Really interesting analysis via Gadfly about under performance in the hedge fund community:

Just last week, the U.S. bull market in stocks became the second longest on record, which — fair or not — leaves it vulnerable to some age discrimination. Over that stretch, equity hedge funds as a group have underperformed the S&P 500, which is a comparison that many fund managers will insist is apples to oranges but which nonetheless is a comparison that will probably continue to be made forever by investors perusing the fruit salad of investment options.

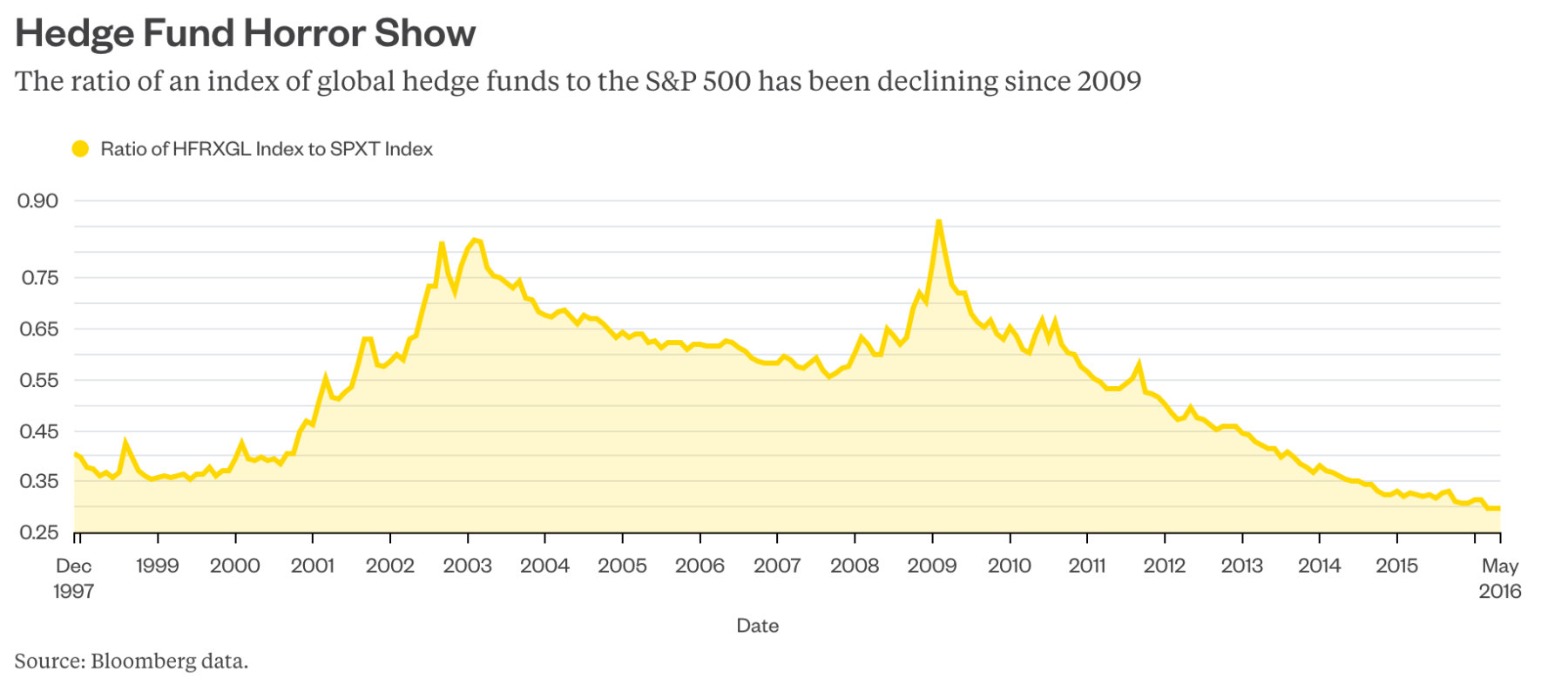

Look at this chart, which shows a ratio of the HFRX Global Hedge Fund Index to a total-return version of the S&P 500. When the line is falling, it means the hedge funds tracked by the index are getting beaten by the S&P 500. And, whoa boy, it has been falling for the last seven years:

Source: Gadfly