Pour yourself a mug of French Roast, and settle into your favorite easy chair, and get ready for our longer-form weekend reads

• Jamie Dimon on Finance: “Who Owns the Future?” (BloombergMarkets)

• Alpha or Assets: Strategies should be built for alpha, not scale—but the asset management industry has gone in the opposite direction. (Investor Field Guide)

• The Hidden Economics of Porn: A gender-studies professor explains how the industry works. (The Atlantic)

• Alexa, Cortana, and Siri Aren’t Novelties Anymore. They’re Our Terrifyingly Convenient Future. (Slate)

• The sugar conspiracy: In 1972, a British scientist sounded the alarm that sugar – and not fat – was the greatest danger to our health. But his findings were ridiculed and his reputation ruined. How did the world’s top nutrition scientists get it so wrong for so long? (The Guardian)

• Crowd Source: Inside the company that provides fake paparazzi, pretend campaign supporters, and counterfeit protestors (California Sunday)

• Time Machines (Stanford)

• Inside Operation Trump, the Most Unorthodox Campaign in Political History (NY Mag)

• The C.E.O. of ‘Hamilton’ Inc.: The producer Jeffrey Seller struck gold with Lin-Manuel Miranda’s Broadway hit about the founding fathers. Now he has a new challenge — managing a runaway success. (NYT)

• Charlize Theron: Hollywood’s Humble Heroine (WSJ)

Be sure to check out our Masters in Business interview this weekend with Keith Ross, chief executive officer of PDQ Enterprises, which operates a dark pool, and former CEO of high-frequency trading company Getco.

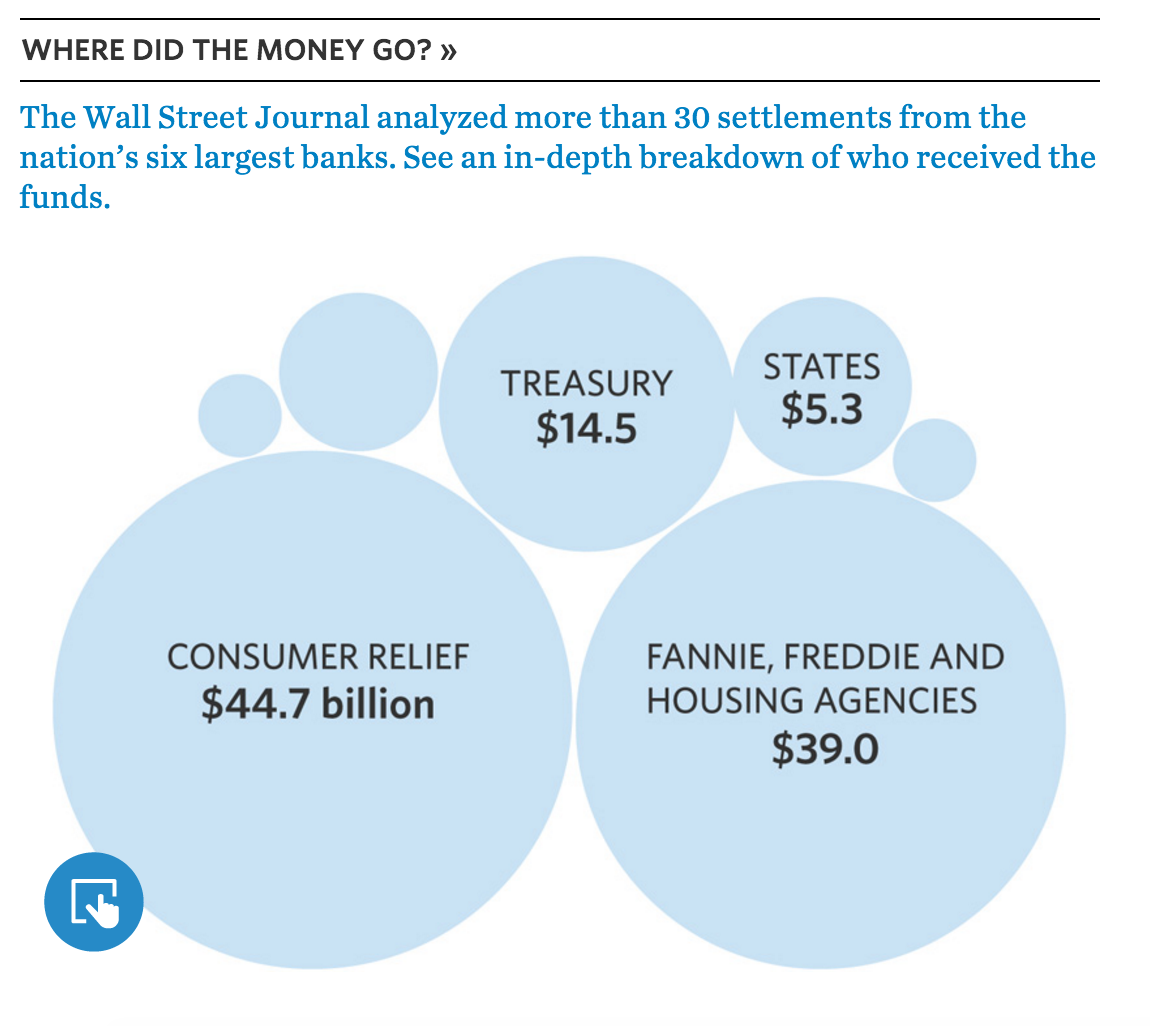

Big banks paid $110 billion in mortgage-related fines. Where did the money go?

Source: WSJ