My back to work, morning train WFH reads:

• Is It Insane to Start a Business During Coronavirus? Millions of Americans Don’t Think So. The pandemic closed hundreds of thousands of businesses across the country. But now applications for new U.S. businesses are rising at the fastest rate since 2007. Why? A mix of necessity and opportunity. (Wall Street Journal)

• Welcome to FinTok, Where Day Trading, Options Investing, and Misinformation Reign: TikTok is Gen Z’s financial education hub. That’s a problem. (Institutional Investor)

• The September market swoon accomplished most of what corrections are supposed to do: The four-week slide took the S&P 500 down 10%, cost the Nasdaq Composite 14%, relieved grossly overextended conditions in mega-cap tech shares, punctured investor overconfidence and showed newcomers to trading that stocks don’t always go up.(CNBC)

• Bloomberg poised to become third largest ETF index provider: The $90bn attracted to its benchmarks this year dwarfs that of MSCI and S&P Dow Jones (Financial Times)

• Negativity Is Not an Investment Strategy: Complaining can be cathartic at times but it’s not an investment strategy. You still have to invest in something if you wish to grow your capital. (A Wealth of Common Sense)

• A Brain Trick to Make You More Creative, Intuitive, and Happy: How to make ‘cognitive ease’ work for you (Medium)

• Larry Ellison’s on-off TikTok deal is a three-ring circus: No significant money is changing hands, and the ownership structure that makes it look like TikTok will largely be owned by US investors is misleading: the tech & algorithm underlying the app will still be owned by Chinese controlled ByteDance. (New York Post)

• Why we’re still years away from having self-driving cars: Self-driving cars were expected to roll out by 2021. Here’s what we need to solve and build first. (Vox)

• O’Brien: Trump’s Taxes Show He’s a National Security Threat: What trade-offs would a president with this level of indebtedness be willing to make to save face? (Bloomberg)

• ‘Losers’ Review: The Lessons of Defeat: To the man who threw the pennant-losing pitch to Bobby Thomson, a priest said it could happen to anyone. ‘Yes, father, but why did it have to be me?’ (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Pedro Earp, Chief Marketing Officer at AB InBev as well as the director of the company’s Venture Capital fund, ZX Ventures Officer. AB InBev is the world’s leading brewer, selling about ~1/4 of all beer around in the world beer in more than 150+ countries with such brands as Budweiser, Corona, Stella, Becks, Hoegarden, Modela, and 100s others.

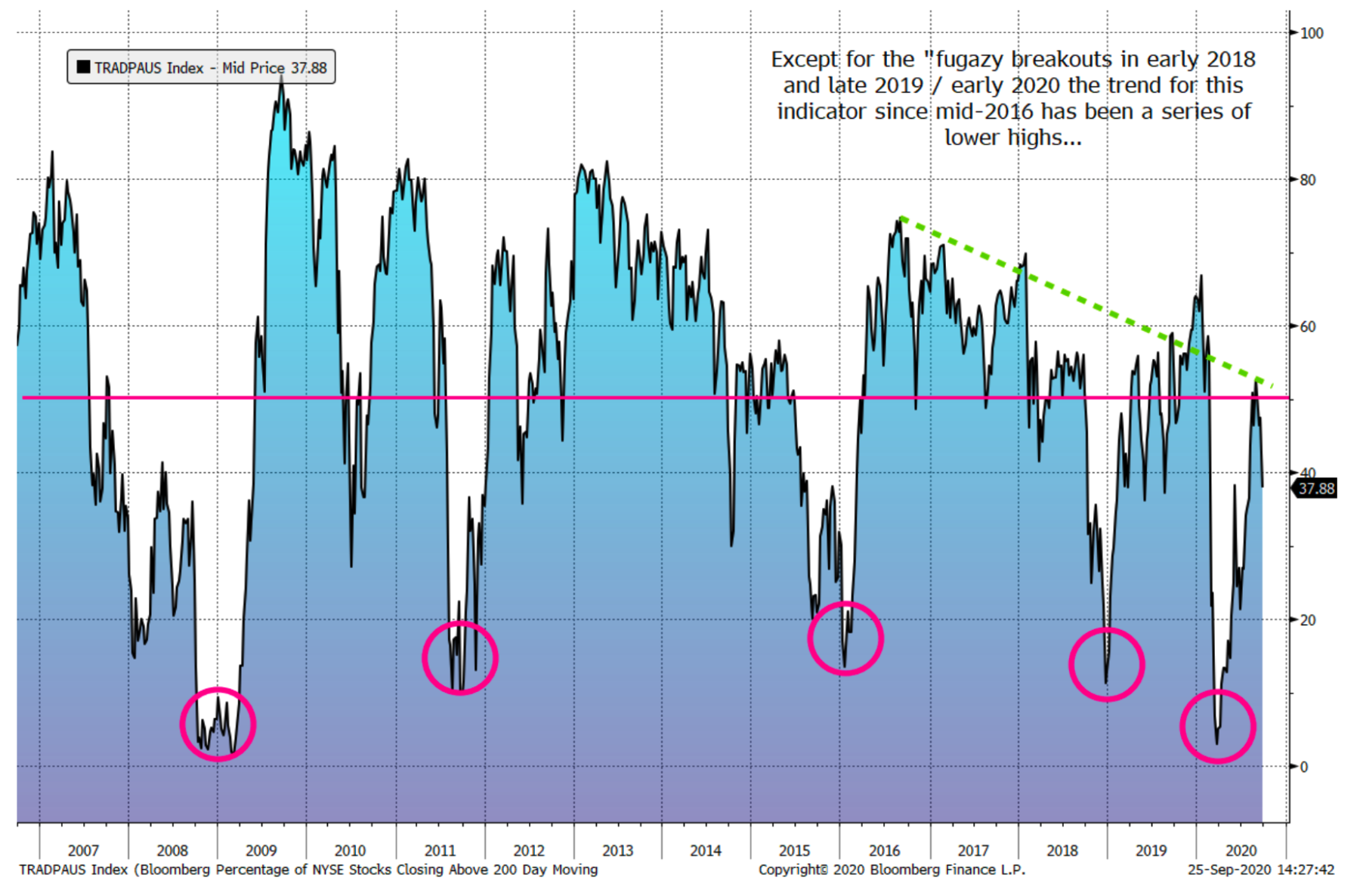

% of NYSE Stocks Above Their 200-Day MAs is 38%, Far Above Last 6 Major Oversold Readings

Source: Wolfe Research