My morning train WFH reads:

• Would You Rather: Buy Too Early or Buy Too Late in a Bear Market? (A Wealth of Common Sense) see also The Relationship Between Earnings and Bear Markets (A Wealth of Common Sense)

• Failing small business (Popular Information)

• Malkiel: It’s a Good Time to ‘Stock’ Up (Wall Street Journal)

• Why Now-Reviled Stock Buybacks Will Rise Anew (Chief Investment Officer)

• Christine Lagarde’s $810 Billion Coronavirus U-Turn Came in Just Four Weeks (Bloomberg)

• The Fed’s Intervention Is Widening the Gap Between Market Haves and Have-Nots (Wall Street Journal)

• Study: Air pollution linked to far higher Covid-19 death rates (The Guardian)

• Why Bernie Sanders Lost (fivethirtyeight)

• Flying Down Empty Roads in Ferrari’s F8 Tributo (Wall Street Journal)

• The secret, ‘Rocky IV’-inspired recovery of Tua Tagovailoa, the NFL draft’s most important prospect (Washington Post)

Be sure to check out our Masters in Business interview this weekend with John Mousseau, CEO and Director of Fixed Income Trading at Cumberland Advisors, which manages $3.5B in fixed income products.

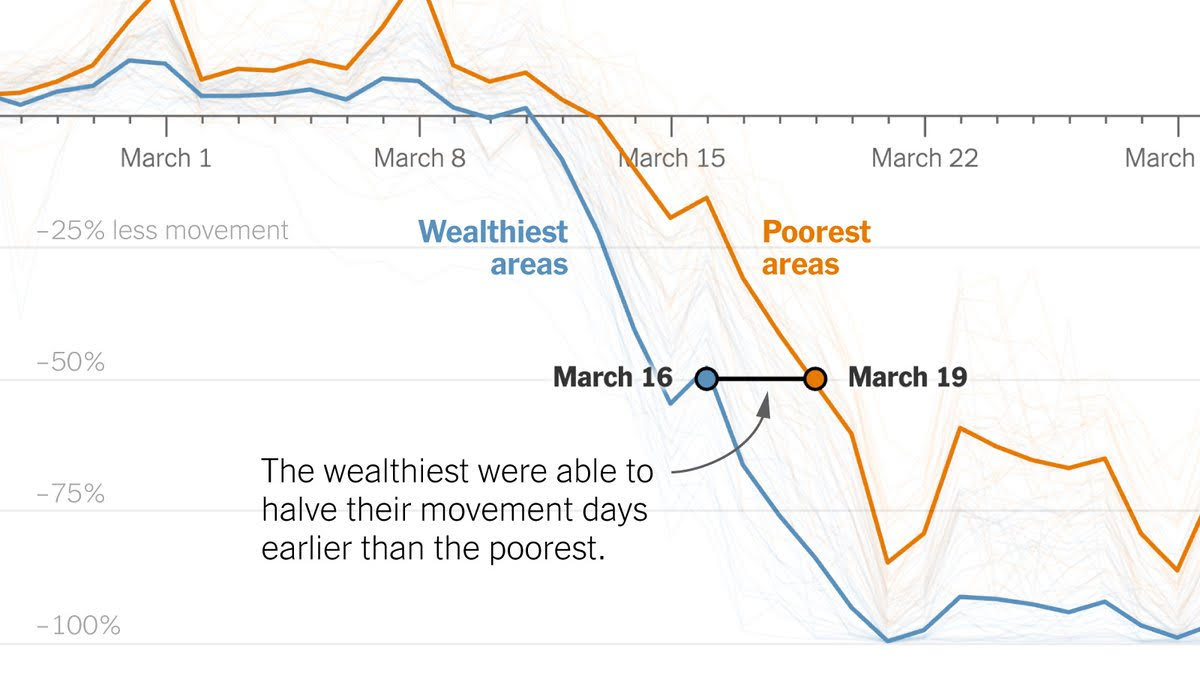

Location Data Says It All: Staying at Home During Coronavirus Is a Luxury

Source: New York Times

Sign up for our reads-only mailing list here.