Crimes Were Committed

Before, during and after the crisis, Financial Felonies abounded

TBP, September 12, 2018

Why did nobody go to jail?

To many people, this is the single most frustrating post-crisis question. Later this week, I will post the 10 issues people still misunderstand, but it is the lack of criminal prosecutions that still infuriates so many.

Multiple attempts have been made to explain this nonfeasance,1 with differing reasons given. Three explanations intrigue me – I agree with two of them – but they all are interesting for different reasons. Let’s jump right in.

1. Prosecutors were terrified: I have said this before, but it is worth repeating:

“The greatest innovation of the financial sector is not the ATM machine or interest-bearing checking accounts or securitization: It was convincing the powers that be that prosecuting them for their actual crimes would bring the economy to the edge of the abyss.”

During the crisis and its immediate aftermath, the idea that enforcing the law would somehow have an economic impact scared the living hell out of Department of Justice prosecutors, local U.S. Attorneys, and even State Attorneys General. Prosecute the banks and/or their executives, went the claim, and the entire system would crash again – and right after we spent all that money bailing them out!

But you know what? That decision is not the jurisdiction of Prosecutors.

It is not their jobs to pass judgment about potential economic impacts indictments might have. They lack the expertise to asses and analyze that — and, as it turned out, so did the people making those claims. But they successfully bamboozled the prosecutors into ignoring their oaths of office. The proper job of prosecuting attorneys is to identify and prosecute crimes, not play macro-tourist in the field of crisis-economics.

2. DOJ Had Been Gutted: This is a compelling explanation. It was made by Jesse Eisinger, writing in The Chickenshit Club: Why the Justice Department Fails to Prosecute Executives.2 In great detail, he traces the lack of white collar prosecution back to Enron’s collapse, and the death penalty imposed on Arthur Andersen (Enron’s accountants). They notoriously were the auditor/enabler of record for many of the era’s biggest accounting frauds and bankruptcies, including WorldCom, Waste Management, Sunbeam, and then finally Enron.3

According to Eisinger, many factors contributed to the great unraveling at the Justice Department, but the Andersen corporate death penalty was one of the bigger ones.4 DOJ lost both the know-how and the will to pursue and win cases in court. The Chickenshit Club tells the tale of how litigators in the corporate defense bar designed and executed a lobbying plan that effectively neutered the prosecutorial arm of the federal government. By the time the economy melted down, there was little motivation or expertise to pursue corporate crime.

3. Lots of Crimes, Few Prosecutions: People who know better keep repeating the trope that no crimes were committed before, during or after the financial crisis. I was reminded of this over the weekend, when a show I watch each week, Michael Smerconish on CNN, had Andrew Ross Sorkin as a guest.5

On CNN Saturday, Sorkin told Smerconish:

“As a journalist I wish I could have . . . really found the crime . . . The whole crisis felt like a crime . . . But in truth on a very individual basis I think these individuals at the top if these institutions made some very terrible decisions. But it is very hard to decide there were crimes, because you have to believe they were defrauding the public from the very top. . . . The people at the top did not understand what was going on two floors below them. So its very hard to convict under that scenario.”

This glib explanation rings hollow to anyone who was paying attention at the time. Those who have looked closely into this have found abundant criminality. Start with the Financial Crisis Investigation Commission Report, which while looking into the root causes of the crisis, saw evidence of felony fraud.6 They detailed their findings in the 663-page The Financial Crisis Inquiry Report.

Other informed people similarly found lots of evidence of fraud and other felonies. On the 5-year anniversary of the crisis, the Columbia Journalism Review pointed out that Sorkin was disingenuous as to the issue of bank executive criminality. I was somewhat less eloquent, calling BULLSHIT on his line of argument — and not for the last time.

Then there is the Federal Judge Jed Rakoff of the Southern District in New York. SDNY is the court has jurisdiction over Wall Street. He published his displeasure over the lack of prosecutions of Wall Street executives in a thoughtful 4000-word missive in the New York Review of Books.

It is highly unusual for a sitting judge to publish something like this in the mainstream media; even more so for a judge who’s jurisdiction includes the New York City’s major financial center banks.

Rakoff explicitly pointed to that the DOJ’s apparent disregard for equally enforcing the law, explaining: “the Department of Justice has never taken the position that all the top executives involved in the events leading up to the financial crisis were innocent; rather it has offered one or another excuse for not criminally prosecuting them—excuses that, on inspection, appear unconvincing.”

That has been my position for the past decade — Chickenshit club, indeed.

So where was the criminality? While I was researching and writing Bailout Nation, it was apparent to me that there was abundant AND systemic criminality7 across four broad categories:

Mortgage underwriting: There were obvious crimes committed in mortgage underwriting, where defects were knowingly ignored. The FBI investigated these cases early on, but investigators never moved forward with prosecutions.

Perhaps the scale of the financial penalties bank agreed to pay had something to do with this inaction. Keefe, Bruyette and Woods, tallied the financial-crisis related regulatory penalties — the total was a “staggering $243 billion.”

Accounting fraud: We could spend months discussing how some executives at banks cooked their books, but look no further then Lehman Brother’s infamous Repo 105. That was a textbook example of defrauding the investing public by hiding the conditions of your insolvency.

Insider Trading: Take a close look at insider stock sales during the period right before the crisis. Sure seems like a lot of selling an a hurry . . . I wonder why?

David DeBoskey, a San Diego State University professor of Accountancy (and a KPMG Faculty Fellow), found total compensation for top executives at just 4 of the firms that collapsed – Lehman, AIG, Fannie Mae and Freddie Mac – was in excess of $1.4 billion dollars from 2003 to 2007.8 That much stock being sold before share prices collapsed was apparently a mere coincidence.9

Foreclosure fraud: There was a huge paper train showing fabricated documents, falsified paperwork, and other perjury. Of all the crimes committed during the financial crisis and in its aftermath, this is one that should have been the easiest to identify and prosecute.

How can one look at all of this evidence and conclude no crimes were committed? It is impossible for any credible analyst or reporter to consider this mountain of evidence and walk away and say “Meh! Nothing here.”10

The reality is lots of objective, fair-minded people — judges, investigators, journalists, analysts and others — have looked at the details of the crisis. They have found ample evidence that broad, deep and systemic criminality existed. Only a handful of high-profile outliers have chosen to ignore the mountains of evidence in order to reach the opposite conclusion.

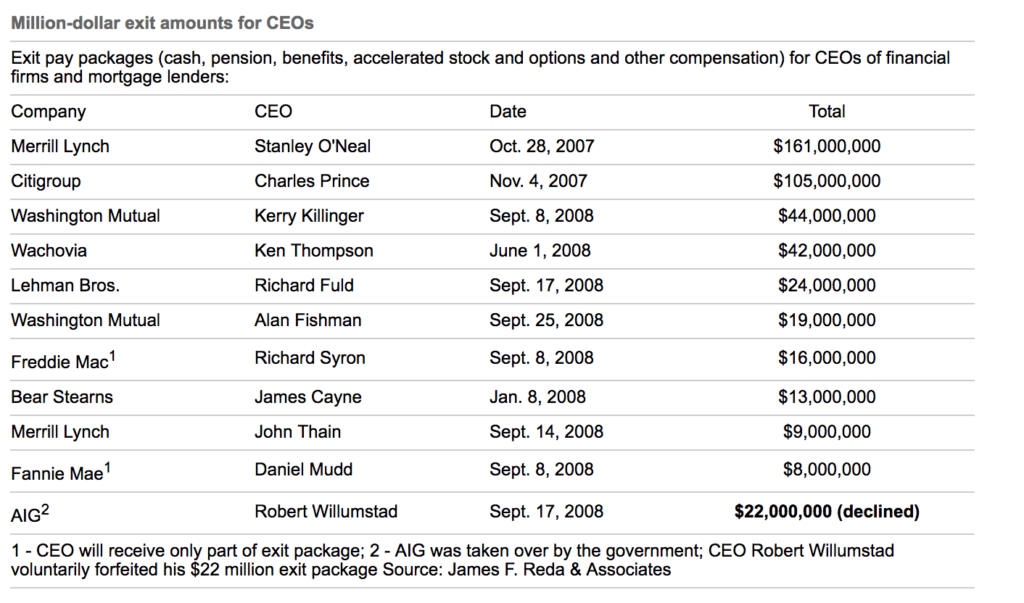

Bank CEO Compensation, Pre Crisis

Source: USA Today; See also, Pre-Crisis Financial Company CEO Compensation

__________

1. The word “Nonfeasance” seems to cause some confusion, especially as it relates to similar words. “Malfeasance” is an affirmative act that is illegal or wrongful by a public official; “Misfeasance” is that official acting in a way that results in injury. “Nonfeasance” is the failure of a governmental organization to act or to discharge its duties. That is clearly the situation with DOJ , USAG, etc.

2. Masters in Business interview with Jesse Eisinger (2017)

3. For many regulators, Enron was finally the last straw. To others, the ultimate penalty for Andersen was about half a dozen frauds too late.

4. Eisinger also points out that post 9/11, lots of human capital from the FBI, DOJ, IRS, AG and other offices with expertise in forensic accounting were moved from pursuing financial crimes to anti-terrorist squads. “Follow the Money” that was so effective in rooting out white collar crime was put to a different use.

5. See discussion at 2:30 mark on CNN.

6. Fortune: “In late 2010, in the waning months of the Financial Crisis Inquiry Commission, the panel responsible for determining who and what caused the financial meltdown that lead to the worst recession in decades voted to refer Robert Rubin to the Department of Justice for investigation. The panel stated it believed Rubin, a former U.S. Treasury Secretary who has held top roles at Goldman Sachs and later Citigroup (C, -0.29%), “may have violated the laws of the United States in relation to the financial crisis.”

7. To say nothing of all the non-crisis linked criminality: LIBOR rates were rigged by key players for their own benefit. See, e.g., the Spider Network for more details (MIB here); Then there was skimming and bid-rigging; see State Street Bank, and BNY Mellon; then there was Money Laundering of staggering sums of money for drug dealers and terrorists; drug cartels relied on big banks to launder their gains – one analysis estimated $1.6 trillion dollars; Wells Fargo admitted to laundering money for Mexican drug gangs; The U.S. Senate linked HSBC to drug lords and terrorists (leading to a record $1.9 billion fine).Cash controls exist to prevent money laundering; the Federal Reserve faulted Citigroup over its cash controls.

8. Note this included salaries, bonuses and stock-related pay.

9. All of Wall Street’s top executives were paid so much money that Graef Crystal, author of The Crystal Report on Executive Compensation, noted the “enormous sums of money paid” was so far above any other industry average as to be “obscene.” She noted, “Wall Street is whacked out.”

10. Access journalism at its finest.