It’s February! My back to work morning train WFH reads:

• The Real Force Driving the GameStop Revolution For all the hyperventilating over this week’s financial revolution, though, investors should regard it as the latest phase in a long evolution—and unlikely to disrupt markets overall. (Wall Street Journal) see also The GameStop Reckoning Was a Long Time Coming: Depending on whom you ask, the GameStop saga is either a cautionary story about a bunch of reckless nerds destabilizing the stock market for laughs in a way that is likely to backfire on them spectacularly, or a David-and-Goliath morality tale about a fearless band of retail investors cleverly putting one over on corrupt financial elites. (New York Times)

• ‘Trillion Dollar’ Mt. Gox Demise as Told by a Bitcoin Insider Many of the Bitcoin lost or stolen from Mt. Gox have since been found, and the Japanese bankruptcy trustee Nobuaki Kobayashi is working to reimburse creditors. (Bloomberg)

• S&P 500 index out-performed hedge funds over the last 10 years (and it wasn’t even close) Most investors will get better financial results over time with with low-cost, unmanaged index funds than from high-cost actively managed stock funds and hedge funds run by highly-paid investment professionals, however well-regarded and incentivized those “helpers” may be. (American Enterprise Institute)

• A Fund That Couldn’t Care Less About the Growth-Versus-Value Debate Markets are going through structural—not cyclical—changes: “Cyclical separates the world into growth and value,” but such stocks typically return to their long-term average levels after up markets or down markets. “Structural separates the world into winners and losers, and losers go bankrupt.” (Barron’s)

• Empty office buildings are still devouring energy. Why? Why are empty office buildings still air-conditioned all day long? Blame pre-pandemic leases. (Fast Company)

• Tim Cook on Why It’s Time to Fight the “Data-Industrial Complex” “They’re manipulating people’s behavior,” the Apple CEO tells GQ in a frank conversation about his hope that Apple’s new privacy initiatives will help solve some of the internet’s scariest problems. (GQ)

• These Doctors Are Using AI to Screen for Breast Cancer During the pandemic, thousands of women have skipped scans and check-ups. So physicians tapped an algorithm to predict those at the highest risk. (Wired)

• Something went terribly wrong with Trump’s defense A week before his second impeachment trial started, former President Trump’s entire legal team has walked away. Trump insistence on defending himself by repeating the same dangerous lie that sparked the Capitol riot — that the election was stolen from him — led to his 5 attorneys quitting. Unlike his election legal counsel — now being sued by Dominion Voting Systems for slander — these attorneys refused to cross that ethical line (CNN)

• The Secret to Getting Rid of Snakes: You Can’t When all other preventative measures fail, the only way left to deal with these legless reptiles is to suck it up and embrace them (Wall Street Journal)

• An Art Revolution, Made With Scissors and Glue What would you say was the most revolutionary new artistic medium of the 20th century? Cinema? Color photography? Video, installation, sharks pickled in formaldehyde? I want to suggest to you that it was something simpler, more low-tech. Something you probably did in elementary school — and do now, by pinching and swiping your phone. (New York Times)

Be sure to check out our Masters in Business interview this weekend with the legendary fund manager Ron Baron of Baron Funds. Founded in 1982, the firm is known for long-term, fundamental, active approach to growth investing, and has $49 billion in AUM. 16 of 17 Baron Funds, representing 98.3% of assets outperformed their passive benchmark since inception; the Baron Partners Fund was up +148% in 2020.

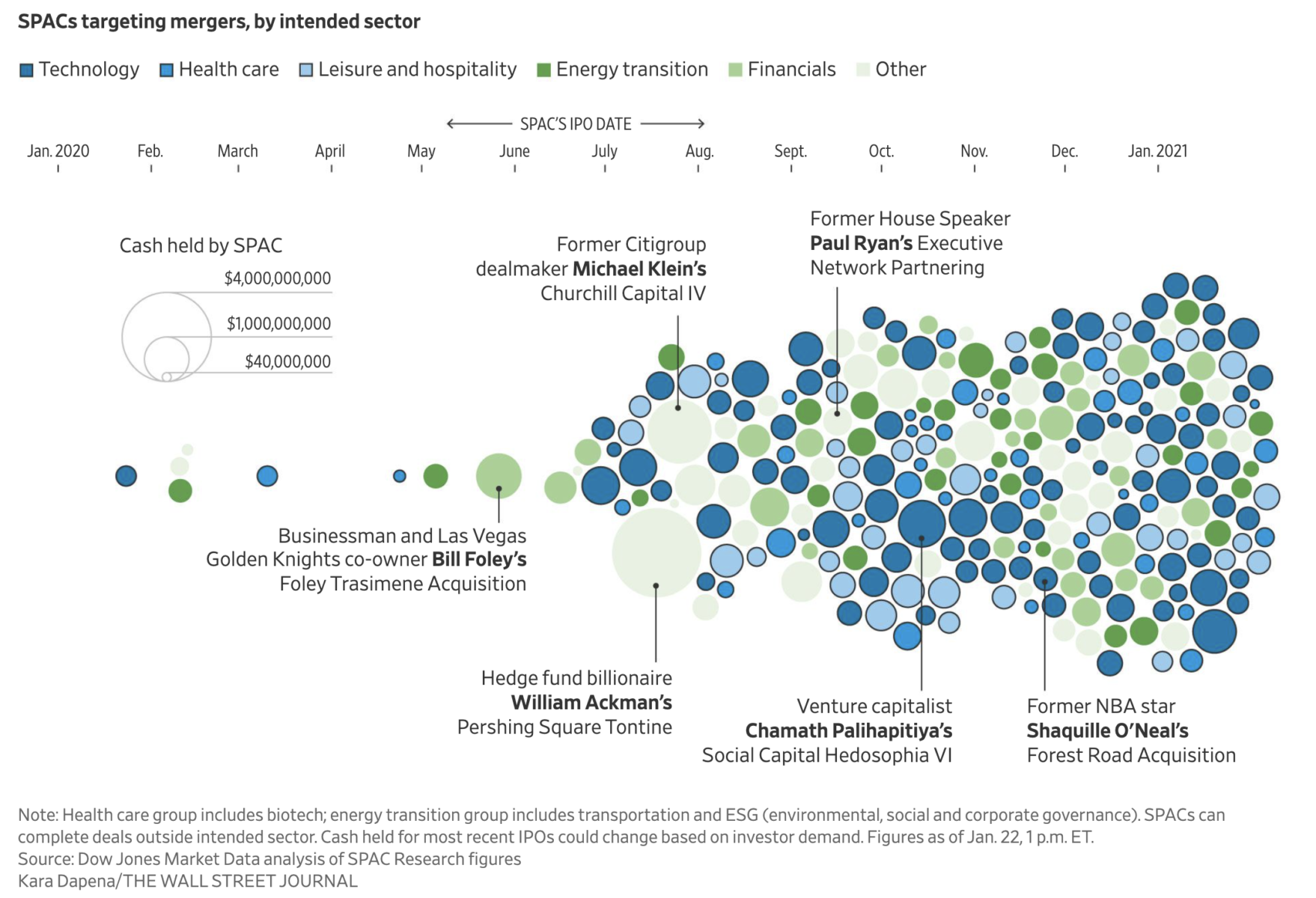

When SPACs Attack! A New Force Is Invading Wall Street.

Source: Wall Street Journal

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.