My morning train WFH reads:

• The Worst Type of Sell-Off Maybe this is a buying opportunity. Or maybe there is still time to sell. How you think about these things depends on your past experiences, your style of investing, your timeframe, and a whole host of other items. I think the risk I’m taking today will be rewarded in the future, but I’m ready for more pain tomorrow. (Irrelevant Investor)

• Watch Out, ETFs. Here Comes Custom Indexing. Custom indexing is a new era, where costs and taxes still matter, but what’s enabled by technology is individual investors matter. The separately managed account has been dwarfed by commingled funds and packaged products and funds and ETFs for a long time. Now, operational costs, fractional shares, and trading costs—all three things make separately managed accounts attractive. (Barron’s)

• Institutional Investors Have Been Influenced by Reddit — But They Still Don’t Trust It One in five investors surveyed by Brunswick said they made a trade, changed a recommendation, or altered a position because of the WallStreetBets subreddit. (Institutional Investor)

• How to Make Money from Distressed Real Estate in 2021 Pension funds and other institutions are considering investing in problem properties via KKR, Apollo, Blackstone, and other Wall Street players. The goal: turnarounds. (CIO)

• If the Economy Overheats, How Will We Know? We asked some prominent participants in the Great Overheating Debate of 2021 to explain what inflationary trends they’re afraid of (or not, as the case may be). (Upshot)

• Who are the biggest tax cheats? The 1% — and here’s how they get away with it The unreported income for the 1%, households with more than about $420,000 in annual income, is as much as one-third higher than previously estimated, the authors wrote. For the 0.1%, households with at least $7.5 million in annual income, it’s 80% (LA Times)

• Most People Don’t Actively Seek to Share Fake News New research shows that subtly nudging people to think about accuracy increases the quality of the news they share (Scientific American)

• America’s unique gun violence problem, explained in 16 maps and charts Americans make up less than 5 percent of the world’s population, yet they own roughly 45 percent of all the world’s privately held firearms (Vox)

• Cern experiment hints at new force of nature Experts reveal ‘cautious excitement’ over unstable particles that fail to decay as standard model suggests Scientists at the Large Hadron Collider near Geneva have spotted an unusual signal in their data that may be the first hint of a new kind of physics. (The Guardian)

• The Story Behind the Iconic Bass-Smashing Photo on the Clash’s London Calling Pennie Smith was not a fan. Maybe that’s what made her the perfect photographer for The Clash. She wasn’t even particularly in love with the most famous shot of her career — the iconic photo of bassist Paul Simonon raising his Fender Precision at New York’s Palladium, seconds before smashing it to bits. “I said, ‘it’s completely out of focus,’” Smith remembers of the image when Joe Strummer insisted on using it for the cover of legendary double-LP London Calling. “But Joe wouldn’t have it. He said, ‘That one is the photo.’” (Open Culture)

Be sure to check out our Masters in Business interview this weekend with Gary Chropuvka, President of World Quant. The firm was spun out of Millennium Management in 2007, and manages about $7 billion dollars. Previously, Chropuvka was co-head of the Quantitative Investment Strategies (QIS) team at Goldman Sachs Asset Management (GSAM).

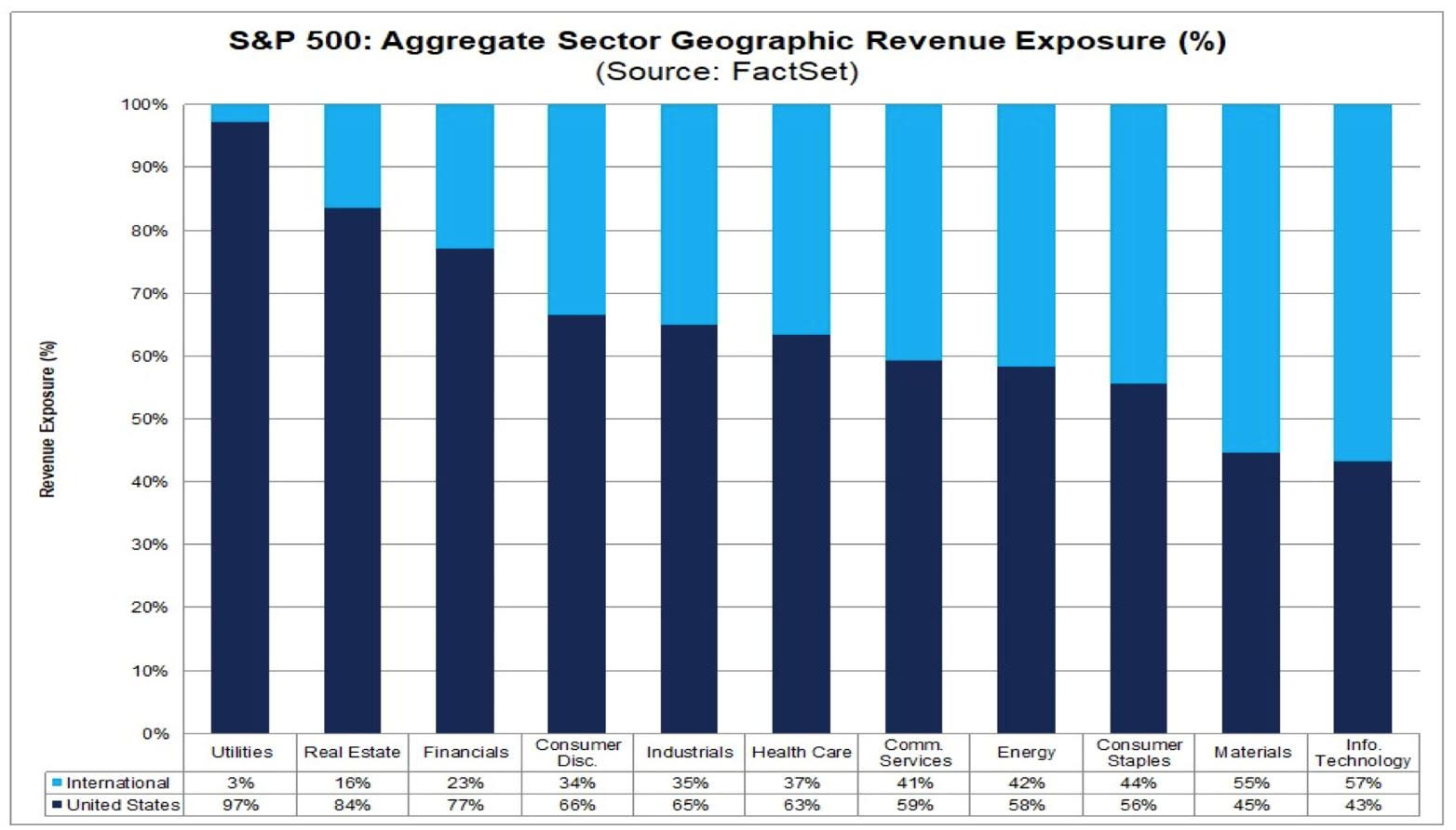

The Dollar has dramatically different P&L effects on various S&P sectors

Source: DataTrek

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.