Negative interest rates not the right tool for this shock

Source: Torsten Sløk, Deutsche Bank Research

Torsten Sløk, chief economist at Deutsche Bank, is one of my favorite economics analysts. I have featured him in these pages over the years and had a fascinating discussion with him two years ago (MiB here).

Alas, I was saddened to learn he was departing Deutsche Bank. He will be joining alternative investment firm Apollo Global Management. I was sad only because I enjoyed getting his daily missives. I am about halfway through Dark Towers, which implies this will likely be a great move for him.

I hope he will be able to continue sharing his charts & analytics at his new job, but for at least one more time, here is his recent chart/discussion on the futility of negative interest rates int he USA:

From Torsten Sløk:

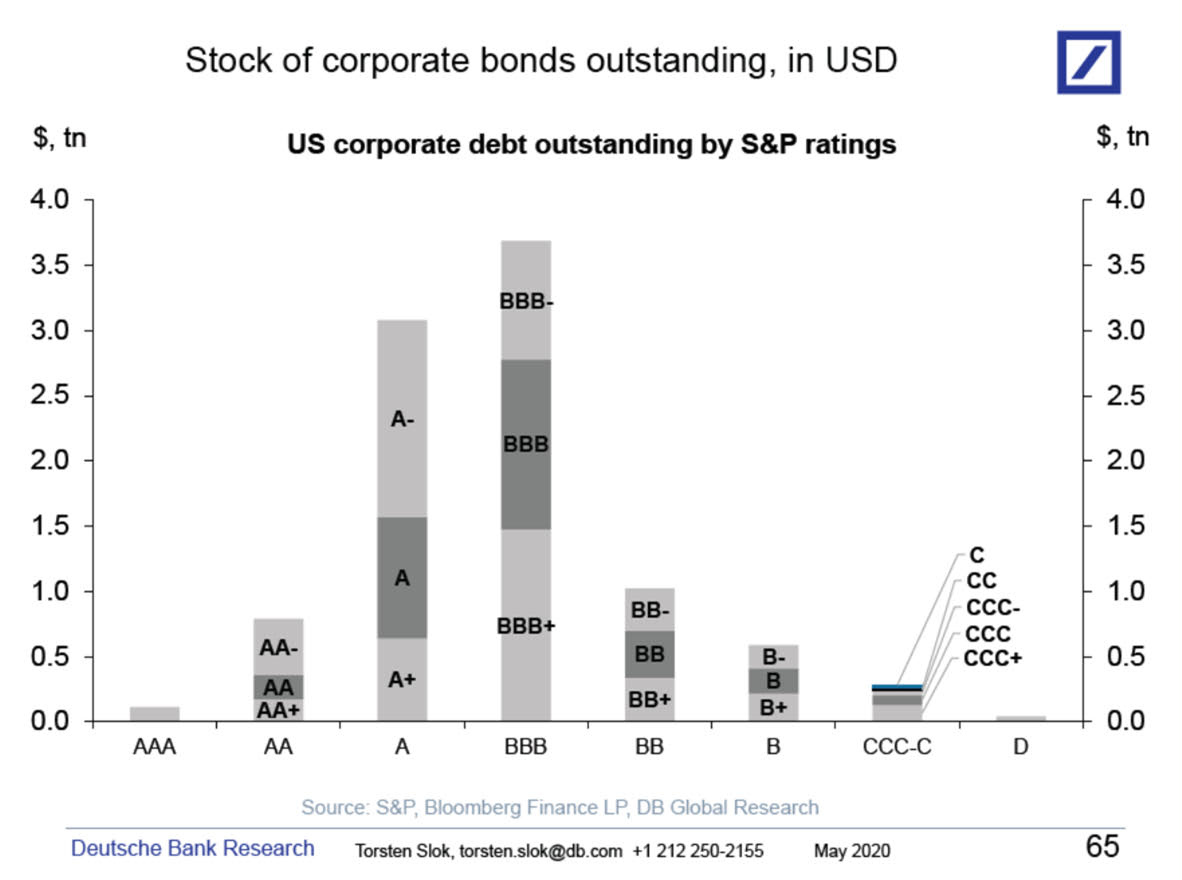

Fed Chair Powell will today at 9 am host a discussion about the economic outlook here, and he is likely to be asked about negative interest rates. This recession was triggered by corporate cash flows going to zero once the economy shut down, which widened spreads on corporate bonds because of uncertainty about the liquidity and solvency of companies. The correct monetary policy response to a corporate cash-flow shock is not negative interest rates but to do QE and buy corporate bonds to narrow spreads and thereby make cash easily available as long as corporate revenue is zero. Also, the experience in Europe and Japan shows how damaging negative interest rates have been, and going much deeper negative on central bank interest rates runs the risk of a bank run where a substantial amount of deposits are suddenly withdrawn and “stuffed into mattresses” to avoid the expensive negative interest rate associated with having money in a bank account. The bottom line is that a negative Fed funds rate in the US is not the right response to this shock and Europe and Japan show that negative interest rates don’t trigger a strong economic recovery and only make the situation worse.

Good luck int he new job, Torsten! Enjoy your summer off.