My morning train reads:

• Adam Neumann created a company that destroyed value at a blistering pace and nonetheless extracted a billion dollars for himself. He lit $10 billion of SoftBank’s money on fire and then went back to them and demanded a 10% commission. How Do You Like We Now? (Bloomberg)

• How Small Differences in Fees Can Make a Big Impact (Of Dollars and Data)

• The Great Antitrust Awakening Can’t Be Stopped (Businessweek)

• Corporate America freaks out over Elizabeth Warren (Politico) but see The Wall Streeters who actually like Elizabeth Warren (Vox)

• Retirement Funds Are in the Crosshairs of US-China Conflict (Chief Investment Officer)

• The Obscure Charges That Utility Companies Add to Your Bills (ProPublica)

• Boris Johnson is discovering that Brexit only works when it’s a fantasy (Washington Post)

• Drivers are killing pedestrians at the highest rate in almost 30 years (The Verge)

• Bureaucratic thriller: Diplomat kept notes, tells his story (AP) see also William Taylor Delivers the Smoking Gun: of course it was a quid pro quo. (The Atlantic)

• The Dinosaur-Killing Chicxulub Asteroid Acidified the Ocean in a Flash (New York Times)

Be sure to check out our Masters in Business interview this weekend with Nobel Laureate Michael Spence, discussing his work on the dynamics of information flows and market structures, and his book, The Next Convergence: The Future of Economic Growth in a Multispeed World.

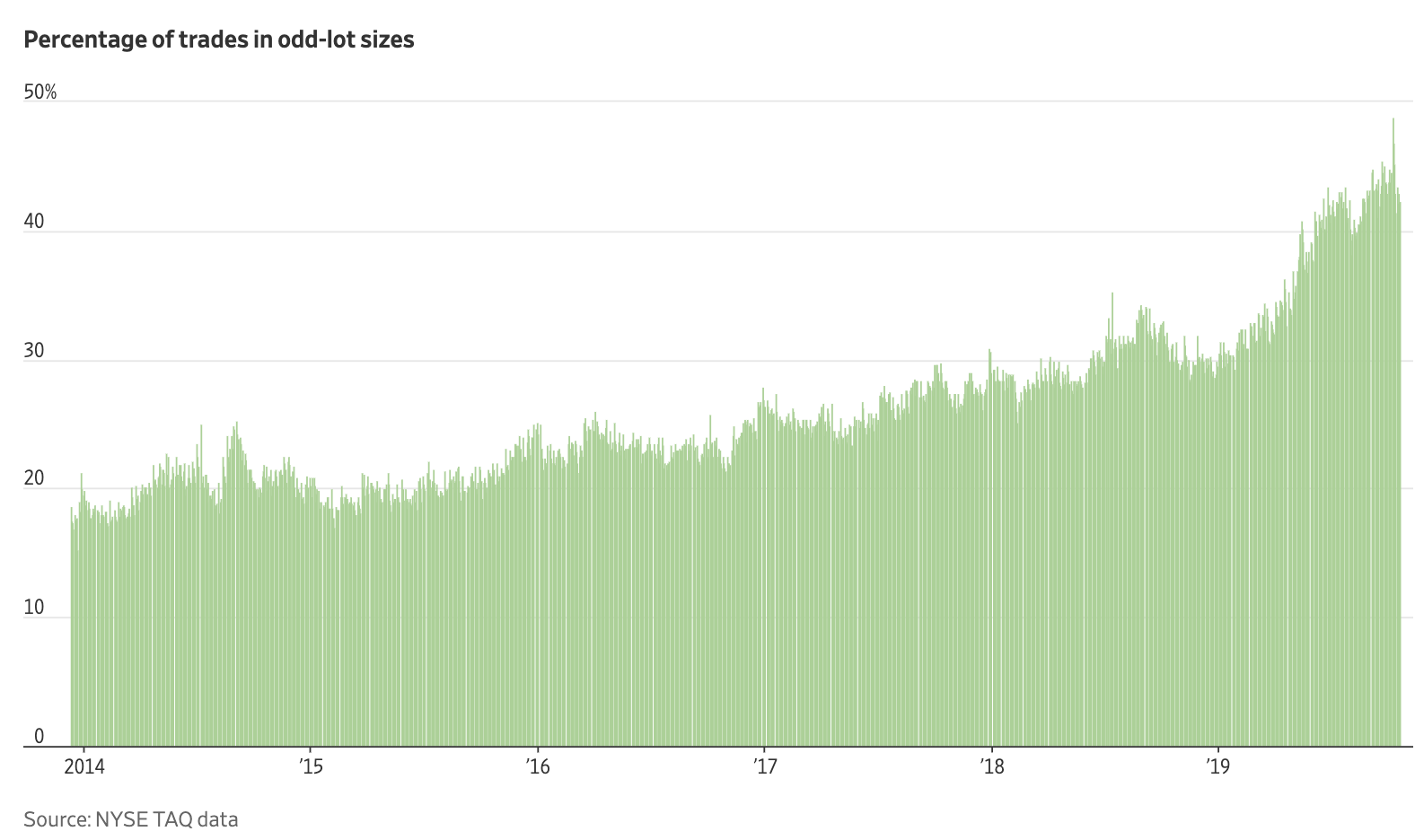

Tiny ‘Odd Lot’ Trades Reach Record Share of U.S. Stock Market

Source: WSJ

Sign up for our reads-only mailing list here.