• More Vaccinations, More Stimulus, More Sanity: A Guide to 2021 The economic outlook is starting to brighten, but the world still needs a shot in the arm. (Businessweek) see also These are 50 companies to watch this year Analysts tracking 2,000 companies in finance, retail, energy, and technology have identified these 50, based on factors including company size and growth opportunities, management changes, scheduled releases of noteworthy products / services, and the impact of the Covid-19 pandemic. (Businessweek)

• Farewell, Mutual Funds: Eventually, ETFs will be the industry standard. ETFs are positioned to overtake mutual funds. That event won’t happen anytime soon, because mutual funds possess the power of history. Currently, U.S. mutual funds hold $18.2 trillion in assets, as opposed to $5.5 trillion for ETFs. But the outcome appears inevitable. ETFs offer several advantages that mutual funds cannot match, without counterbalancing drawbacks. Eventually, assets will be on their side. (Morningstar)

• 9 Uncomfortable Facts About the U.S. Stock Market Things feel pretty comfortable in the stock market right now. Pretty much anything you put your money into has worked spectacularly well since stocks bottomed this past March. The crash last year shows how risky investing in stocks can be but it was over in the blink of an eye. There have been plenty of other instances where investors in U.S. stocks have been much more uncomfortable for longer periods of time. (Wealth of Common Sense)

• Pandemic-Era Central Banking Is Creating Bubbles Everywhere Cheap money provided by central banks has been inflating assets and reshaping how we save, invest, and spend. So what’s next? (Bloomberg)

• What Biden’s EV push could mean for jobs: The U.S. lags far behind the rest of the world in electric vehicle adoption. Catching up will require big investments in EV production — including battery cell manufacturing and mining of raw materials — to avoid dependence on imports and foreign supply chains. (Axios)

• Biden faces a historic unemployment crisis The week before Biden took office, 1.4 million Americans filed for unemployment. (Vox)

• The office as we know it is over—and that’s a good thing 2021 will be the year we finally get to enjoy the true benefits of the remote work revolution. Herewith, three predictions for a post-office future (Fast Company)

• Kicking people off social media isn’t about free speech The debate over deplatforming Trump has overshadowed how effective social media bans are at fighting extremism. (Vox)

• The Crooked Geometry of Round Trips Imagine if we lived on a cube-shaped Earth. How would you find the shortest path around the world? (Quanta Magazine)

• Nobody — And We Mean Nobody — Was Consistently Great Like Hank Aaron Great players are often consistently great, of course … but nobody in the history of the game is really in the same neighborhood as Aaron in this regard. How do you get to 755 home runs without ever cracking 50 in a season? Unrelenting consistency. (fivethirtyeight)

Be sure to check out our Masters in Business interview this weekend with Andrew Beer, Founder and Managing Member of Dynamic Beta investments. The firm manages several ETFs that seek to replicate illiquid alternatives at lower costs, with full transparency and daily liquidity. Their hedge fund replication fund, iM DBi Long Short Hedge Strategy ETF (DBEH) is up 27.7% since it launched in December 2019.

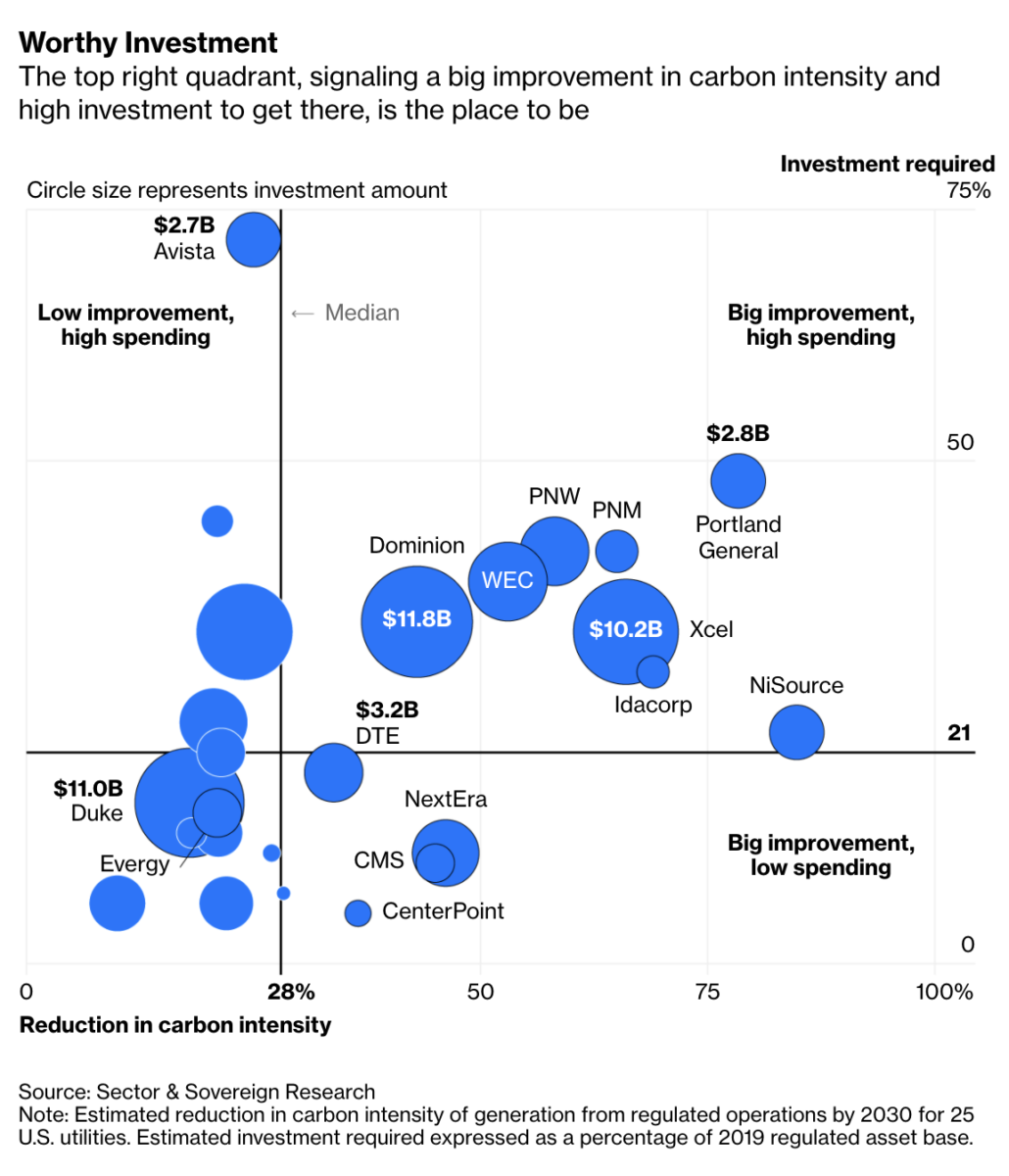

Today’s Dirty Utilities May Be Tomorrow’s ESG Winners

Source: Bloomberg

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.