100 mph in half?

….

http://espn.go.com/espn/story/_/page/instantawesome-SamuraiBaseball-1501015

Amazon Files Suit Against Individuals Offering Fake Product Reviews On Fiverr.com

10/16/2015

Sarah Perez (@sarahintampa)

In April of this year, Amazon filed suit against the operators of websites that offered Amazon sellers the ability to purchase fake, four and five-star reviews of their products. Most of those websites have now been closed, and Amazon took action against the sellers involved. Now Amazon is continuing its crackdown on fake reviews by going after individuals who provide these sort of fake reviews – this time, those who used the online freelancing marketplace fiverr.com.

The defendants in the new case, listed as “John Does,” each used Fiverr.com to sell fake positive or 5-star Amazon reviews. In some cases, they even offered “verified” reviews, meaning those where they buy the product – provided they’re compensated for that, of course. Other times, they also tell the purchaser to just provide the product review and they’ll post it.

….

http://techcrunch.com/2015/10/16/amazon-files-suit-against-individuals-offering-fake-product-reviews-on-fiverr-com/

It will probably take more than a weekend to properly digest this.

The Scary Debate Over Secular Stagnation: Hiccup or Endgame?

Bernanke… says we have entered an age of a “global savings glut.”… Rogoff… points to the emergence of global “debt supercycles.”… Krugman warns of the return of “Depression economics.” And… Summers calls for broad structural shifts in government policy to deal with “secular stagnation.” All… are expecting a future that will be very different than the second half of the 20th century, or even the so-far, not-so-good third millennium. But they… [differ on] optimism or pessimism… [and on whether] cautious repairs or an abrupt break with policy as usual [are needed. This] is, I believe, the most important policy-relevant debate in economics since John Maynard Keynes’s debate with himself… which transformed him from a monetarist to the apostle of active fiscal policy.

I think we are seeing something new in history:

1. The first generation to grow to maturity with modern medicine and farming. As a result, numerous societies around the world are getting old simultaneously, with an increasing percentage of the population getting old and not working.

2. These societies have generally not used the alternate method of reducing population size, war, since the mid-20th century. Nuclear weapons have meant that wars are now fought in third world countries using proxies. Modern warfare has gotten more efficient for the first world countries with technology instead of millions of people.

I don’t think economic theory has caught up to the implications of this.

The clip of Bill Gates was interesting. When we solve a way to cheaply store energy coupled with green energy such as solar and wind the world as we know it will change. Fossil fuels will become a minor part of our energy mix and the ability to live off the grid will open many remote places for inhabitation. This will make it harder for governments and corporations to control our population.