My Two-for-Tuesday morning train WFH reads:

• The 20th Annual Rich List, the Definitive Ranking of What Hedge Fund Managers Earned in 2020 A bad year for humanity was a wonderful year for the hedge fund elite. (Institutional Investor)

• Reinventing Capitalism – The Bitcoin ETF Opportunity The SEC and the U.S. Treasury has a chance to lead by working with the crypto community to create a viable framework for technologies and securities that helps smooth capital flow across these barriers. (ETF Trends) see also Throw Out The Playbook: How to Build A Crypto ETF Build standards. Build a regulatory framework supporting those standards. Implement. That’s how this always works. Doing so would put the U.S. back conducting the train of global capitalism, instead of hanging out in the caboose. (ETF Trends)

• How Does the Stock Market Perform When Interest Rates Rise? The truth is there is no rule of thumb with these things. But rising rates, in and of themselves, don’t always spell doom for the stock market. (A Wealth of Common Sense)

• Covid Housing Boom Is Even Bigger Than Imagined The latest Fed data on household finances shows the extent to which record-low mortgage rates and surging home prices turbocharged the economic recovery. (Bloomberg) see also These Families Are Stuck at Home During Covid, but Have Plenty of Places to Go Some homeowners are rethinking spaces where they can spend time with family–or no one at all (Wall Street Journal)

• What the Bond Market Is Telling Us About the Biden Economy A recent rise in interest rates hints that a recovery is on the way, but it could also mean harder choices ahead on spending. (New York Times)

• A Different Early-Bird Special: Have Vaccine, Will Travel People over 65 have been among the first in line to receive Covid-19 vaccinations. And they are leading a wave in new travel bookings. (New York Times) see also Are New York Restaurant Customers Ready to Dine Inside Again? New York City is again allowing indoor dining at 25 percent capacity, but the policy is no panacea for the struggling restaurant industry. (New York Times)

• Inside the ‘Wikipedia of Maps,’ Tensions Grow Over Corporate Influence As Apple, Facebook, Amazon and other private companies play larger roles in OpenStreetMap, some volunteers worry that the open-source project is losing its way. (Bloomberg)

• The crypto art world is exploding — so here come the tech moguls to screw it up NFTs are everywhere, including at a Christie’s auction of the artist Beeple. But the new tech seems to be recreating the old problems of the art world. (Business of Business) see also What Is Top Shot? I’m participating in the early days of a mania for the first time in my life. I tend to be a knee-jerk skeptic, so I feel like a fish out of water right now. I never bought Bitcoin in its infancy, and I don’t do meme stocks. It’s just not in my personality. (Irrelevant Investor)

• NASA’s new Mars rover is equipped with the first aircraft to fly on another planet Some powerful autonomous tech has landed on the red planet. (Vox)

• Peter Frampton on the Thunderous Legacy of Frampton Comes Alive!, 45 Years Later In 1976, nobody ascended to a sonic astral plane quite like Peter Frampton and his luscious locks: His live album, Frampton Comes Alive!, catapulted him from a respected rocker to a sex god among guitarists (Vulture) see also Music Videos Are Over-the-Top Again, Thank God Cardi B and Megan Thee Stallion are leading the charge for the return of the elaborate music video. (Vice)

Be sure to check out our Masters in Business interview this weekend with Doug Braunstein, former Chief Financial Officer at JPMorgan Chase. Braunstein is founder and managing partner at Hudson Executive Capital, which has underwritten several successful SPAC offerings, with $1.6B in AUM. Braunstein worked directly with Jamie Dimon as CFO and a member of JPMorgan’s Executive Committee. He served as head of JPMorgan’s Americas Investment Banking and Global M&A.

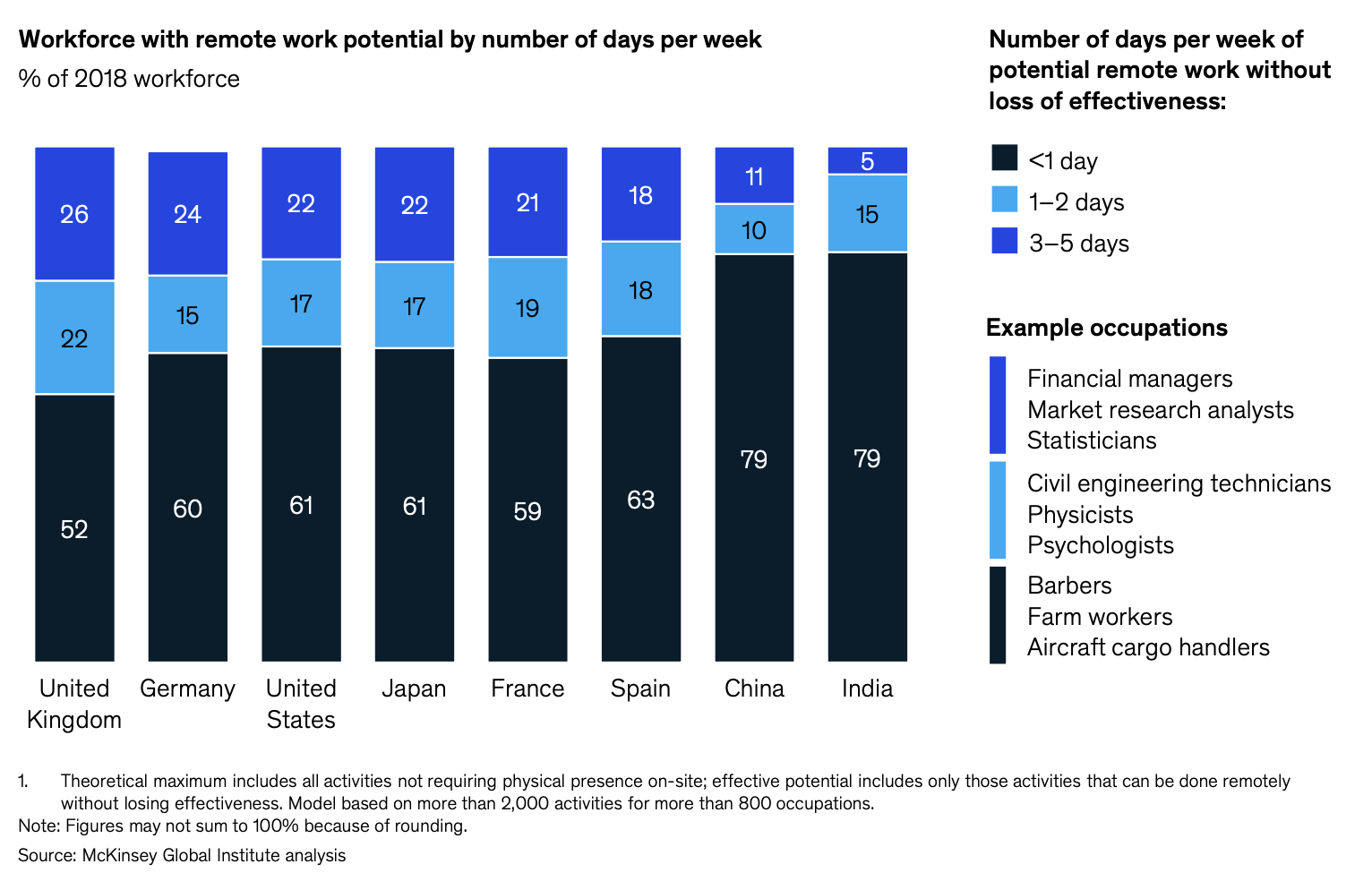

Potential for remote work is higher in advanced economies, yet only 20 to 25 percent of workers could work remotely three to five days a week.

Source: McKinsey via Daily Graphs

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.