My mid-week morning train WFH reads:

• The home of the Sopranos is under siege: Inside the battle for the soul of HBO AT&T CEO John Stankey wants to make HBO the centerpiece of a new mission: Build a true Netflix competitor, dubbed HBO Max, which launched in May. Along the way, he has dismantled the old Time Warner, attempting to funnel all of the company’s resources from cable, film, and HBO into HBO Max. (CNBC)

• GMO: Value: If Not Now, When? After more than a decade of disappointing performance, Value stocks just experienced their worst 12-month performance in history. This has left these stocks trading at some of the cheapest levels relative to the market we have ever seen. If Value were to continue trading at current spreads to the market and experienced the same relative fundamental performance as it has over the past 14 years, it would beat the market. The flip side of the extraordinary cheapness of Value is the expensiveness of Growth: we believe Growth stocks have entered a bubble similar to the one in 2000. (GMO)

• Hedge Funds Love SPACs But You Should Watch Out Free lunches don’t last long in finance but hedge funds have identified a temporary exception to that rule: the special purpose acquisition company. North American SPACs have raised almost $70 billion this year in IPOs, and a big chunk of that money comes from the hedge fund industry. Some funds hold scores of SPACs and it’s been a lucrative bet. Retail investors need to understand the role hedge funds play in seeding SPACs. The two groups’ interests aren’t always aligned. (Bloomberg)

• How to Invest When You’ve Already Won the Game If you started 2020 with a $1 million portfolio invested exclusively in the U.S. stock market, your balance would have fallen to less than $700,000 by March 23, 2020. As of the close on Friday your portfolio would now be worth close to $1.2 million. This volatility can become a cause for concern among many investors who have a sizable nest egg. (A Wealth of Common Sense)

• San Francisco’s 35% Plunge in Rents Shows Effects of Tech Fleeing City Tech stocks are soaring and high-profile IPOs are set to mint millionaires. Yet in San Francisco, the boom times are over. The resurgent coronavirus has thrust the tech hub back into lockdown. Offices sit empty as work-from-home policies stretch indefinitely. (Bloomberg) see also Covid-19, Remote Work Make Austin a Magnet for New Jobs The pandemic and the prospect of working remotely have spawned an exodus from New York and San Francisco to sunnier, more-affordable cities. Few have benefited more than Austin. (Wall Street Journal)

• Milton Friedman was wrong on the corporation What should be the goal of the business corporation? For a long time, the prevailing view in English-speaking countries and, increasingly, elsewhere was that advanced by the economist Milton Friedman in 1970, “The Social Responsibility of Business is to Increase Its Profits”, published in September. I used to believe this, too. I was wrong. After 50 years, the doctrine needs re-evaluation. (Financial Times)

• Why Venture Capital Is Doing So Well With stocks and bonds offering meager futures, pension plans and other investors find under-appreciated VC beats another alt, private equity, which grabs all the attention. (CIO)

• The pandemic was great for Zoom. What happens when there’s a vaccine? If 2020 was the year Zoom rode the pandemic to skyrocketing success, 2021 could be the year the videoconferencing company comes back down to Earth. When Zoom started trading on the stock market in April 2019, it was a rarity: a newly public tech company that actually turned a profit. One year later, the world was in lockdown for the coronavirus pandemic, and Zoom went from being a niche business software popular among tech companies to the way people did just about everything. (Vox)

• Trump’s coup depends on the right-wing information bubble President Donald Trump and his supporters are actively working to overturn the results of the election he lost to President-elect Joe Biden in order to keep him in power. Their despicable plot involves disenfranchising hundreds of thousands of Americans on the grounds that their ballots were fraudulent. Their claims have been thoroughly demolished in legal proceedings finding no evidence that widespread fraud took place, because it did not. (Media Matters)

• Q&A with Elvis Costello: Why he doesn’t like rock and what happened when Sheryl Crow asked him to play a Led Zeppelin song In 1977, people would talk about swinging London, but that was gone. Whereas America, even though to the locals it might have seemed mundane, to me it was like another planet. Record stores stayed open until midnight, clubs much later. You could go out to a club at 4 in the morning in Chicago, and it was everything I ever imagined about jazz, blues, all the music I loved. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Catherine Keating, CEO of BNY Mellon Wealth Management. The group has $265 billion in assets, Previously, she was the Chief Executive Officer of Commonfund. Keating has been named to the “Most Powerful Women in Finance” list and one of the “Most Powerful Women in Banking” list by American Banker.

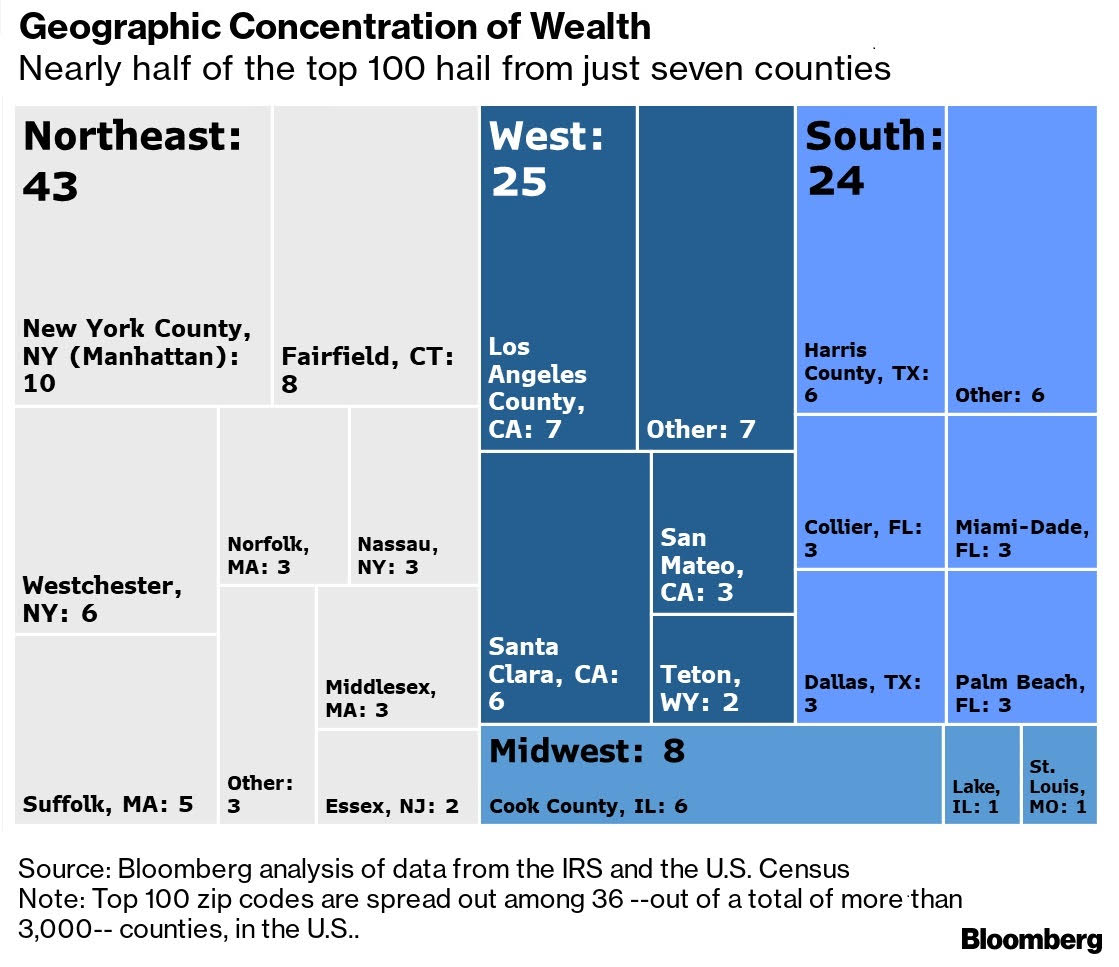

It Takes $2.2 Million a Year to Live in America’s Richest Zip Code

Source: Bloomberg

Sign up for our reads-only mailing list here.