@TBPInvictus here:

Long overdue: My pal David Rosenberg has finally decided to hang his own shingle: Please say hello to Rosenberg Research.

I have known “Rosie” for about 20 years. I recall back in 2002, when he was tapped to be the Chief North American Economist for Merrill Lynch. I have had the privilege of reading some version of “Breakfast with Dave,” (nee “Tidbits”) his daily cornucopia of data, musings, cogent thoughts on the state of the economy from the very beginning. They were immediately popular both within the firm and more widely all over the Street, as he was perennially highly rated in Institutional Investor.

Within a couple of years I had established an ongoing email dialogue with Rosie. He was incredibly responsive to my inquiries on every last economic question I put to him, no matter how basic it was. (For the record, he was even more responsive to my emails regarding the Yankees, but that’s another story.) Eventually, we met face-to-face (to go to a Yankees game, of course), and have been very close friends ever since.

I know lots of economists (save your pity), and most of them think of Rosie as a unique savant among their brethren.

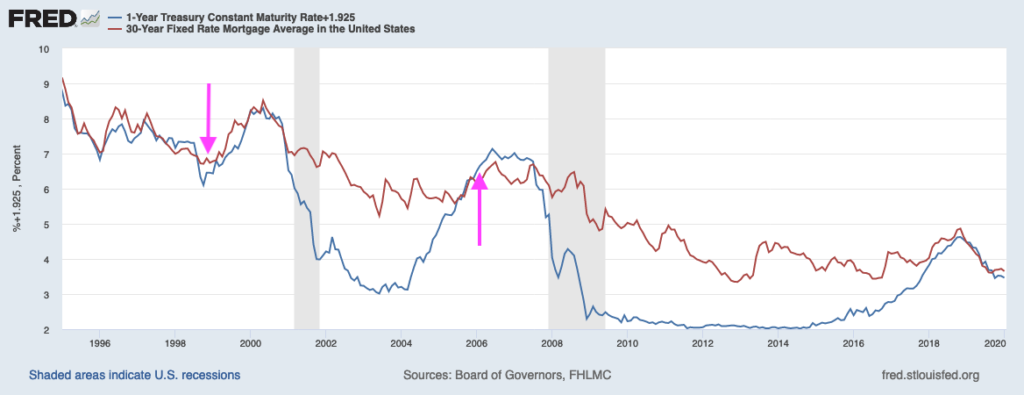

A quick anecdote, because what’s a post without a bit of data? I’d taken out a 30-year fixed rate mortgage in the late ’90s, at a rate of either 6.75% or 6.875% (downward pink arrow below). Circa 2006, Rosie and I were discussing his forecast for the economy and interest rates when he told me, “Rates are going to go much lower than anyone thinks for much longer than anyone thinks.”

This comment, of course, had me wondering if it might behoove me to refinance into a floating rate mortgage (something I’d never envisioned myself doing). With a bit of trepidation, I swapped out of my fixed rate mortgage and into a 1-year CMT+spread floater (upward arrow below). There was a bit of pain initially as rates edged a bit higher, but that swap has turned out – with great thanks to Rosie – to be spot-on. Rates did indeed go lower than anyone thought for longer than anyone thought, and for literally years I was paying little more than the spread. The savings, while I suppose not technically incalculable, have been immense.

True story: Way back when, Barry had been pressing Rosie go out on his own for about a decade, and urged Dave to go buy the URL “RosenbergResearch.com” just in case. Knowing Dave was not ready to launch, BR reserved it himself. When Rosie complained to us years later the domain was not available, BR showed him how to see who owned it via a WHOIS lookup. When he did, he was astonished to see who owned it. (Laughs were had by all).

When Rosie left Merrill to go Gluskin-Sheff + Associates (and home to Toronto) in 2009, I continued to religiously read his daily missives. Whether I agree or disagree with any particular point of view, there is no one who brings a more thoughtful, comprehensive, and encyclopedic knowledge of economics to the table than Dave. What he gets it wrong – and everybody on Wall St. gets things wrong and is humbled on an almost daily basis – it is never due to ideology or close-mindedness.

As of the start of 2020, Rosie has embarked on a new chapter to his illustrious career – Rosenberg Research. Rosie’s new website says: “We are the trusted advisor who connects the dots between ‘macro’ and the ‘market’, and in so doing help our clients make well-informed financial decisions.” This is exactly what Dave has been doing for 30+ years. It’s what he did for me. It’s what he can do for you. Hop on over to his new website, sign up for a trial and read some of the best economic commentary anywhere on the Street.