My back to work morning train WFH reads:

• The $52 Trillion Bubble: China Grapples With Epic Property Boom Real-estate surge eclipses the one in U.S. housing in the 2000s; desperate buyers undeterred by Covid pandemic Residential buildings and apartment towers in Shanghai. (Wall Street Journal)

• The Hedge Fund That Bridgewater Says Stole Its Trade Secrets: Tekmerion’s Origin Story: Two days after Zachary Squire and Lawrence Minicone launched their hedge fund firm, their former employer — and its founder — stepped in. (Institutional Investor)

• Robinhood Is Democratizing Markets, Not Disrupting Them: The investment platform’s users are gaining valuable experience without destabilizing stocks. (Bloomberg)

• Should Universities Spend More From Their Endowments? It’s the first question during a crisis. Given unprecedented disruption, some schools are starting to increase payouts from their troves. (CIO)

• From 1720 to Tesla, FOMO Never Sleeps: The South Sea bubble is the classic story of an investing mania. Are investors today any wiser? (Wall Street Journal)

• How Dixie cups became the breakout startup of the 1918 pandemic: Dixie cups were like the Zoom of the Spanish flu pandemic in 1918, which helped the product become a household name. (Fast Company)

• Why Advisory Teams of the Future Will Be More Diverse: The future of the wealth management industry lies with teams—groups of individuals working together—as opposed to sole proprietors. And research shows that the best financial teams are those that exhibit diversity. (Barron’s)

• Your New Home Office May Be in the Backyard: With more people working from home, business is booming for companies selling livable sheds. (New York Times)

• JFK Jr. didn’t die! He runs QAnon! And he’s No. 1 Trump fan, omg!!! QAnonism is not some tabloid trash conspiracy theory. Its claims are impeccably sourced, copiously researched and rigorously tested. LOL JK! (Washington Post)

• No MILFs, No Gang Bangs: How the Porn Industry Is Changing During COVID-19: Adult film companies that have gradually started to move back into production after more than three months of an industry-wide production hold (Rolling Stone)

Be sure to check out our Masters in Business interview this weekend with Martin Franklin of Mariposa Capital. Franklin is credited with successfully reviving the use of SPACs, or blank check companies, as public vehicles for long term M&A.

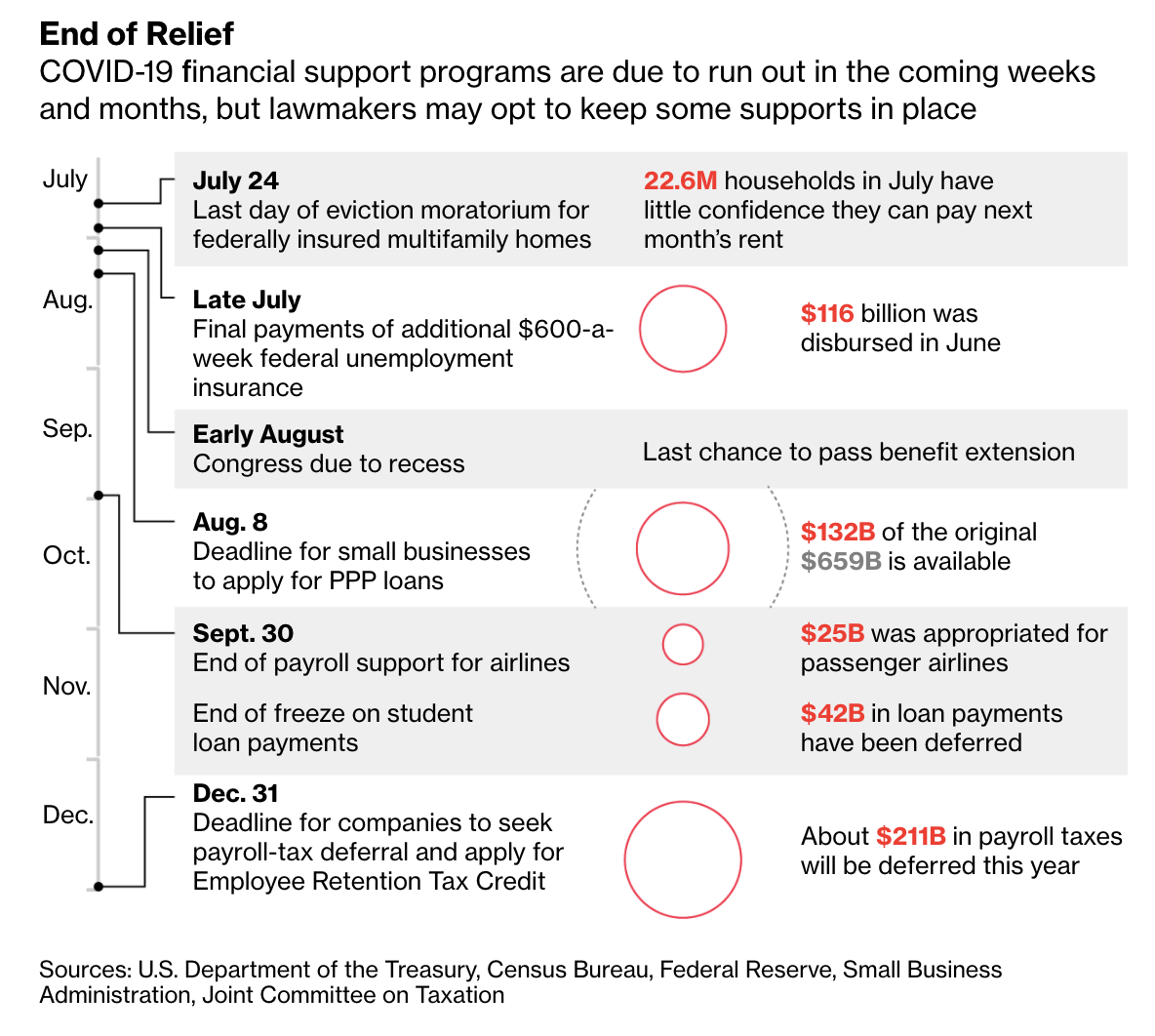

Fiscal Cliffs Threaten Fragile U.S. Recovery

Source: Bloomberg