So here’s the thing about the current set of Tax Reform and Tax Cuts out of conference and heading to a vote next week: It is not a simplification; it is not a consistent philosophical body of work. It is a hodgepodge of unrelated changes, cuts, and increases; a few loopholes closed and more opened. To me, it looks like a Christmas tree of various interest group ornaments and desires.

Tax cutters and fiscal policy advocates like Jack Kemp, Bruce Bartlett and even Ronald Reagan would not recognize this as a coherent policy position. Claims that it is an attempt to get a win on the board, regardless of how ugly as a coherent policy it might be, do resonate.

In the finance industry, it seems to be less of an issue for employees — Finance being one of those professional services not eligible for pass throughs — than it is for the financial planning side — the doubling of the Estate Tax exemption as just one example.

Here is what the “Joint Agreement” between House and Senate negotiators looks like (as of now):

-Corporate Rate cut to 21 percent from 35 percent beginning in 2018.

-Top Individual Rate cut to 37 percent for the highest earners, down from 39.6 percent.

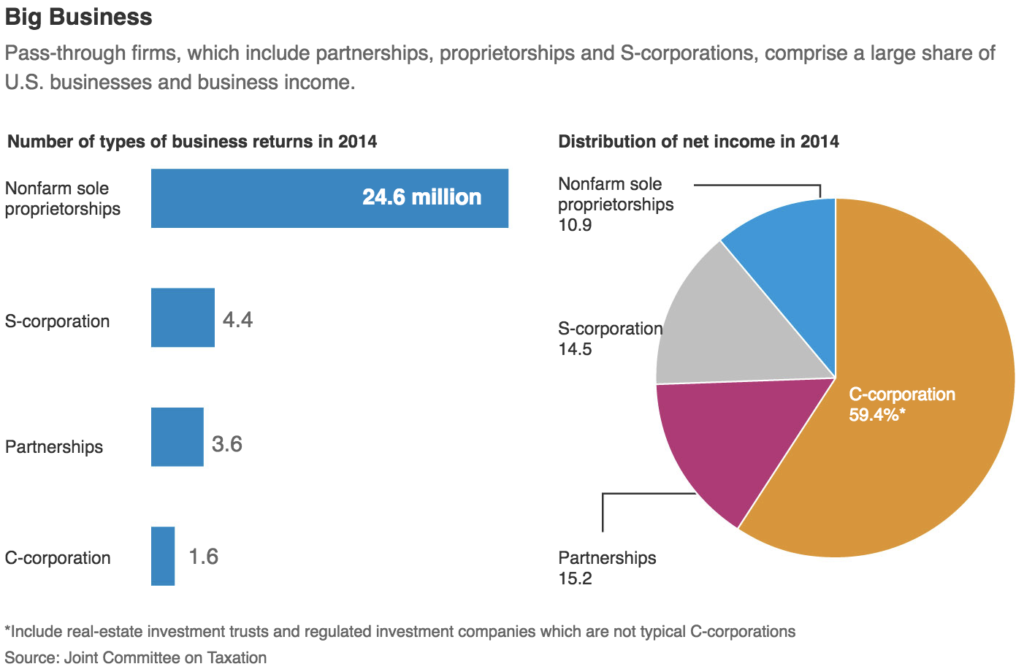

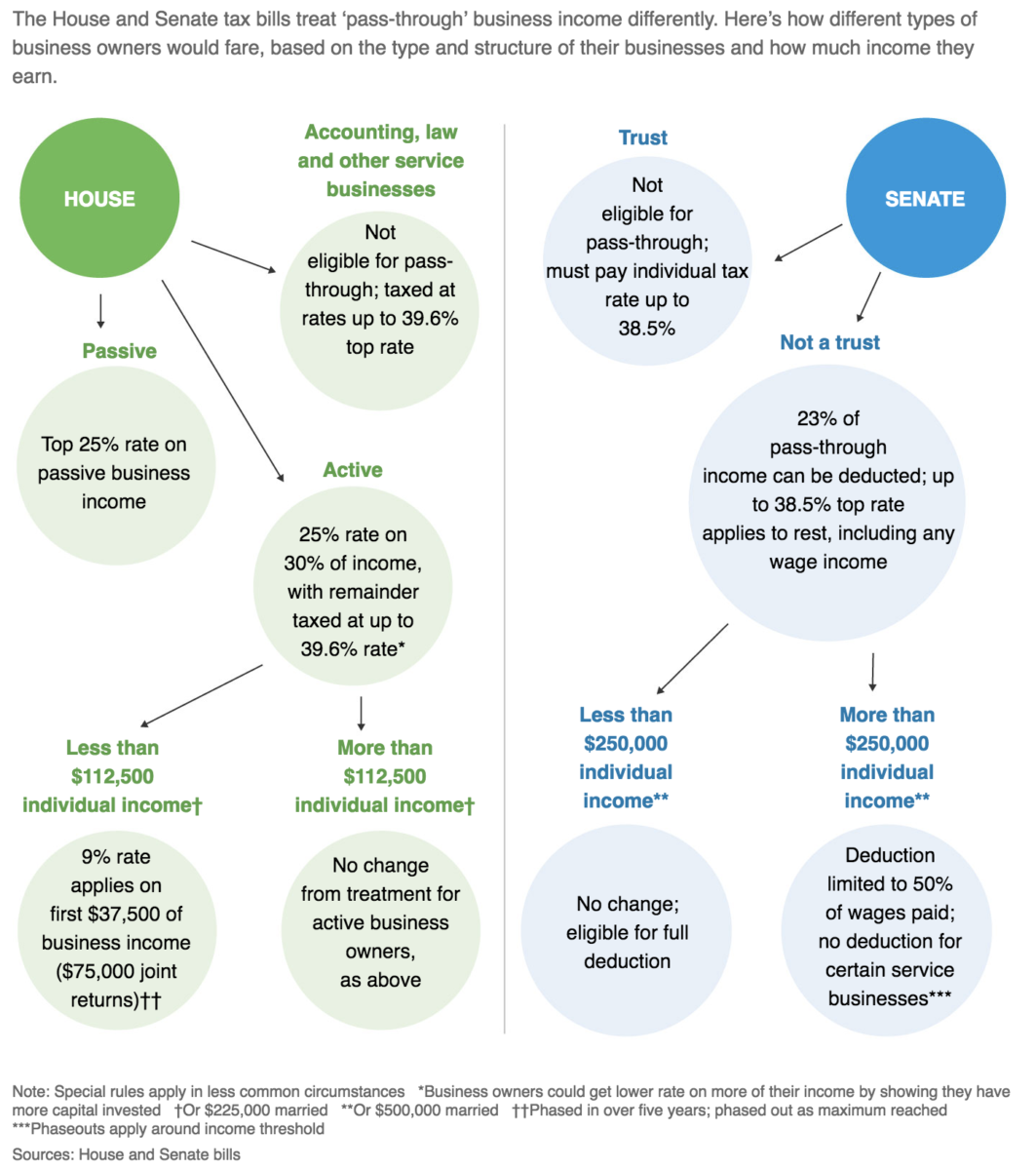

-Pass-Through Tax Breaks provides a 20 percent deduction on pass-through business income, and extend that break to trusts as well as individuals.

-Corporate Alternative Minimum Tax would be repealed.

-Obamacare Individual Mandate would be repealed.

-Mortgage Interest Deduction is capped for loans of $750,000 — down from $1 million — for new purchases of homes (prior purchases grandfathered)

-Individual State and Local Tax Deductions limits combined deductions for state and local income taxes and property taxes to $10,000.

-State Income Break for state income taxes in addition to property levies — up to a $10,000 cap.

These are pretty generous to the highest 1% of earners, but punitive to those upper class high earners (top20%) in Blue States like California, New York, New Jersey, Connecticut and Illinois.

My disclosure: I could be wrong, but it looks like the cuts to top bracket and the pass-throughs will generate a greater savings for me personally than the limitations on SALT and RRE deductibility will cost. This is before we set the lawyers and accountants loose to figure out ways to minimize tax liability.

Some people have claimed that the GOP controlled congress has managed to weaponize the tax code for partisan purposes; depending upon the final bill, there may be some truth in that.

As always, the devil is in the details. What the final version looks like will be determinative . . .

Source: Wall Street Journal

Source: Wall Street Journal