• Long a Holdout From Covid-19 Restrictions, Sweden Ends Its Pandemic Experiment A late autumn surge in infections led to rising hospitalizations and deaths, the government has abandoned its attempt—unique among Western nations—to combat the pandemic through voluntary measures. The Swedes are now heading into the winter facing broad restrictions on large gatherings and school closures aimed at preventing hospital’s from being swamped by patients. The clampdown ends a hands-off approach that had made the Scandinavian nation a prime example between opponents and champions of pandemic lockdowns. (Wall Street Journal) see also Can We Finally Stop Talking About “Natural” COVID-19 Herd Immunity? Please? As an epidemiologist whose very specific area of expertise is herd immunity, I was glad Scott Atlas had resigned. Now I can stop trying to explain why achieving herd immunity through massive infection is not a solution to the pandemic. “Natural” herd immunity is a horrible, dangerous idea that would not accomplish what its promoters promise. (Slate)

• The death of the department store and the American middle class Across the US, department stores are shrinking or shuttering altogether. In 2011, US department stores employed 1.2 million employees across 8,600 stores, according to estimates from the research firm IBISWorld. But in 2020, there are now fewer than 700,000 employees in the sector, working across just over 6,000 locations. The collapse of America’s middle class crushed department stores. Amazon and the pandemic are the final blows. (Vox)

• Even the Best Investors Stink at Selling Stocks Think of that. People who buy and sell stocks for a living aren’t just unskilled when it comes to selling—they’re the inverse of skilled. These aren’t chimps throwing darts at the financial pages. They are Ivy Leaguers sticking darts in painful places. Poor selling hurts their returns by close to two percentage points a year, on average. Compounded over a career, that’s a fortune. (Barron’s) see also Fund Managers are Good Buyers But Terrible Sellers Money managers know how to buy. What they need to do is to learn how to sell. Most of them are terrible at it. The stunning conclusion of a research paper found fund managers would be better off, and in some cases much better off, merely selling holdings completely at random. (The Big Picture)

• The Bloomberg 50 There was a joke on Twitter this fall: Decades from now, Ph.D. candidates in history will specialize in a particular day from 2020. Which is to say this year was, uh, big. Covid, a reckoning on race, and a U.S. election made compiling the fourth annual Bloomberg 50 easier in ways (many people are doing notable things) and harder in others (many people are doing notable things). (Businessweek)

• Why Your House Price Might Keep Going Up This isn’t the first boom in property prices the country has seen before. It certainly won’t be the last. (Bloomberg) but see also Homebuyers Brace for Pain in a Post-Pandemic Market Record-low housing inventories, rising demand and higher prices will strengthen the argument for renting next year. (Bloomberg)

• A gamble pays off in ‘spectacular success’: How the leading coronavirus vaccines made it to the finish line The astonishing, 11-month sprint harnessed new technology that will pave the way for other vaccines and breakthrough medical treatments (Washington Post)

• WarnerMedia’s CEO explains why he’s blowing up the movie business You can see all of Warner Bros.’ movies on HBO Max next year — on the same day they come to theaters. Here’s a Q&A with Jason Kilar about the logic behind the move. (Vox) but see Christopher Nolan Rips HBO Max as “Worst Streaming Service,” Denounces Warner Bros.’ Plan “Some of our industry’s biggest filmmakers and most important movie stars went to bed the night before thinking they were working for the greatest movie studio and woke up to find out they were working for the worst streaming service,” filmmaker Christopher Nolan, whose relationship with Warners dates back to Insomnia in 2002, said in a statement to The Hollywood Reporter. (Hollywood Reporter)

• These Vehicles Are Dead for 2021 Every year, manufacturers tweak the model mix to reflect the market they expect to encounter in the upcoming year. Just like the cars discontinued last year, 2021 will bring far fewer two-door coupes, four-door sedans, and what’s left of available wagons. It also means fewer small economy cars as they’re superseded by small, economy crossovers. (Car and Driver)

• Trump Administration Passed on Chance to Secure More of Pfizer Vaccine The pharmaceutical company offered the government a chance to lock in additional supplies before its vaccine was proved effective in clinical trials. (NYT) see also U.K. Begins Rollout of Pfizer’s Covid-19 Vaccine in a First for the West Less than a week after the shot was authorized, the first Britons receive doses(WSJ)

• The Grit and Glory of Dolly Parton: More than 50 years into her legendary career, she’s still capturing America’s particular mythology — its dreams and its disappointments — like no other. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Catherine Keating, CEO of BNY Mellon Wealth Management. The group has $265 billion in assets, Previously, she was the Chief Executive Officer of Commonfund. Keating has been named to the “Most Powerful Women in Finance” list and one of the “Most Powerful Women in Banking” list by American Banker.

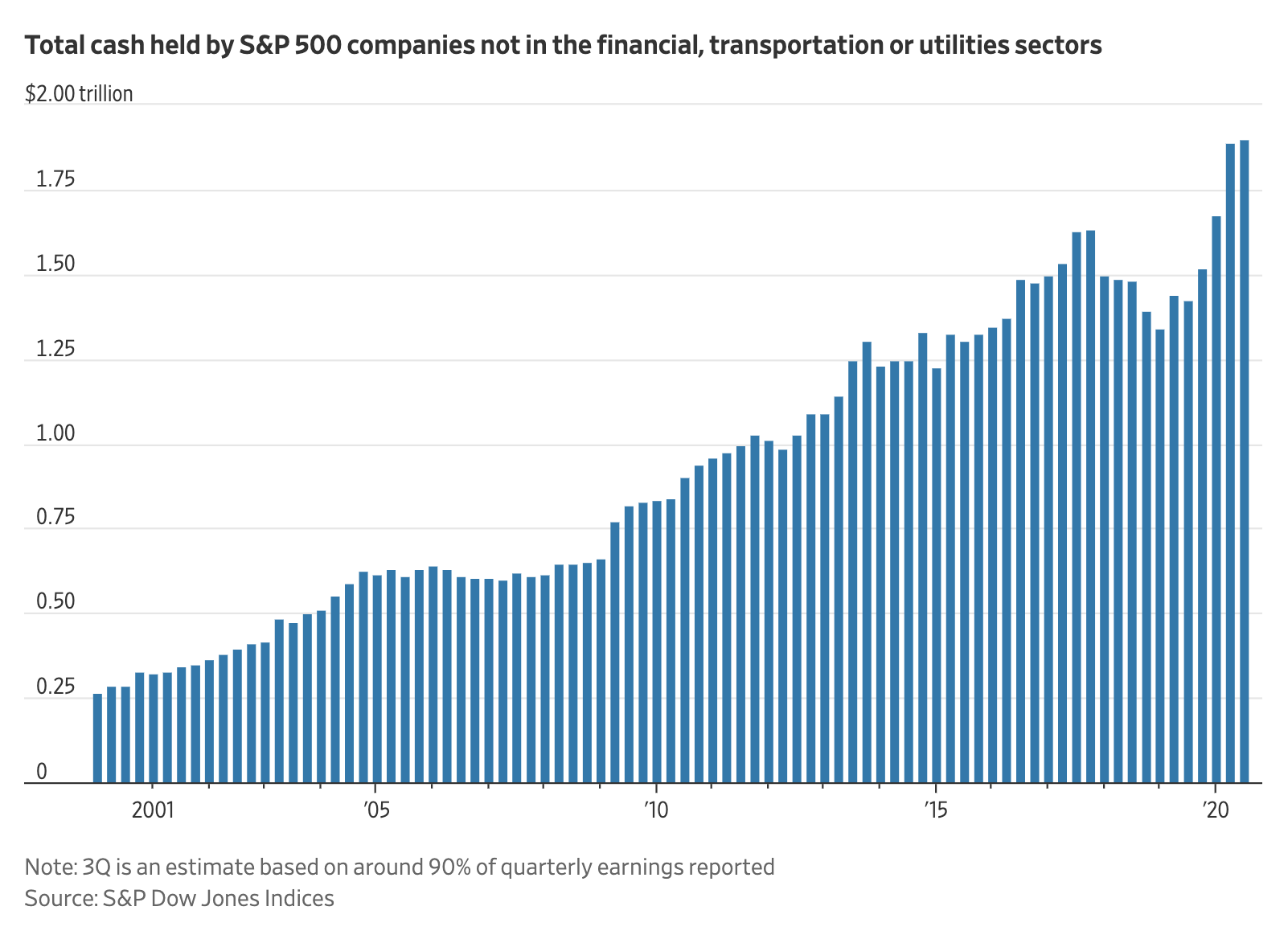

Investors Circle Largest Corporate Cash Hoard Ever

Source: Wall Street Journal