My morning train WFH reads:

• Our dangerous addiction to prediction: When it comes to forecasting, what we need more than anything is humility (Unherd) but see Don’t Expect A Quick Recovery. Our Survey Of Economists Says It Will Likely Take Years. (FiveThirtyEight)

• With M&A Dead, Wall Street Bankers Keep Busy With Stock Sales (Bloomberg)

• Reality Check: Are Food Delivery Apps Actually Awful Businesses? (The Information)

• How Much of the Bear Market Losses Have Been Recovered? (Wealth of Common Sense)

• Jamie Dimon Captures the Stock Market Moment (Bloomberg)

• A New York real estate agent on what’s actually luring apartment buyers right now. (Slate)

• Social Media Usage Is At An All-Time High. That Could Mean A Nightmare For Democracy (NPR)

• With 100,000 dead from coronavirus, U.S. sees its promise and flaws far more clearly (NBC)

• Steve Carell Charts a Return to TV Comedy With ‘Space Force’ (New York Times)

• In crucial Florida, some senior voters cast a skeptical eye toward Trump’s reelection (Washington Post) see also COVID-19 Brings Private Equity Investment in Nursing Homes into the Spotlight (Skilled Nursing News)

Be sure to check out our bonus podcast, with Michael Lewis, author of Moneyball, The Big Short, and so many others. The second season of his podcast Against the Rules, just dropped, focusing on Coaches.

Be sure to check out our Masters in Business interview this weekend with

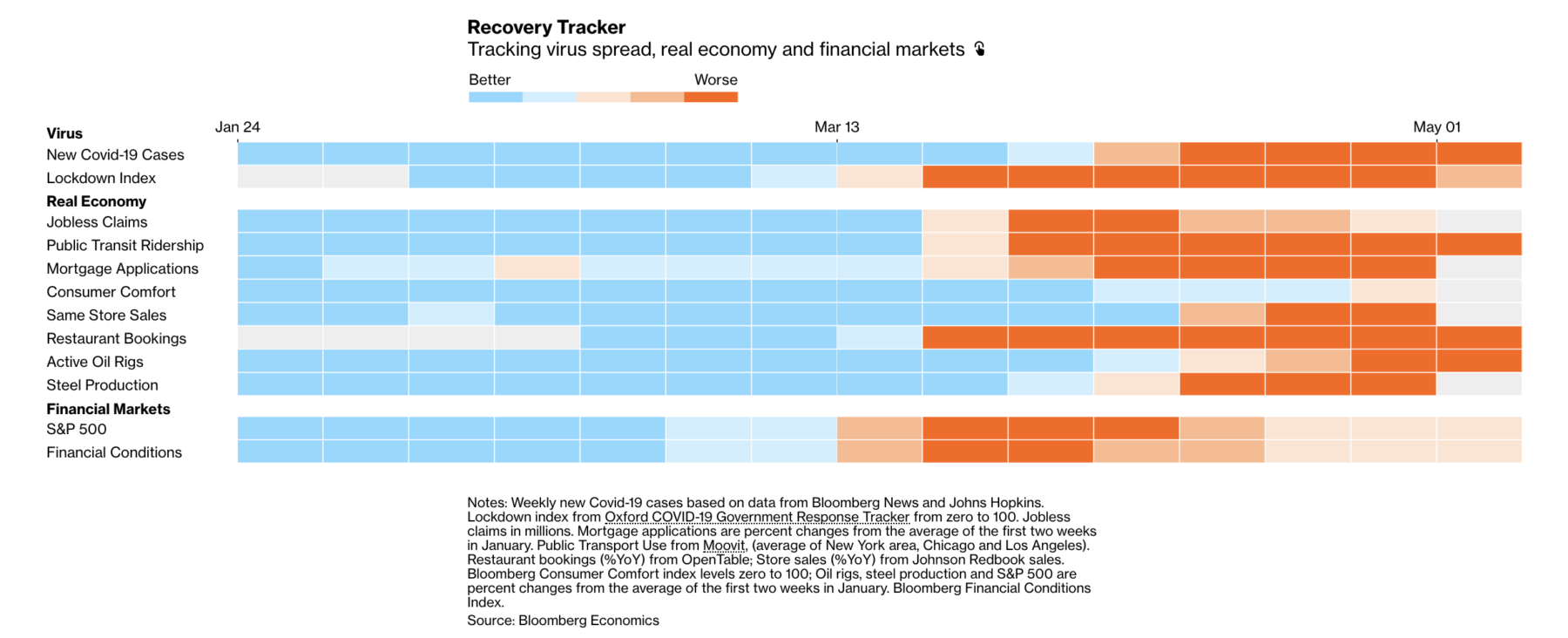

Recovery Tracker: A Real-Time Look at the Post-Covid U.S. Economy

Source: Bloomberg

Sign up for our reads-only mailing list here.