My Two-for-Tuesday morning train WFH reads:

• First the Cyberattack Hits. Then the Insider Trading. Researchers share their striking evidence of pre-disclosure spikes in options trading. (Institutional Investor)

• Your 2021 Financial To-Do List Improve your financial life on a month-by-month basis: The myriad tasks associated with maintaining an organized financial life seem daunting in list form, but they’re more manageable when spread throughout the year. (Morningstar) see also Schwab’s Liz Ann Sonders: How to Prepare Your Portfolio for the New Year Diversification is key because rotational shifts we are now seeing are happening so quickly. Diversification needs to happen not just across sectors, but also across market cap, geographies, asset classes, and within asset classes. (Barron’s)

• Byron Wien’s Ten Surprises of 2021 This is the 36th year of Byron’s “surprises” — events that the average investor would only assign a one out of three chance of taking place but which Byron describes as “probable,” e.g., having a better than 50% likelihood of happening. The tradition began in 1986 when he was the Chief Strategist at Morgan Stanley (Blackstone)

• How the American Mortgage Machine Works A lot has to happen to make 30-year mortgages at super-low interest rates possible. Investors should understand what each player in the process does, and what risks they take. (Wall Street Journal)

• USDA: Government checks constituted 40% of farmers’ income in 2020 Farmers received $46.5 billion from the government, the largest direct-to-farm payment ever. That includes $32.4 billion in assistance through CARES act payments to farmers. Additional support comes from more traditional revenue loss programs due to low commodity prices, compensation for trade disruptions resulting from tariff battles and conservation programs assistance. (Marketwatch)

• Hawaii’s Beaches Are Disappearing Over the past two decades, oceanfront property owners across the state have used an array of loopholes in state and county laws to get around the “No Seawall” policy, armoring their own properties at the expense of the environment and public shoreline access. (ProPublica)

• You’re Infected With the Coronavirus. But How Infected? Knowing the amount of virus carried in the body could help doctors predict the course of a patient’s illness. (New York Times) see also He Was Hospitalized for Covid-19. Then Hospitalized Again. And Again. Significant numbers of coronavirus patients experience long-term symptoms that send them back to the hospital, taxing an already overburdened health system. (New York Times)

• All 10 living former defense secretaries: Involving the military in election disputes would cross into dangerous territory As former secretaries of defense, we hold a common view of the solemn obligations of the U.S. armed forces and the Defense Department. Each of us swore an oath to support and defend the Constitution against all enemies, foreign and domestic. We did not swear it to an individual or a party. (Washington Post)

• What Is the Geometry of the Universe? In our mind’s eye, the universe seems to go on forever. But using geometry we can explore a variety of three-dimensional shapes that offer alternatives to “ordinary” infinite space.(Quanta Magazine) see also These science claims from 2020 could be big news if confirmed Discoveries about the cosmos and ancient life on Earth tantalized scientists and the public in 2020. But these big claims require more evidence before they can earn a spot in science textbooks. Findings in need of more proof include potential signs of life on Venus and Earth’s oldest parasites (Science News)

• What Makes LeBron James The GOAT What makes James so great to begin with: his seemingly infinite longevity as perhaps the best player in the world, and how he can change what he’s so good at to fit the needs of his team. James has enjoyed a run of 15 consecutive seasons (and counting) in which he ranked among the league’s top five players. (FiveThirtyEight)

Be sure to check out our Masters in Business interview this weekend with Dave Welling, CEO of Mercer Advisors. The Denver-based RIA has 450 employees and manages more than $21 billion.

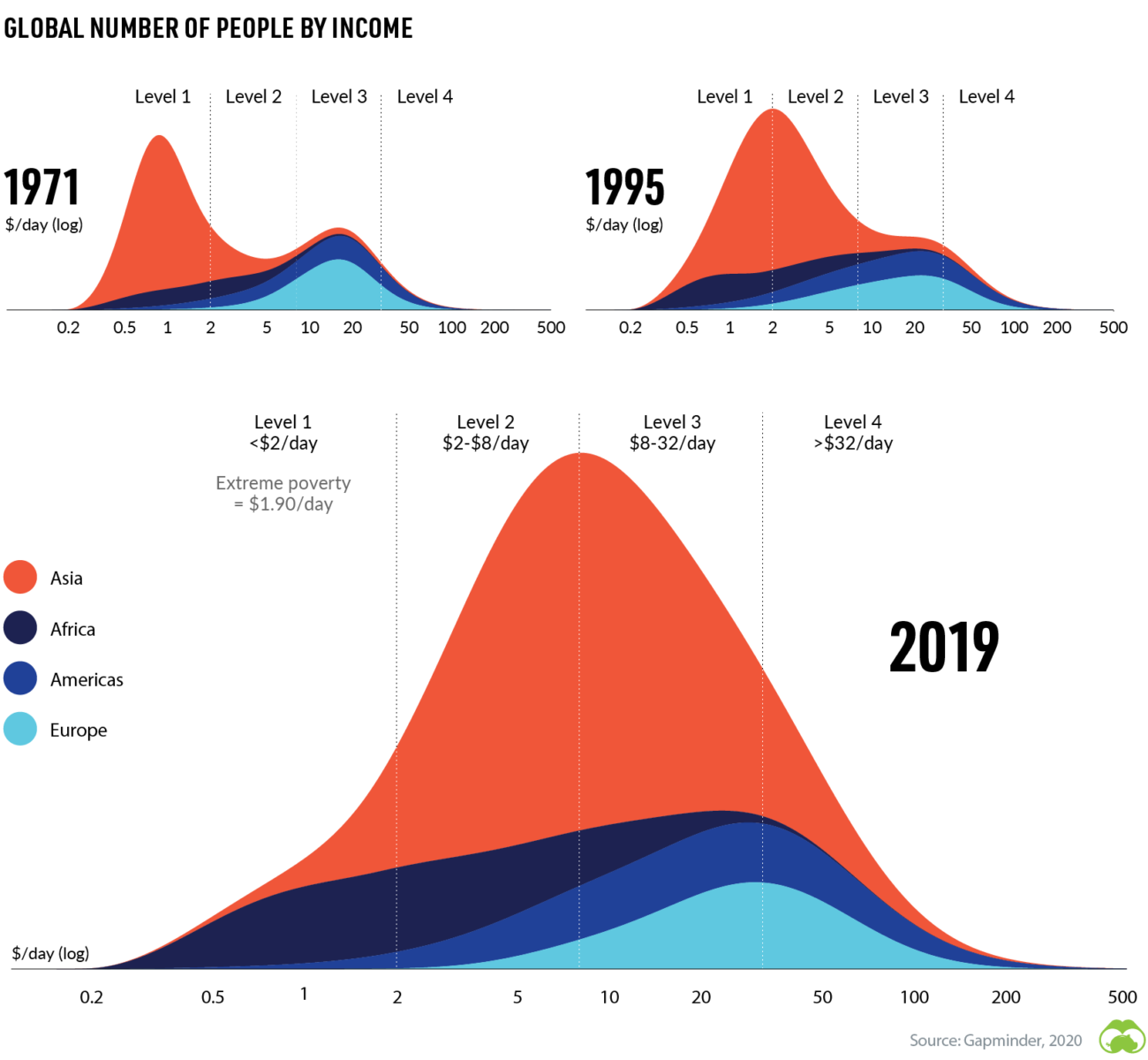

5 Undeniable Long-Term Trends Shaping Society’s Future

Source: Visual Capitalist