My Two-for-Tuesday morning train WFH reads:

• Yes, It Was a Coup. Here’s Why. What Trump tried is called a “self-coup,” and he did it in slow motion and in plain sight. (Politico) see also Six hours of paralysis: Inside Trump’s failure to act after a mob stormed the Capitol “He was hard to reach, and you know why? Because it was live TV,” said one close Trump adviser. “If it’s live TV, he watches it, and he was just watching it all unfold.” (Washington Post)

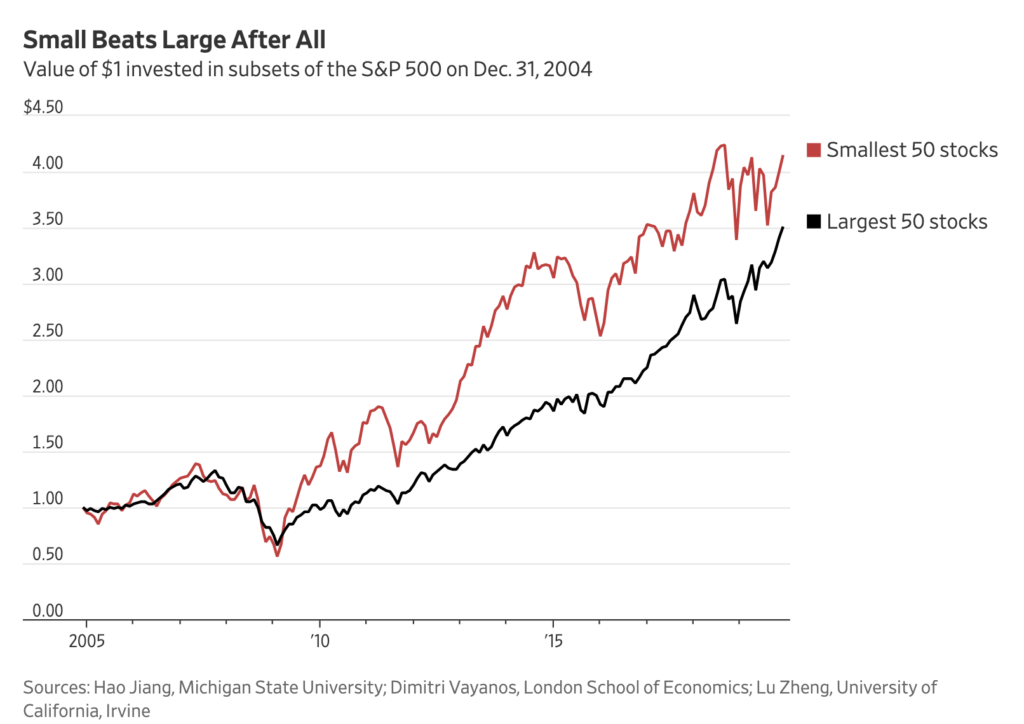

• What’s Behind Value Investing’s Long Losing Streak? The strategy has suffered a devastating drought for more than a decade, sending investors scrambling for answers. (Bloomberg)

• The Top Stock Funds of 2020 Morgan Stanley’s Inception Portfolio, under Dennis Lynch, won the stock-fund race with a gain of 150% (Wall Street Journal) see also Dennis Lynch: Generating Performance via Concentrated Growth What if your investing process was to find attractive companies to buy, regardless of style, size, or location? Surprisingly, this is the opposite philosophy of how most mutual funds operate (The Big Picture)

• Howard Marks: Something of Value The dichotomy of “value” and “growth” investing has become a sharp stylistic divide. But is it helpful? Howard Marks writes in his latest memo how he views the art and science of value investing, especially in the increasingly efficient and complex world we face today. (Oaktree Capital)

• The Hot Alternative Investments to Watch in 2021 Whisky, music and the great outdoors are just some of the other ways to put your money to work. (Bloomberg) see also Stifel is worried that Hipgnosis Songs Fund is slipping out of tune By aggregating catalogues of songs into one fund, Hipgnosis can create a stream of cash flows that can be paid out to investors. In a world starved of yield, a 4.3 per cent dividend that is uncorrelated with other assets sounds like a pretty good deal on paper. (Financial Times)

• Trump’s Brand Loses Its Luster in the Backlash Companies and institutions are shunning President Trump and many associates. His business, built on luxury hospitality, is contemplating a reinvention. (New York Times)

• Every Deleted Parler Post, Many With Users’ Location Data, Has Been Archived In the wake of the violent insurrection at the U.S. Capitol by scores of President Trump’s supporters, a lone researcher began an effort to catalogue the posts of social media users across Parler, a platform founded to provide conservative users a safe haven for uninhibited “free speech” — but which ultimately devolved into a hotbed of far-right conspiracy theories, unchecked racism, and death threats aimed at prominent politicians. (Gizmodo) see also All the platforms that have banned or restricted Trump so far (Axios)

• Coronavirus Today: The front-line workers turning down the vaccine Some Firefighters, EMTs, and healthcare workers in hospitals and care facilities are refusing to roll up their sleeves. Around 20% to 40% of L.A. County’s front-line medical workers who were offered the vaccine have turned it down. So have roughly half of their counterparts in Riverside County. (L.A. Times)

• Hawley should resign. Silent enablers must now publicly condemn Trumpism. (St. Louis Post-Dispatch) see also Resign, Senator Cruz. Your lies cost lives. (Houston Chronicle)

• How New York City Vaccinated 6 Million People in Less Than a Month When a single case of smallpox arrived in Manhattan in 1947, a severe outbreak was possible. A decisive civil servant made a bold decision. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Sébastien Page, head of T. Rowe Price’s Multi-Asset Division, which manages $363.5 billion. T. Rowe Price’s total AUM was $1.31 trillion.

The ‘Small-Cap Effect’ Isn’t Dead, After All

Source: WSJ

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.