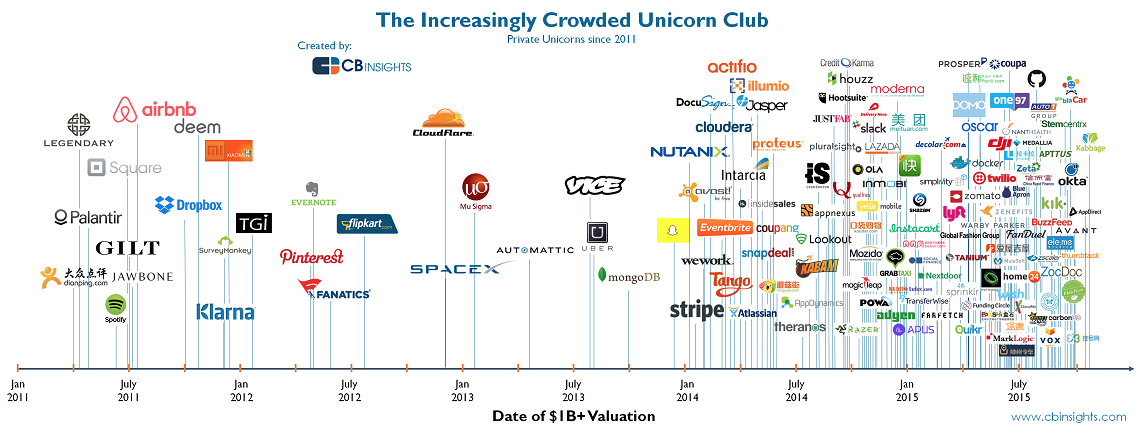

Click for a ginormous graphic.

Source: CB Insights

The Increasingly Crowded Unicorn Club

November 2, 2015 2:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

How’s Your Story Going to Fail?Next Post

John Oliver: Medicaid Gap

In 2000, most companies like this turned out to be actual mythical unicorns. Only a few became horses, i,e, real animals. It will be interesting to see what real:mythical ratio this financing round will have.

I think this means that the next tech crash won’t involve the general public, just the genius ‘insiders’.

One big difference from 2000 is that a lot of these companies have actual businesses and growing revenues — they aren’t just being measured on “eyeballs” or other dubious metrics that were popular then. Several of the “enterprise focused” companies will do well, I think — Nutanix, Apttus, Coupa, Stripe, Zenefits. Others that are more focused on consumers might do pretty well, but the valuations may be a stretch — Warby Parker, Prosper.

Theranos — looks like that one is heading to the bottom of the bowl.

Docusign feels like a feature to me, not a company. There are still quite a few that look like Amazon/Google et al could put out of business. Zomato — what the heck is that? A restaurant finder? Instacart? Andreesen Horowitz invested in Instacart, and those folks are all super smart, but I don’t get that one — except as possibly an acquisition target for AMZN or GOOG.

Watch out for Shazam — I don’t really understand how they’re going to make money, but they seem to be some smart mofos ;-)

Jan 2014 seems to be a good dividing line. I recognize most of the companies on the left and almost none on the right. Even without knowing anything, I’d bet that in five years 10% of the companies on the right will either be out of business or, if public, not worth their current valuation.