Source: Economic Policy Institute

We have been discussing the fiduciary standard of care owed to investors for some time now — I am pro, much of the commission side of the business is con.

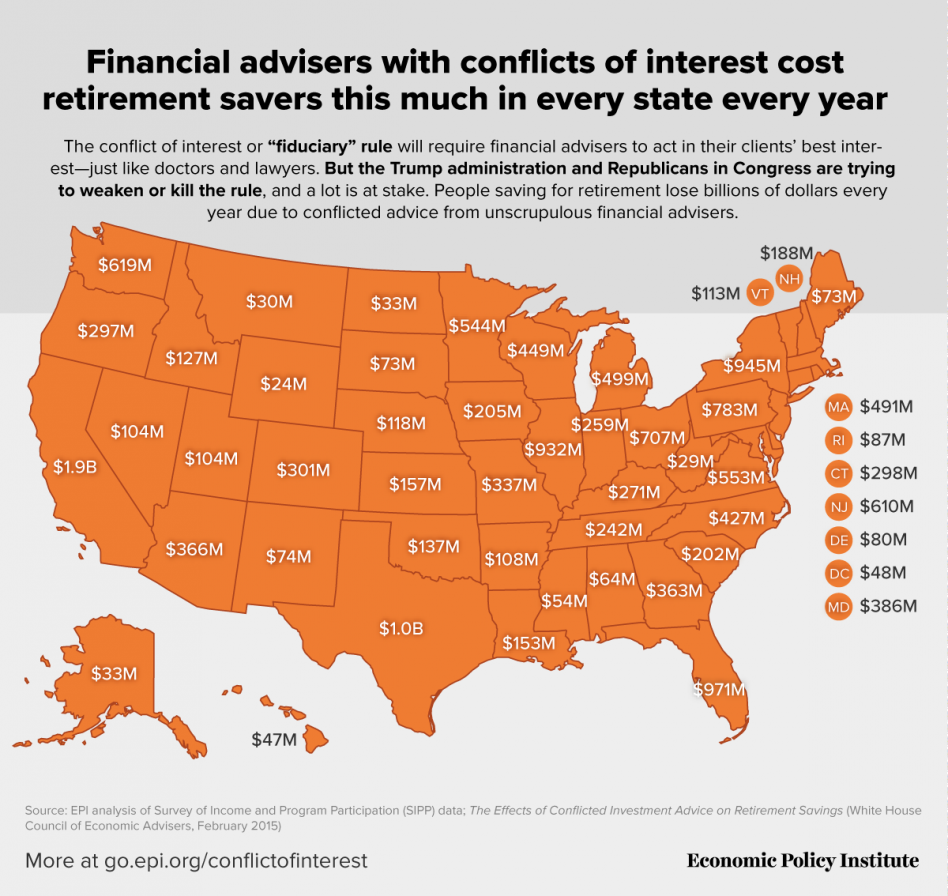

The map above shows how the cost of that conflicted advice — how much it costs retirement savers annually. The state by state breakdown of self-interested salesmanship — NOT ADVICE — simply works against the interest of both the saver and the taxpayer.

Annual losses are as high as a billion dollars in Texas and New York and nearly $2 billion in California. Some estimates have the annual excess fee friction as high as $20 billion dollars nationally. Now compound that over 30 years, and imagine how big a shortfall that is going to create.

Guess who is going to have make-up that giant gap? You the taxpayer are, that is who . . .

Previously:

The enlightened view on managing other people’s money (Washington Post, March 19, 2016)

Brokers Behaving Badly (Bloomberg, March 2, 2016)

mirror Bad Broker!

Imagine: Brokers Who Work for Investors (Bloomberg, April 20, 2015)

mirror The Fiduciary Standard is Coming!

Find a financial adviser who will put your interests first (Washington Post, October 25, 2014)

Brits May Cap Retirement-Plan Fees, Should We? (Bloomberg, November 7, 2013)

mirror Brits Debate Capping Retirement-Plan Fees, Should the USA?

Fiscal Hawks Should Love Cheaper Retirement Plans (Bloomberg, February 24, 2015).

mirror Attention Fiscal Conservatives: New IRA/401k Fiduciary Rules Will Reduce Future Taxes.

Regulating Big Firm Bad Behavior (June 19, 2009)