My two for Tuesday morning train reads:

• Howard Marks: Nobody knows what will happen. (Finanz und Wirtschaft)

• Hedge Funds Ain’t Dead Yet (Wall Street Journal) but see Hedge funds keep accidentally naming themselves after gory, swindling, incestuous Greek gods (Quartz)

• Invesco Buys Guggenheim’s ETFs: Invesco’s PowerShares is still a distant No. 4, but the $1.2 billion deal was a smart move for the long term. (Barron’s)

• How Active Fund Managers Can Get Their Groove Back (Bloomberg View) see also 5 Things Active Fund Managers Should Do (Bloomberg View)

• The real problem with credit reports is the astounding number of errors (Brookings)

• The Story of the USS Pension Fiasco (Institutional Investor) see also Shining Light on Hefty Fees to Outside Managers of Public Pension Funds (NJ Spotlight)

• South Korea’s Looming Crisis by Lee Jong-Wha (Project Syndicate)

• America’s unique gun violence problem, explained in 17 maps and charts (Vox) see also How to Prevent Gun Deaths? Where Experts and the Public Agree (The Upshot)

• Slack’s CEO has big plans for using AI to keep people from getting overwhelmed by information (MIT Technology Review)

• Facebook’s Frankenstein Moment (New York Times) see also Obama tried to give Mark Zuckerberg a wake-up call over fake news on Facebook (Los Angeles Times)

What are you reading?

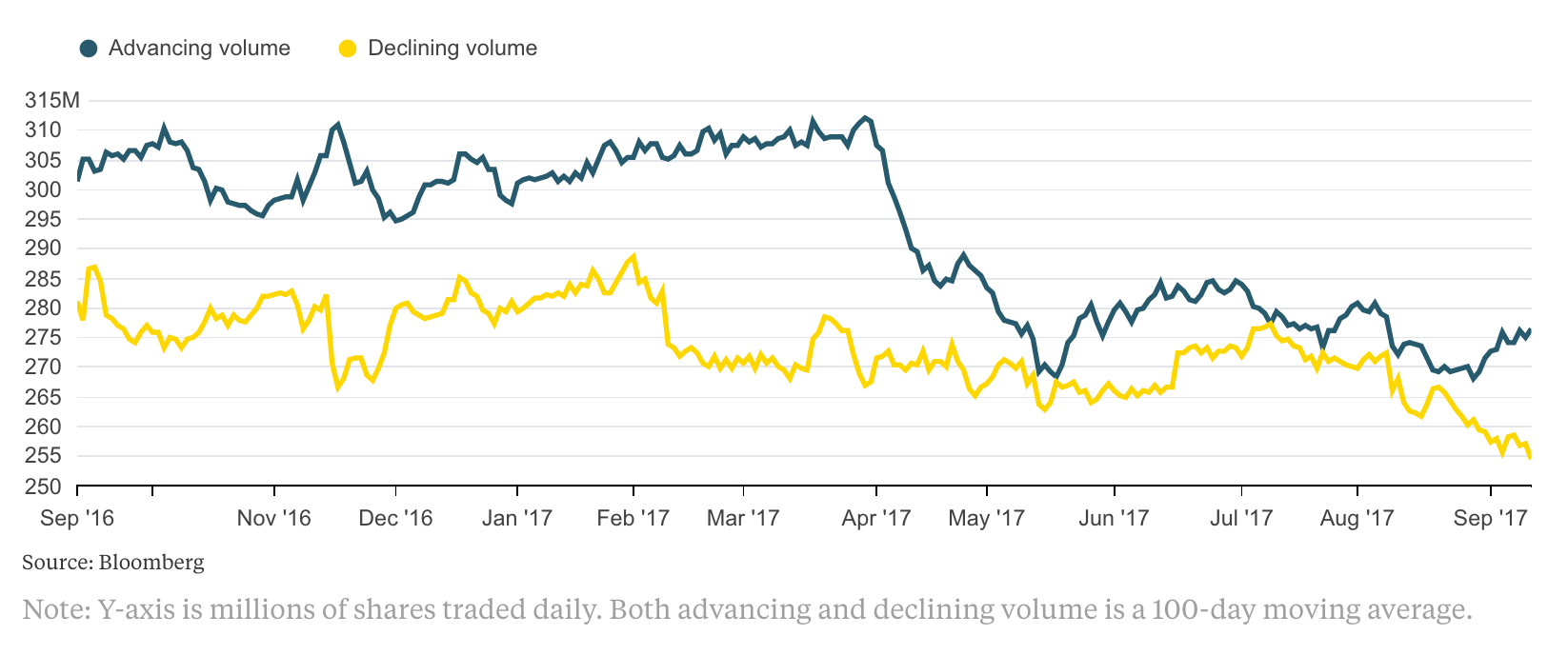

More and more investors are piling into stocks that are rising rather than buying those that are falling

Source: Bloomberg Gadfly

Want to receive our daily reads in your inbox? Sign up here!