My end of week morning train WFH reads:

• Stocks Typically Climb, Regardless of Who’s in the White House Nonetheless, some analysts are drawing comparisons to 2000 when a contested election led to a selloff (Wall Street Journal)

• Why Own Bonds When Rates are So Low? With 10-Year U.S. Treasury Bonds currently yielding less than 1% annually, the question on so many investors’ minds is: Why should I own bonds at all? (Of Dollars And Data)

• FOMO is every investor’s worst enemy. Here’s how to fight it Face the fear of missing out so you don’t miss new opportunities (Marketwatch)

• Mediocre SPAC Returns Shouldn’t Be a Surprise The latest Wall Street craze puts Sturgeon’s Law to the test. (Bloomberg)

• The American Pickup: As far as most consumers and producers are concerned, a pickup isn’t a pickup unless it’s big. (N+1) see also Spread of Electric Cars Sparks Fights for Control Over Charging States across U.S. weigh what role electric utilities should play in building new networks for powering vehicles (Wall Street Journal)

• During the Great Financial Crisis, Overly Optimistic Ratings Helped Kill the Market. Could It Be Happening Again? An academic report found a major difference between ratings for tranches and their underlying securities that could indicate CLOs are riskier than investors think. (CIO)

• What Al Fresco Dining May Look Like When It’s Cold In some neighborhoods, rows of heat lamps may become a defining feature of Covid winter sidewalks. But costly heaters aren’t the only or best option for many restaurants. (Bloomberg)

• Are We Trading Our Happiness for Modern Comforts? As society gets richer, people chase the wrong things. (The Atlantic)

• David Letterman Isn’t Here to Cheer You Up This Time The veteran TV host is back with more episodes of his Netflix interview series and a perspective that has been altered by the coronavirus pandemic. (New York Times)

• ‘Letter to You’ by Bruce Springsteen: A Memo From The Boss Bruce Springsteen’s 20th studio LP is an album tailored to longtime fans that explores aging, loss and the meaning found in music. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Ray Dalio, founder and Chairman of Bridgewater Associates, the world’s largest hedge fund. His latest book, The Changing World Order: Why Nations Succeed and Fail, will be published January 12, 2021.

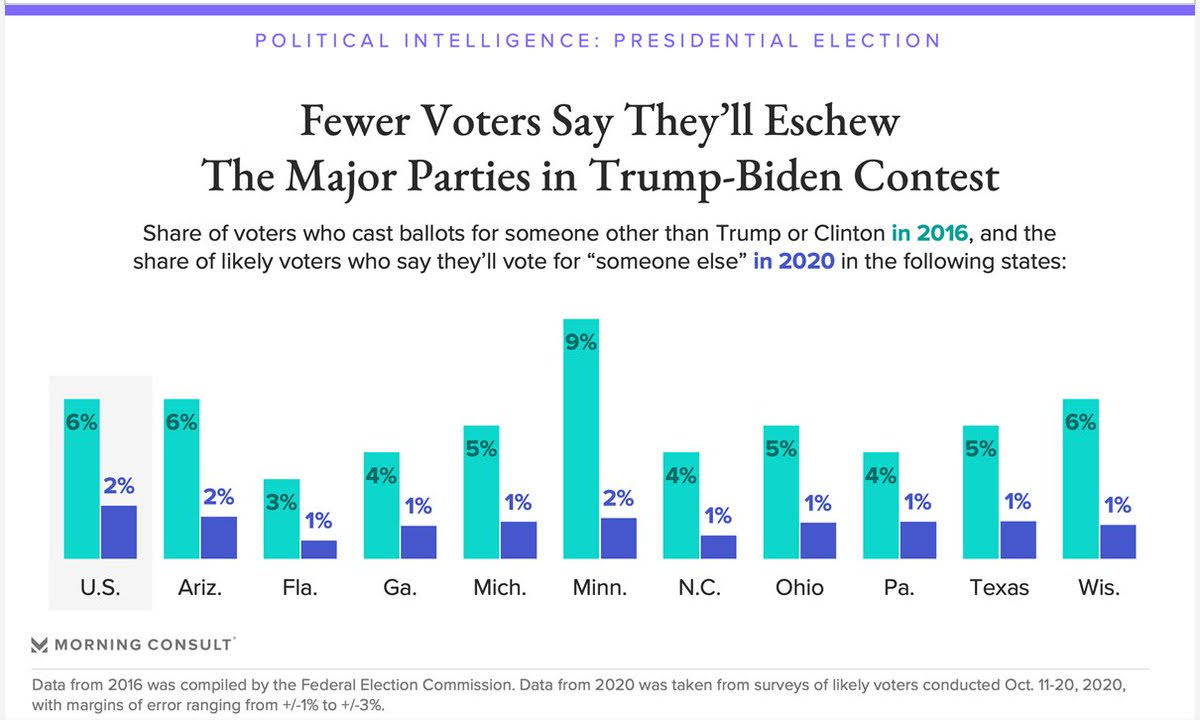

Diminished impact of 3rd parties in 2020 vs 2016

Source: @MorningConsult via @bpmehlman

Sign up for our reads-only mailing list here.