My end of week morning train WFH reads:

• America’s Next Great Economic Experiment: What if We Run It Hot? Supporters of aggressive stimulus see an opportunity to finally correct the mistakes of the last recession and achieve boom times quickly. (Upshot)

• Robinhood’s Customers Are Hedge Funds Like Citadel, Its Users Are the Product The Wallstreetbets subreddit are furious after Robinhood stopped allowing trading on GameStop. Here’s how the “commission free” investing app makes money. (Vice)

• Short Sellers Crushed Like Never Before as Retail Army Charges Short traders in the American stock market are taking a historic pounding as the retail crowd charges into the most-hated names on Wall Street. The 50 most-shorted companies on the Russell 3000 Index have now surged 33% so far this year, with the Goldman Sachs Group Inc. basket set for its best month since at least 2008. (Bloomberg) see also Reddit’s r/WallstreetBets breaks all-time traffic record as hedge fund bleeds Driving the surge is an unlikely face-off between David-like retail investors vs. a hedge-fund Goliath — and David is very much winning. It can often be hard to decipher what is real and what is a joke on the board, making the whole subreddit an entertaining mess. (Mashable)

• Salt Fat Acid Defeat: The restaurant before and after Covid What was the restaurant? To put the question in the past tense implies that it’s no longer possible to ask what the restaurant is. In time that may come to seem a ridiculous position; in many parts of the world outside the United States, where restaurants are holding firm in the face of the coronavirus, it already seems moot (N+1)

• Your Next Car Will Probably Be an Electric Pickup Truck With their mass appeal, automakers say selling battery-powered models should be a breeze. If they ever get made. (Bloomberg)

• Why you should care about data privacy even if you have “nothing to hide” Yes, your data is used to sell you shoes. But it also may be used to sell you an ideology. (Recode)

• Can the US Keep Covid Variants in Check? Here’s What It Takes The covid-19 variants that have emerged are eliciting notably distinct responses from U.S. public health officials. If these or other strains significantly change the way the virus transmits and attacks the body, as scientists fear they might, they could cause yet another prolonged surge in illness and death in the U.S., even as cases have begun to plateau and vaccines are rolling out.(Kaiser Health News)

• Capitol riot arrests: See who’s been charged across the U.S. Federal prosecutors continue to charge participants in the riot at the Capitol on Jan. 6, adding to dozens of arrests that took place in Washington D.C. that day. Included are those arrested on charges federal prosecutors have filed since the riot, and those arrested by Capitol Police and D.C. Metro Police for entering the Capitol or for crimes related to weapons or violence. (USA Today)

• This is How You Recover From Fascism — and America’s Not Doing Any of It What does it take for a society to recover from fascism? That’s a question — maybe the question — that America should be asking right now. Over the last few years, the Trump Years, America experienced the classical sequence of fascist collapse, from concentration camps all the way right down to a bloody coup attempt at the Capitol.(Eudaimonia) see also How to Defeat America’s Homegrown Insurgency As a former overseas operative who has struggled both on the side of insurgents and against them, the past few days have brought a jarring realization: We may be witnessing the dawn of a sustained wave of violent insurgency within our own country, perpetrated by our own countrymen. (New York Times)

• Did Everyone Buy a Guitar in Quarantine or What? Online music instrument sales rose dramatically in 2020. “We’re now selling a thousand guitars every day,” says the CEO of Sweetwater, which posted more than $1 billion in annual revenue for the first time (Rolling Stone)

Be sure to check out our Masters in Business interview this weekend with the legendary fund manager Ron Baron of Baron Funds. Founded in 1982, the firm is known for long-term, fundamental, active approach to growth investing, and has $49 billion in AUM. 16 of 17 Baron Funds, representing 98.3% of assets outperformed their passive benchmark since inception; the Baron Partners Fund was up +148% in 2020.

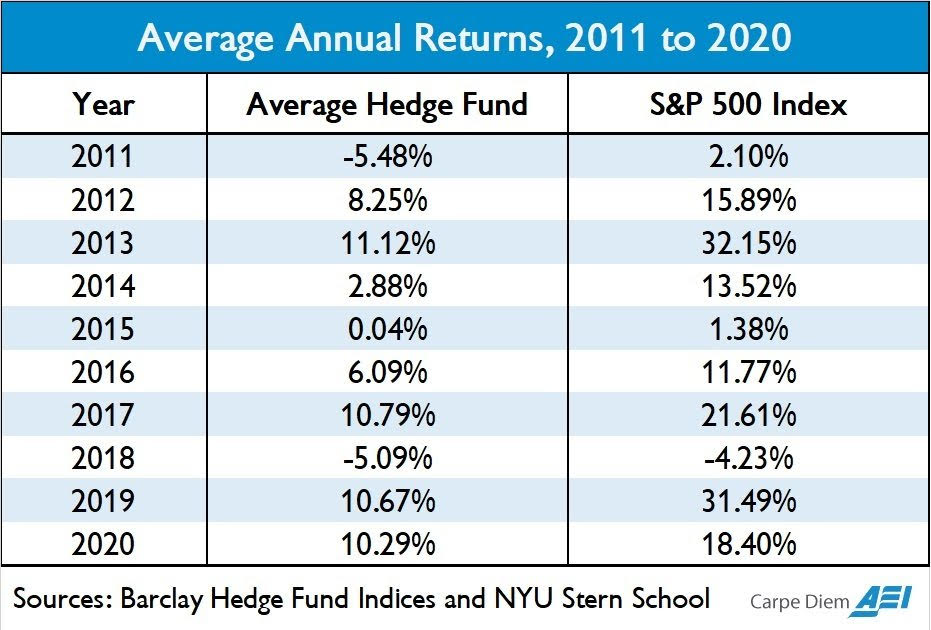

The S&P 500 index out-performed hedge funds over the last 10 years.

Source: American Enterprise Institute

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.