My Two-for-Tuesday morning train WFH reads:

• How Robinhood Convinced Millennials to Trade Their Way Through a Pandemic (Medium) see also Robinhood Midas Touch in Stocks Disputed by Barclays Researcher (Bloomberg)

• COVID19 Was Never “Under Control” in America: We need to remember this as we proceed with reopening (Slate)

• Low-information ‘investors’ rule the stock market — at least until they lose every cent (Marketwatch) see also Pessimistic Pros Missed the Big Rally, and So Did Many Americans (Businessweek)

• Solving online events (Benedict Evans).

• Home Prices Are Rising, Along With Post-Lockdown Demand (New York Times) but see also Nearly a Third of U.S. Renters Worried About Their Next Payment (Bloomberg)

• How To Read 2020 Polls Like A Pro (Fivethirtyeight)

• Economists’ silence on racism is 100 Years in the making (Newsweek) see also Economics, Dominated by White Men, Is Roiled by Black Lives Matter (New York Times)

• The Supreme Court’s landmark LGBTQ rights decision, explained in 5 simple sentences (Vox)

• These Prosecutors Are Refusing Hundreds of Cases from Blacklisted Cops (Marshall Project) but see also Support For Defunding The Police Department Is Growing. Here’s Why It’s Not A Silver Bullet. (Marshall Project)

• At 99, Al Jaffee Says Goodbye to Mad Magazine (New York Times)

Be sure to check out our Masters in Business interview this weekend with Luke Ellis, CEO of Man Group, a global active investment manager with $104.2 billion in AUM.

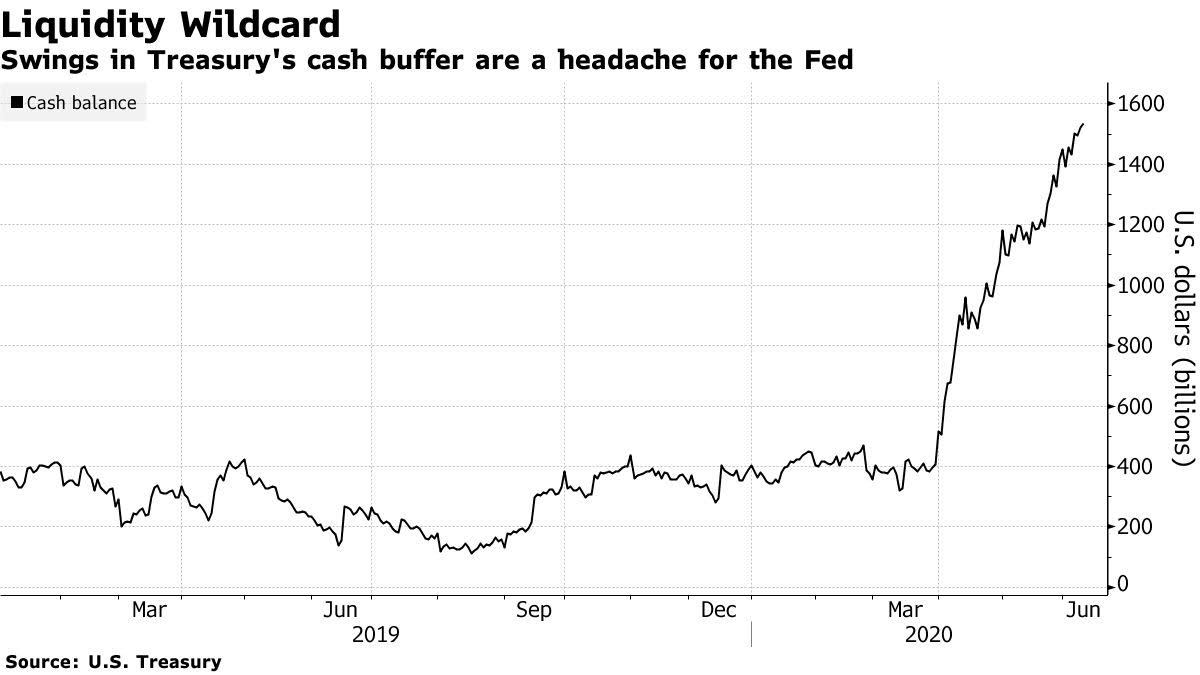

Treasury’s Record Cash Pile Is Jerome Powell’s $700 Billion Headache

Source: Bloomberg

Sign up for our reads-only mailing list here.