My morning train WFH reads:

• A Housing Boom Is Sweeping U.S. Cities That Aren’t New York or San Francisco Maybe you’ve heard: The pandemic is killing cities, fueling a rush to spacious houses in the suburbs. But beyond pricey New York and San Francisco, real estate demand is booming in downtowns across America. From Pittsburgh to Detroit and Phoenix, condos and townhouses within stumbling distance of bars and restaurants are hot. Young white-collar workers are taking advantage of record-low mortgage rates and flexible remote-work policies to move to desirable cities with relative affordability. (Bloomberg)

• Everybody Says Higher Interest Rates Are Coming … But When and By How Much? There are three reasons why, after long dwelling at subterranean levels, the cost of money will eventually poke its head up. (CIO) see also 2021 Muni Outlook: The Sun Also Rises The Covid-19 pandemic made 2020 a year like no other. But the municipal bond market largely weathered the storm. In 2021, another supply surge and the potential for policy changes may create volatility and opportunity for municipal credit. (GSAM / PDF)

• Tesla spent $1.5B in clean car credits on bitcoin, the filthiest asset imaginable Bitcoin is an environmental disaster. The bitcoin network currently burns around 116.87 terawatt-hours per year. To give you an idea of how devastating that is to our climate, that is as much energy as a small country or seven nuclear power plants. Keep in mind, bitcoin’s energy consumption increases right alongside the price of bitcoin. As bitcoin goes up in price, more people want to mine the virtual currency for profit, leading to greater energy consumption as they pile more money into power-hungry ASIC rigs. (AmyCastor)

• Merger Idea: Twitter/CNN Twitter has massive potential and would register a 20% increase in value upon moving to a subscription model. After cleansing its platform of rage-generating bots, Twitter could acquire CNN and begin to command the space it occupies. This move would make CNN/Twitter the iOS of news (more expensive, but higher quality) and Facebook/Fox the Android. (No Mercy No Malice)

• MacKenzie Scott’s Remarkable Giveaway Is Transforming the Bezos Fortune As MacKenzie and Jeff Bezos, the couple’s donations were mostly unremarkable. Then came a divorce and her $6 billion gift—a true feat—which upstaged her ex-husband, who has pledged big numbers but has been slower to spend. (Businessweek)

• Fidelity Holds Secret Weapon to Take On Robinhood and Vanguard Firm’s offspring, Geode Capital Management, is strong competitor in era of low-cost investing (Wall Street Journal) see also Robinhood Wants More Female Investors. So Does Everyone Else. Attracting more women will be key to its growth. But getting more women to trade can be a tall task for all online brokerages. (Wall Street Journal)

• Raising the steaks: First 3-D-printed rib-eye is unveiled An Israeli company unveiled the first 3-D-printed rib-eye steak on Tuesday, using a culture of live animal tissue, in what could be a leap forward for lab-grown meat once it receives regulatory approval. (Washington Post)

• How Fox News Will Fight a $2.7 Billion Suit About the 2020 Election Will Fox News tell the American public that it’s high time for Donald Trump to shoulder the blame for his perpetual lying? That became a much more distinct possibility when Fox responded in court Monday to a $2.7 billion defamation lawsuit from voting technology company Smartmatic. (Hollywood Reporter)

• Republican group pressures GOP senators to convict Trump in impeachment trial The Republican Accountability Project is spending a half-million dollars on television advertisements that will begin airing on Fox News starting Monday and are aimed at 22 senators the group views as potential votes for conviction. The group has pledged to spend $50 million defending GOP lawmakers who cross Trump. (McClatchy DC Bureau)

• Can’t Find an N95 Mask? This Company Has 30 Million That It Can’t Sell. Health workers are still being forced to ration protective masks, but small U.S. manufacturers can’t find buyers, and some are in a danger of going under. (New York Times) see also The Unlikeliest Pandemic Success Story How did a tiny, poor nation manage to suffer only one death from the coronavirus? (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Ben Inker, head of Asset Allocation at GMO, which manages about $60 billion in assets. During Dotcom implosion, GMO’s US Aggressive Long/Short Strategy achieved 80+% cumulative net returns for their clients. Inker is widely regarded as founder Jeremy Grantham’s heir apparent.

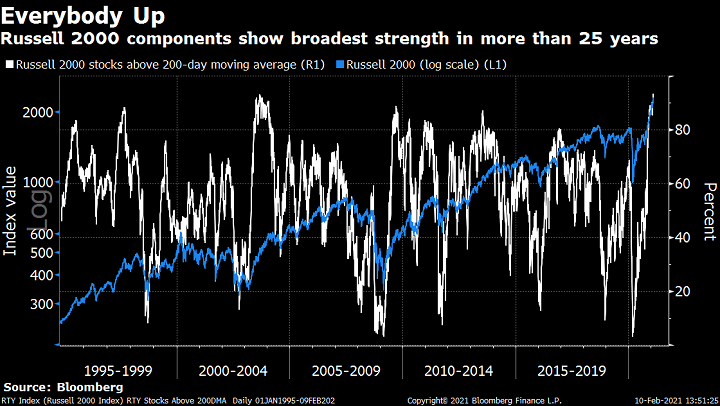

Smaller U.S. companies biggest show of strength in 25 years

Source: Dave Wilson’s Chart of the Day

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.