My Two-for-Tuesday morning train WFH reads:

• Biden and the Fed Leave 1970s Inflation Fears Behind After years of dire inflation predictions that failed to pan out, the people who run fiscal and monetary policy in Washington have decided the risk of “overheating” the economy is much lower than the risk of failing to heat it up enough. (New York Times) see also Stop Stressing About Inflation Inflation is periodic, driven by specific events; Deflation is consistent, the background state of the modern economy. Scarcity and abundance act as the drivers of the price of labor and goods. The economists who came of age during earlier eras of inflation fail to discern how the world has changed since. (The Big Picture)

• The Algebra of Wealth Opportunity remains abundant, even as the headwinds of policy make it increasingly difficult for the young to capture their fair share of the spoils. Achieving economic security requires hard work, talent, and a tremendous amount of focus on . . . money. Yes, some people’s genius will be a tsunami that overwhelms a lack of focus and discipline. Assume you are not that person. (No Mercy / No Malice)

• Bitcoin’s Volatility Should Burn Investors. It Hasn’t. Wild price swings normally have a way of reversing fortunes. So how do you explain when they don’t? (Bloomberg) but see Bitcoin’s rise reflects America’s decline Cryptocurrencies have a place in a new world order where the dollar has less of a starring role (Financial Times)

• The 100 Most Sustainable Companies Sustainability means many things, but companies usually are judged on a series of environmental, social, and corporate governance metrics that measure how a company’s managers make decisions and plan for the future in areas beyond profitability. (Barron’s)

• Bored, Lonely, and Confused: Why It’s OK to Feel Lousy While Investing Investing inverts intuition and scrambles patterns, whereas we’re wired to trust our instincts and popular culture lionizes those who follow breadcrumbs or crack codes. (Morningstar) see also Unfortunate Investing Traits It’s not exciting, but we should spend more effort on ensuring we’re capable of doing the average thing all the time before we spend a moment trying to do a great thing some of the time. (Collaborative Fund)

• The Apple car, briefly explained The Apple car, if there is one, could be on the road by 2024. (Vox)

• The First Rule for Sending a Science Experiment to Space Constraints translate into a golden rule for modifying an experiment for space: simplification. Long before launch, researchers rehearse their experiments in the lab to weed out any superfluous details and flaws. (Slate)

• ‘Its Own Domestic Army’: How the G.O.P. Allied Itself With Militants Actions taken by paramilitary groups in Michigan last year, emboldened by President Donald J. Trump, signaled a profound shift in Republican politics and a national crisis in the making. (New York Times) see also The national GOP is broken. State GOPs might be even worse. Extreme moves in Oregon, Arizona, and Hawaii point to a discouraging conclusion: The post-Trump Republican Party shows no signs of reforming. The national GOP is broken. State GOPs might be even worse. (Vox)

• Shark Populations Are Crashing, With a ‘Very Small Window’ to Avert Disaster Oceanic sharks and rays have declined more than 70 percent since 1970, mainly because of overfishing, according to a new study. (New York Times)

• Trevor Bauer Became Baseball’s Highest-Paid Player. The Dodgers Got a Tax Break. Bauer can earn $85 million in two years under his unusual short-term free-agent contract with the Dodgers–who can soften the penalties for their high payroll. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Ben Inker, head of Asset Allocation at GMO, which manages about $60 billion in assets. During Dotcom implosion, GMO’s US Aggressive Long/Short Strategy achieved 80+% cumulative net returns for their clients. Inker is widely regarded as founder Jeremy Grantham’s heir apparent.

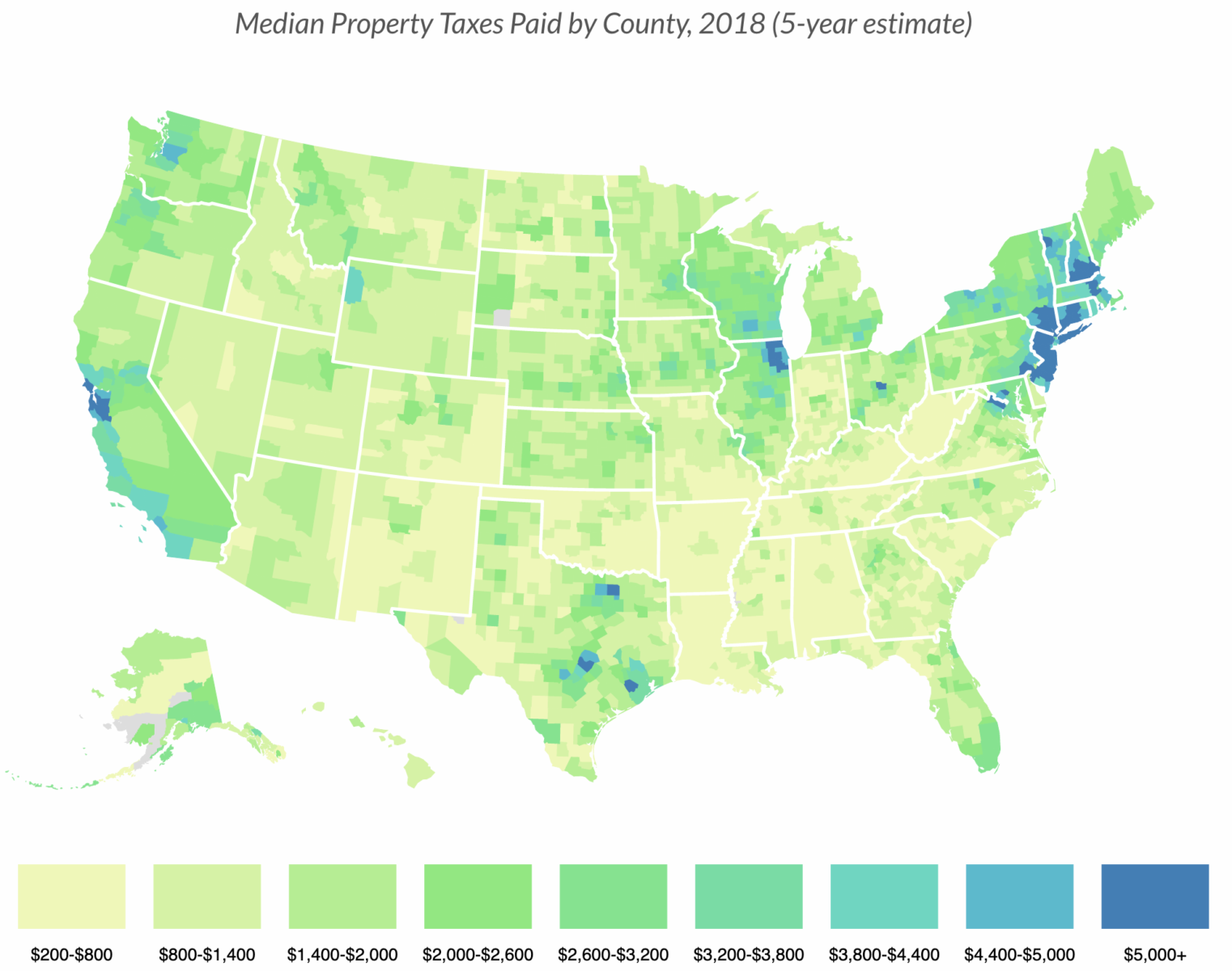

Where Do People Pay the Most in Property Taxes?

Source: Tax Foundation

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.