My mid-week morning train WFH reads:

• Elon Musk Becomes Unlikely Anti-Establishment Hero in GameStop Saga The billionaire has inserted himself into the confounding stock market drama and solidified his role as the ultimate insider outsider. (New York Times) see also When the Electric Car Is King, Less Energy Is More Here’s a surprise: Electrifying U.S. vehicles wipes out the equivalent of our entire current power demand. (Bloomberg)

• Meet the Man Spending Billions on Rock Music Royalty Merck Mercuriadis of Hipgnosis is buying up songs from artists like Neil Young, Fleetwood Mac and Shakira. Here, he talks about his approach (Bloomberg)

• Howard Marks: «The Biggest Risk Is Rising Interest Rates» Howard Marks, co-chairman of Oaktree Capital, explains why he thinks high valuations in financial markets should be a reason for concern. The legendary investor argues for a prudent approach and says where he spots opportunities in today’s challenging environment. (The Market)

• Markets Have ALWAYS Been Rigged, Broken & Manipulated When were the markets ever not somehow broken, rigged, manipulated or untethered from fundamentals? When was the glorious period where markets were completely free and devoid of intervention from the forces of either governments, central banks or investors who overstepped the bounds of fair play? (A Wealth of Common Sense)

• The second act of Jeff Bezos could be as big as his first Bezos isn’t getting less powerful. His power is just getting less obvious. (Recode)

• Cuban: The Store of Value Generation is Kicking Your Ass and You Don’t Even Know it There are inefficiencies and traditions in every marketplace that have become so engrained by the power players that they literally think they are “rules” that most, if not all participants will follow. Until they don’t (Blog Maverick)

• Facebook Knew Calls for Violence Plagued ‘Groups,’ Now Plans Overhaul The giant struggled to balance Mark Zuckerberg’s free-expression mantra against findings that rabid partisanship had overrun a feature central to its future (Wall Street Journal)

• Report: Claim of anti-conservative bias by social media firms is baseless: Disinformation experts found that far from suppressing conservatives, social media platforms have, through algorithms, amplified rightwing voices, “often affording conservatives greater reach than liberal or nonpartisan content creators.” (The Guardian)

• How Universes Might Bubble Up and Collide To understand how universes might inflate and bump into each other in the hypothetical multiverse, physicists are studying digital and physical analogs of the process. (Quanta Magazine)

• What’s a Wendy’s doing there? The story of Washington’s weirdest traffic circle. There’s a Wendy’s in the middle of the intersection. It’s been there since the mid-’80s, on a wedge of land bordered by First Street NE and Florida and New York avenues, at a major gateway to Washington, D.C. Surrounding the Wendy’s is a “virtual traffic circle,” a polite way to refer to this urban aneurysm — a pair of triangles, really, with a roundabout movement forced upon them. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with the legendary fund manager Ron Baron of Baron Funds. Founded in 1982, the firm is known for long-term, fundamental, active approach to growth investing, and has $49 billion in AUM. 16 of 17 Baron Funds, representing 98.3% of assets outperformed their passive benchmark since inception; the Baron Partners Fund was up +148% in 2020.

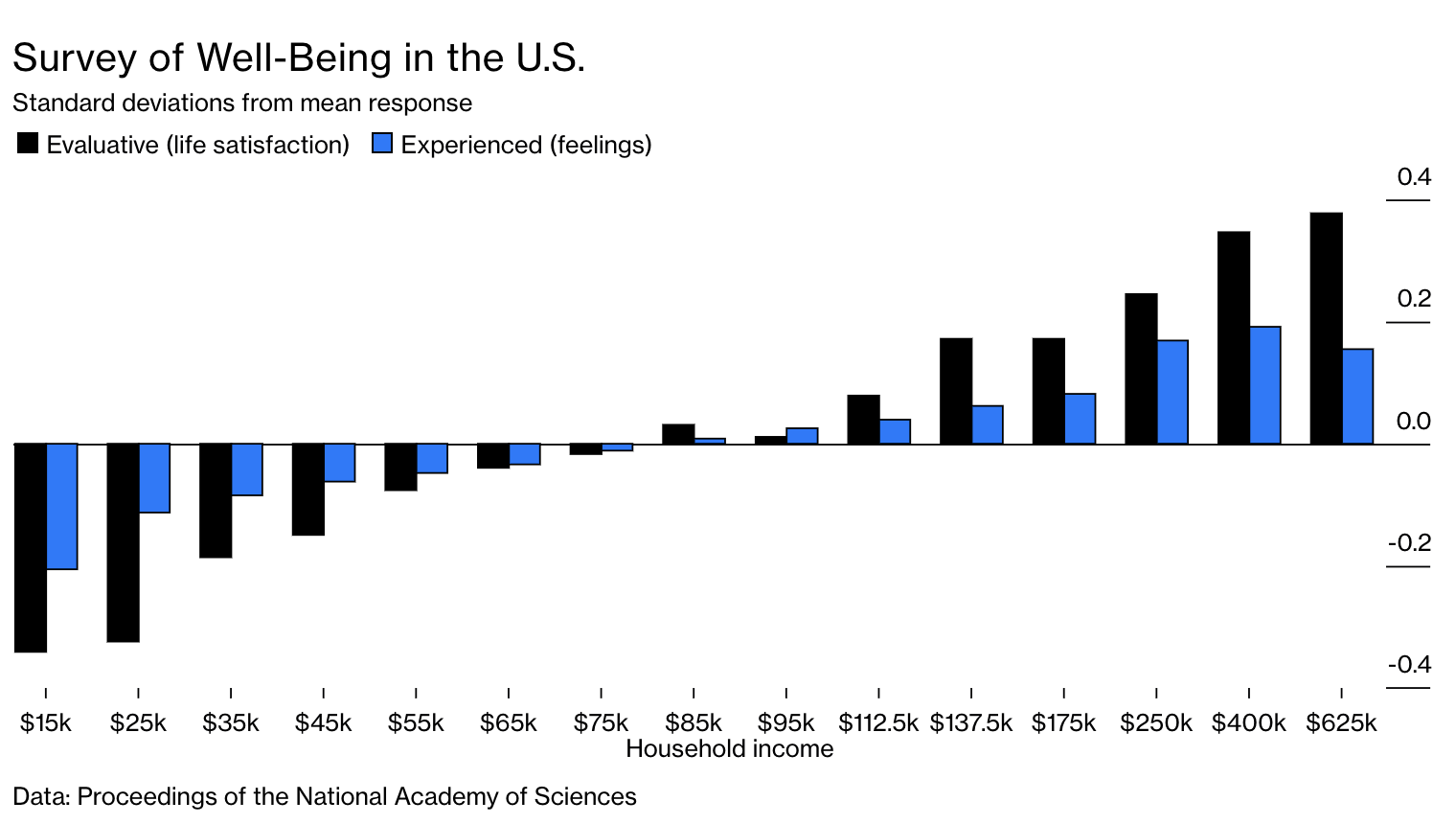

It Seems Money Does Buy Happiness After All

Source: Businessweek

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.