My back to work morning train WFH reads:

• One Year Since the Bottom One of the big lessons from 2020 is that risk is always present, even if we don’t always feel it. Things were smooth sailing until they weren’t. The other big lesson: Survival is the name of the game. It’s not about maximizing returns or beating the market. It’s about staying the course. And you can only stay the course if you have a course to stay on. (Irrelevant Investor)

• The New Stock Influencers Have Huge—and Devoted—Followings Stocks surge on tweets from the likes of Elon Musk, Cathie Wood and Chamath Palihapitiya. The notion of a market influencer isn’t new. Prior generations were enraptured by star investors like Bill Miller, Peter Lynch and Warren Buffett. They soaked up shareholder letters and book recommendations, eager to glean insights into how to routinely beat the markets. (Wall Street Journal)

• Big Market Delusion: Electric Vehicles The “big market delusion” is when all firms in an evolving industry rise together, although as competitors ultimately some will win and some will lose. The electric vehicle industry, with its astronomical growth in market-cap over the 12 months ending January 31, 2021, is a prime example of a big market delusion. In the highly competitive and capital-intensive auto industry, the January 2021 valuations of electric vehicle manufacturers are simply not sustainable over the long term. (RAFI)

• How to Play the New Space Race While space tourism gets the attention, investors can pick from satellite makers, launch-services providers, even space-logistics companies—all generating actual revenue from new businesses.The market capitalization of pure-play space companies now totals roughly $25 billion, up from essentially nothing a few years ago. That doesn’t include privately held SpaceX, founded by Elon Musk or Blue Origin, founded by Jeff Bezos. (Barron’s)

• What If Housing Prices Aren’t As High As They Appear? Mortgage rates were more than 10% in 1989. So while prices were far lower in the past, borrowing rates were much higher. Taking the median sales price and applying the prevailing 30 year fixed mortgage rate (after accounting for a 20% down payment) shows a different story when it comes to monthly payments: (A Wealth of Common Sense)

• Climate change is driving a metals and mining boom: The world is transitioning from a carbon-intensive to a metals-intensive economy. Low-carbon technologies use much larger amounts of metal than traditional fossil fuel-based systems. Demand for metals is rising exponentially, fueling a boom in mining and production. But this creates an environmental challenge. Metals extraction and processing is a significant contributor to global warming and a major pollutant. (Coppola Comment)

• Where Anti-Vaccine Propaganda Went When YouTube Banned It Rumble is the favored video platform of conspiracy theorists and the far right. Now medical disinformation has a home there. (Slate)

• Redlined, Now Flooding Flooding is a rising threat across the U.S., with homeowners facing as much as $19 billion in damages every year. What puts a neighborhood at high risk for flooding? Geography is key, but new data reveal another factor that can be determinative, too: race. Maps of historic housing discrimination show how neighborhoods that suffered redlining in the 1930s face a far higher risk of flooding today. (CityLab)

• If You Look at Your Phone While Walking, You’re an Agent of Chaos An experiment by Japanese researchers revealed how just a few distracted walkers really can throw off the movements of a whole crowd. (New York Times)

• The Haunted Imagination of Alfred Hitchcock From earliest days, he was obsessed by the shadow play of three-dimensional images on a two-dimensional screen. He made a career out of exploiting our fascination with, and fear of, the uncanny: How the master of suspense got his sadistic streak (The New Republic)

Be sure to check out our Masters in Business interview this weekend with Bill Gurley, the legendary venture capital investor at Benchmark. His investments include GrubHub, Nextdoor, OpenTable, Zillow and of course, Uber. He is a member of the Board of Trustees of the Santa Fe Institute, and is widely considered one of most influential dealmakers in technology. He was named TechCrunch’s VC of the Year in 2016.

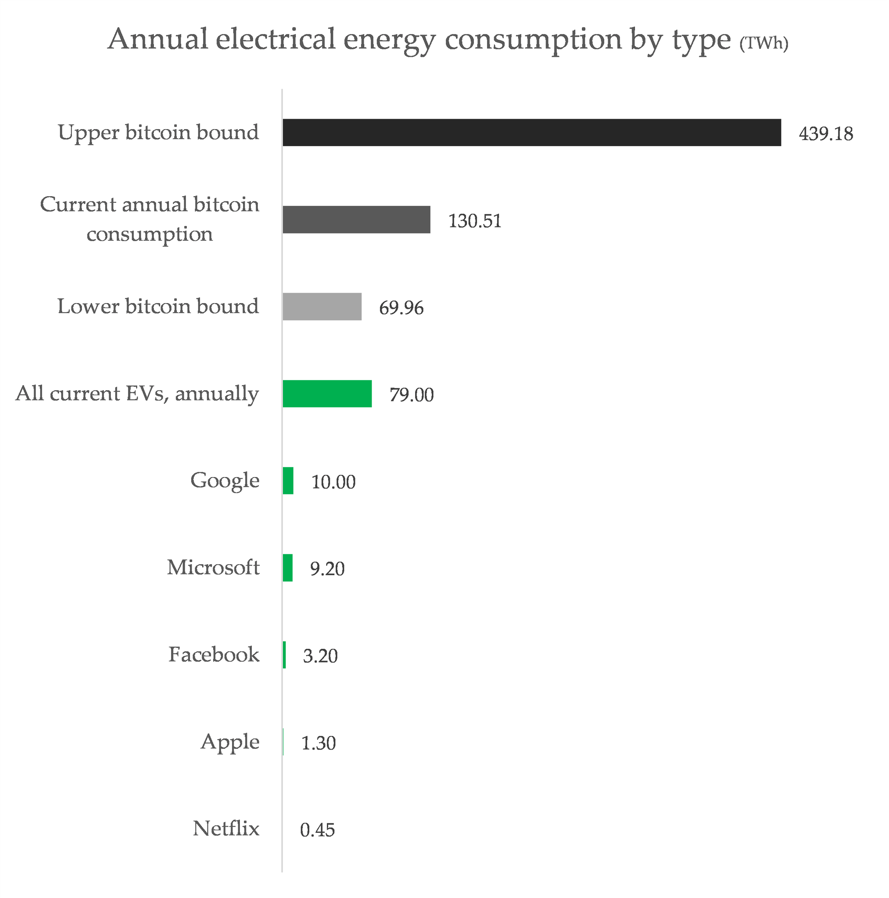

Bitcoin is a mouth hungry for fossil fuels

Source: Ketan Joshi

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.