My Two-for-Tuesday morning train WFH reads:

• Dot-Com Survivors Give Verdict on Current Tech Boom: “The only people who say, ‘Yes, it’s like the 1990s’ are hedge-fund managers who are net short and annoyed. To say it’s like the late 1990s — they have no idea.” (Bloomberg) see also Has the Market Changed at All Since the Bottom? This is how fear and greed work. (A Wealth of Common Sense)

• Hulbert: Hedge fund fees are truly shocking: If you already see hedge fund fees as exorbitant, you ain’t seen nothing yet. Over the past two decades, the hedge fund industry has kept 64 cents of every dollar of gross profits that it has generated above the risk-free rate. (Marketwatch)

• ETF Boom Fuels Gold’s Sharp Rise Surge in precious-metals prices this year comes alongside rising exchange-traded-fund purchases and increased volatility (Wall Street Journal) see also Why Gold Prices Are Hitting All-Time Highs: A guide to the market for the precious metal, whose price hit an all-time high during the coronavirus pandemic (Wall Street Journal)

• Debt, eviction and hunger: Millions fall back into crisis as stimulus and safety nets vanish: Without federal aid to stave off the impact of the pandemic and economic recession, households that were already on the margins are now being pushed to the brink of financial ruin. (Washington Post)

• Many Companies Planned to Reopen Offices After Labor Day. With Coronavirus Still Around, They’re Rethinking That. Companies had hoped to bring homebound workforces back in September, but employee outcry and fears over outbreaks have led bosses to change course. (Wall Street Journal) see also Retail Landlords Offer Pandemic Clauses in New Leases Some agreements will allow tenants to defer some rent if the government orders another shutdown related to coronavirus (Wall Street Journal)

• How University of Chicago, Howard, & Other Endowments Are Tackling Asset Management’s Big Problem: The school’s efforts to increase the representation of female and minority managers in its portfolio over the last decade was among several success stories cited by the Intentional Endowments Network in its new guide on how college and university endowments can better invest in racial equity. (Institutional Investor)

• It’s Not Too Late to Save the Internet: The Trump administration has done enormous damage to the free and open internet worldwide. Here’s what would need to happen to reboot it. (Slate) see also Facebook is finally cracking down on QAnon: For years, the conspiracy theory has spread unchecked on the social media network, amassing millions of followers. (Vox)

• An Epidemic of Depression and Anxiety: Among Young Adults As Covid-19 spreads, so do mental-health problems, especially among Gen Z and Millennials. A lot of this has to do with uncertainty. (Bloomberg)

• Record melt: Greenland lost 586 billion tons of ice in 2019: Greenland lost a record amount of ice during an extra warm 2019, with the melt massive enough to cover California in more than four feet (1.25 meters) of water. (AP) see also Greenland’s ice sheet has melted to a point of no return: Greenland’s ice sheet has melted to a point of no return, and efforts to slow global warming will not stop it from disintegrating (CNN)

• Jerry Seinfeld: So You Think New York Is ‘Dead’ (It’s not.) “You found a place in Florida? Fine. We know the sharp focus and restless, resilient creative spirit that Florida is all about. You think Rome is going away too? London? Tokyo? The East Village?” (New York Times)

Be sure to check out our Masters in Business interview this weekend with Mandell Crawley, head of Private Wealth Management for Morgan Stanley, which manages more than $2 trillion in assets under management.

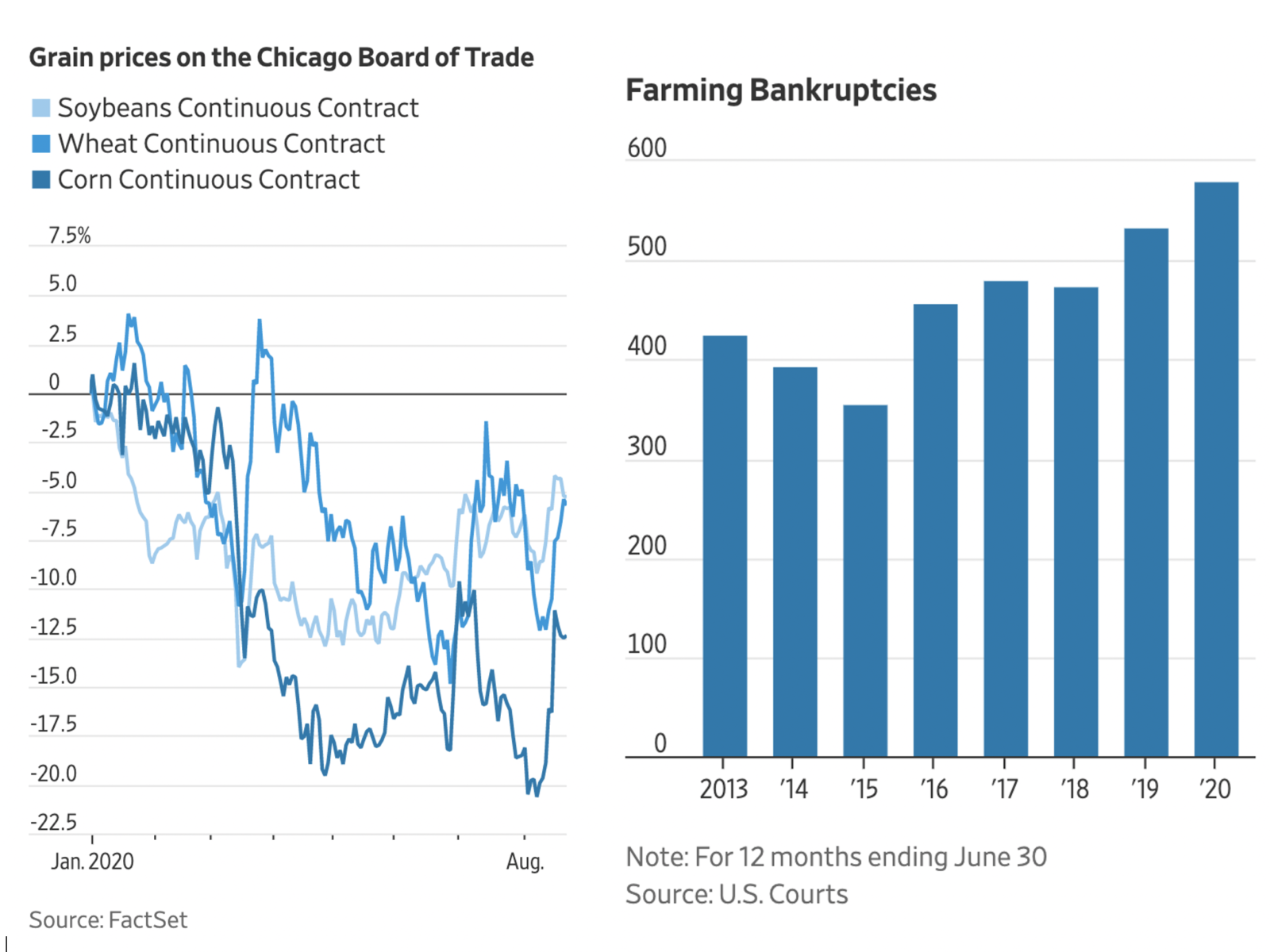

The economic picture for U.S. farmers remains fragile

Source: Wall Street Journal

Sign up for our reads-only mailing list here.