Vaccinated yet? If not, then enjoy our Two-for-Tuesday morning train WFH reads:

• When SPAC-Man Chamath Palihapitiya Speaks, Reddit and Wall Street Listen Buy! Sell! Tweet! An icon of the amateur trading masses and an evangelist for SPACs, Chamath Palihapitiya is commanding the financial moment with a blend of deal-making prowess, social-media savvy and moxie. (Wall Street Journal) see also SPACs, the investment term you won’t stop hearing about, explained The term SPAC stands for special purpose acquisition company, essentially a publicly listed pile of cash meant to buy a private company. SPACs have become the main maneuver through which companies list on the stock market. (Vox)

• Debranding Is the New Branding From Burger King and Toyota to Intel and Warner Brothers, major brands are discarding detail and depth. Why now, and what’s the rush? (Bloomberg)

• The Most Important Chart of the Decade I take comfort in knowing that inflation is now the headline risk, and when’s the last time we saw the big risk coming? (Irrelevant Investor) see also It’s Not Different This Time We’ve had a handful of pullbacks and corrections over the last ten years and only one led to way lower prices. That’s not to say that now is a good time to go all in, for crying out loud we’re not even in pullback territory (-5%) and I shudder to think what would happen if we get to a correction (-10%). (Irrelevant Investor)

• They Created the SPAC in 1993. Now They’re Reaping the Rewards. Blank-check companies have raised more than $70 billion this year; their co-creator once feared the SPAC wouldn’t make it (Wall Street Journal)

• ‘This Is Unprecedented’: Why America’s Housing Market Has Never Been Weirder In America’s largest, richest cities, home prices and rents are going in opposite directions. (The Atlantic) see also Manhattan Landlords Take Apartments Off Market During Rental Slump Reduced demand during pandemic sent median rental prices down sharply; some bet market will rebound in spring (Wall Street Journal)

• The Bitcoin Lottery The sudden rise of “special purpose acquisitions companies” and cryptocurrencies speaks less to the virtues of these vehicles than to the excesses of the current bull market. In the long term, these assets will mostly fall into the same category as speculative “growth stocks” today. (Project Syndicate)

• EVs Could Make Dealerships a Thing of the Past, Too When cars don’t need repairs or in-person updates, it changes the whole sales model (Bloomberg) see also A Cultural Arms Race: Is a truck an appropriate purchase for the majority of people that buy them? Detractors of the truck upswing say the popularity of light trucks symbolizes American wastefulness and supersizing culture. (Jalopnik)

• Which Vaccine? Making sense of the differences between COVID-19 vaccines, for public and personal health. (Slate)

• Which Americans Are Least Willing to Get a Covid-19 Vaccine Census survey shows vaccine hesitancy remains a challenge among Black and young people, those in the South (Wall Street Journal) see also Younger Military Personnel Reject Vaccine, in Warning for Commanders and the Nation About one-third of the troops have declined to take the vaccine. Many say they worry the vaccines are unsafe or were developed too quickly. Others want a sense of independence, even in uniform. (New York Times)

• The Dude Survives: Jeff Bridges on the Enduring “Big Lebowski” Actor breaks down his own Dude philosophies and recalls favorite moments from the set (Rolling Stone)

Be sure to check out our Masters in Business interview this weekend with William J. Bernstein, Ph.D., M.D., retired neurologist, and principal in the money management firm Efficient Frontier Advisors. He is the author of several best-selling books on finance and history. Bernstein’s new book The Delusions Of Crowds: Why People Go Mad in Groups was just published.

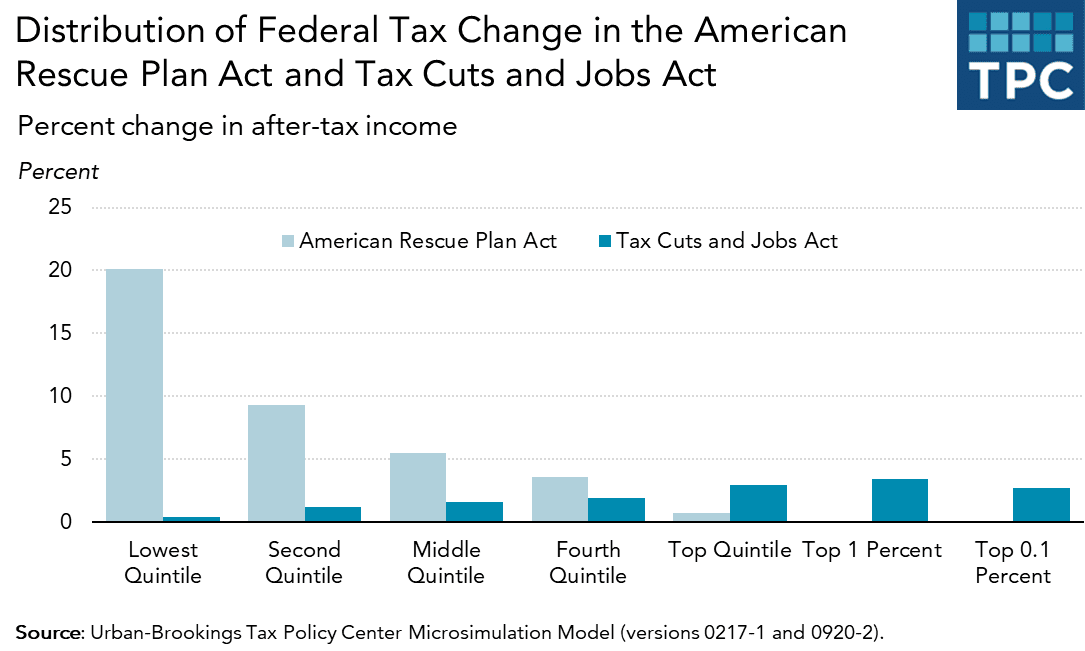

Pandemic Bill Has Most Relief Going to Low- And Middle-Income Households

Source: Tax Policy Center

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.