My Welcome to Q4 morning Barcelona reads:

• The Kindest Quarter Arrives for a Stock Market That Nothing Can Rattle (Bloomberg)

• Bears, Return to Your Caves—at Least for Now: High valuations alone don’t cause bear markets. There must be other factors, too. And the biggest concerns probably won’t arise in 2017. (Barron’s)

• No Inflation? Technology May Have Left it in the 20th Century (Wired)

• U.S. Climate Change Policy: Made in California: A peculiar confluence of history, legal precedent and defiance has set the stage for a regulatory mutiny in California that would reverberate throughout the country (New York Times)

• The typical US family was richer in 1998 (FT Alphaville)

• An investing legend who has nailed the market at every turn just got even more bullish on stocks (Business Insider)

• Electric Car Mania Proves Sum of Parts Is Sometimes Greater (Bloomberg Businessweek)

• Trump Has Started a Brain Drain Back to India (ForeignPolicy)

• The claims of anti-immigrant hysterics are disproved — again (Washington Post)

• Blade Runner 2049: our spoiler-free review (The Verge)

Be sure to check out our Masters in Business interview this weekend with Ranji Nagaswami, chief executive officer of Hirtle Callaghan, a firm that helped popularize the idea of the outsourced CIO. Previously, she was chief investment officer of Alliance Bernstein Investments.

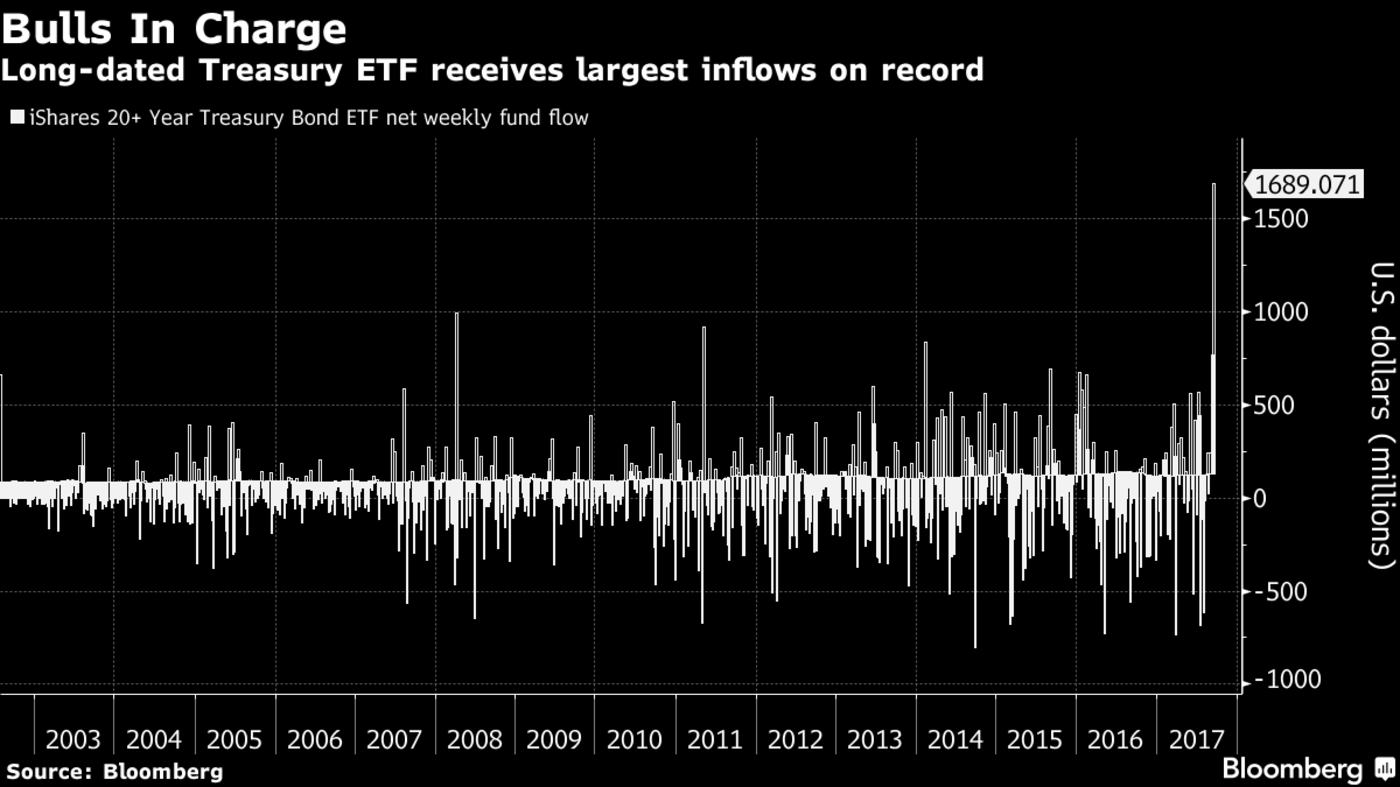

Long-dated treasury ETF receives largest inflow on record

Source: Bloomberg

Want to receive our daily reads in your inbox? Sign up here!