My easy like Sunday morning reads:

• When Earning $1 Million A Year Isn’t Enough To Retire Early (Financial Samurai) see also Low Fidelity (HumbleDollar)

• The Half-Life of Investment Strategies (A Wealth of Common Sense)

• “They Could Have Made a Different Decision”: Inside the Strange Odyssey of Hedge-Fund King Eddie Lampert (Vanity Fair)

• $100 Million Was Once Big Money for a Start-Up. Now, It’s Common. (New York Times)

• In This Never-Ending Lehman Short, $170,000 Is Still on the Table: Whitney Tilson made millions when Lehman went bust a decade ago, but he didn’t quite close the deal (Bloomberg)

• Dude, She’s (Exactly 25 Percent) Out of Your League (The Atlantic)

• An unusual medical training tool got its start as a childish prank (Quartz)

• South Korean women protest against growing epidemic of spycam porn (The Next Web)

• A satanic idol goes to the Arkansas Capitol building (Washington Post)

• Spotify is falling behind on lyrics and voice (TechCrunch)

Be sure to check out our Masters in Business interview this weekend with Richard Sylla, professor emeritus of economics at New York University’s Stern School of Business, and the author of several books, including “A History of Interest Rates” and most recently, “Alexander Hamilton: The Illustrated Biography.” He notes that rates in recent years are “the lowest in history, from the Code of Hammurabi to Babylon Civilization, Greek and Roman Civilization, the Middle Ages, Renaissance, right up until the present.”

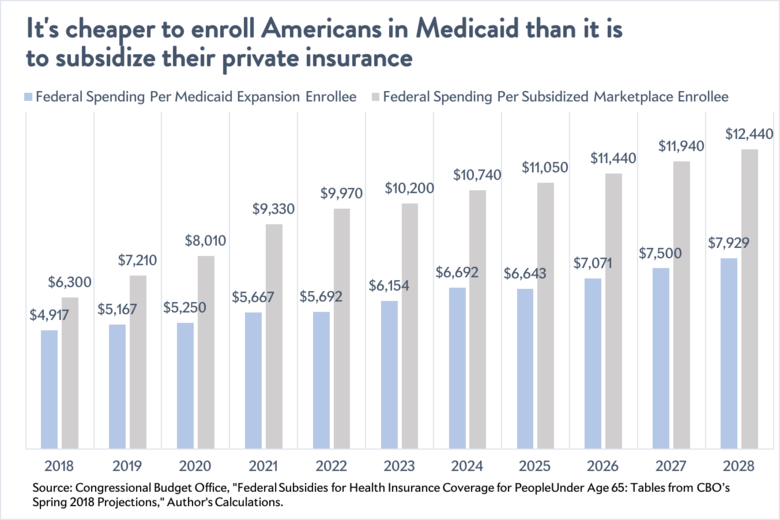

Enrolling Americans in Medicaid Is Now Cheaper Than Subsidizing Their Obamacare Coverage

Source: Slate

Want to receive our daily reads in your inbox? Sign up here!