My mid-week morning train WFH reads:

• Move Over, Nerds. It’s the Politicians’ Economy Now. Leaders of both parties have become willing to act directly to extract the nation from economic crisis, taking that role back from the central bank. American political leaders have learned a few things in the last 12 years, since the nation last tried to claw its way out of an economic hole. (New York Times)

• The Conventional Investor’s Guide to Bitcoin Is the currency worth owning Only 800,000 Bitcoin wallets held as much as one coin, which equals just over $50,000 at today’s rates. In contrast, about 15 million households had investable assets of greater than $1 million. (Morningstar) see also NFTs Explained: What’s Driving Prices for LeBron James and Kings of Leon Digital Collectibles Market for non-fungible tokens, which convey ownership of digital assets, ballooned in 2020 (Wall Street Journal)

• On Inflation: How inflation drives asset prices and how to predict inflation What we have learned so far about inflation: what works in inflationary environments, which indicators best predict inflation, and, most importantly, how this can generate returns in simple trading strategies. (Verdad)

• World Trade Post-Pandemic: Same Old Problems, Now Worse A surging China elbows others, the deficit-burdened US struggles, and Brexit is in the pits. (CIO)

• Biggest Players in the Short-Selling Game Are Getting a Pass It’s in the air again, on Reddit, in Congress, in the C-suite: Hedge funds that get rich off short-selling are the enemy. The odd thing is, the biggest players in the game are getting a pass. (Bloomberg)

• The Usefulness of Our Delusions Self-deception and complicity in schemes are not an aberration. Many are clothed in respectability—no one would go around calling them “scams” or demand they be prosecuted in the courts. All involved dances of complicity between deceivers and deceived. These pacts of deception and self-deception were sometimes explicit but, far more often, implicit and unspoken. (Behavioral Scientist)

• Senior Stoners: Marijuana was a cornerstone of the youth counterculture of the ’60s and ’70s. Today, with increasing legalization, it ain’t just for kids anymore. (Saturday Evening Post)

• These cities could become the biggest winners and losers as more Americans shift to remote work Allows many Americans to work anywhere is likely to cause a reshuffling of the nation’s 403 metro areas, with some losing residents no longer tethered to local offices and others gaining citizens who can work from home and enjoy a better lifestyle (USA Today) see also North America’s Biggest Bet on Downtowns Shifts to the Suburbs Toronto, Montreal and Vancouver built more apartment units per capita than almost every other large North American city over the past decade. But the Covid-19 pandemic and its attendant remote-work revolution now have urbanites leaving in record numbers, emptying condo towers and sending rents tumbling for thousands of mom-and-pop investors who took part in the boom. (Bloomberg)

• Getting to the Bottom of the Runner’s High For years we’ve been crediting endorphins, but it’s really about the endocannabinoids. (New York Times)

• How a Forgotten TV Network Changed Music & Predicted the Future Rock ‘n’ roll accounted for the bulk of The Box’s early catalogue, same as with MTV. But before long, a potent and long-neglected market made itself heard. “Because we allowed people to select what they wanted to see, we very rapidly became a channel that was dominated by hip-hop,” recalls Robson. “They couldn’t get it anywhere else — or, couldn’t get it when they wanted it. Nobody was serving that hip-hop need.”(Thrillist)

Be sure to check out our Masters in Business interview this weekend with Jeff Immelt, former CEO of General Electric from 2001 to 2017. He joined GE in 1982, in its plastics, appliances, and healthcare division, and led GE’s Medical Systems division from 1997 to 2000. His new book is: Hot Seat: What I Learned Leading a Great American Company.

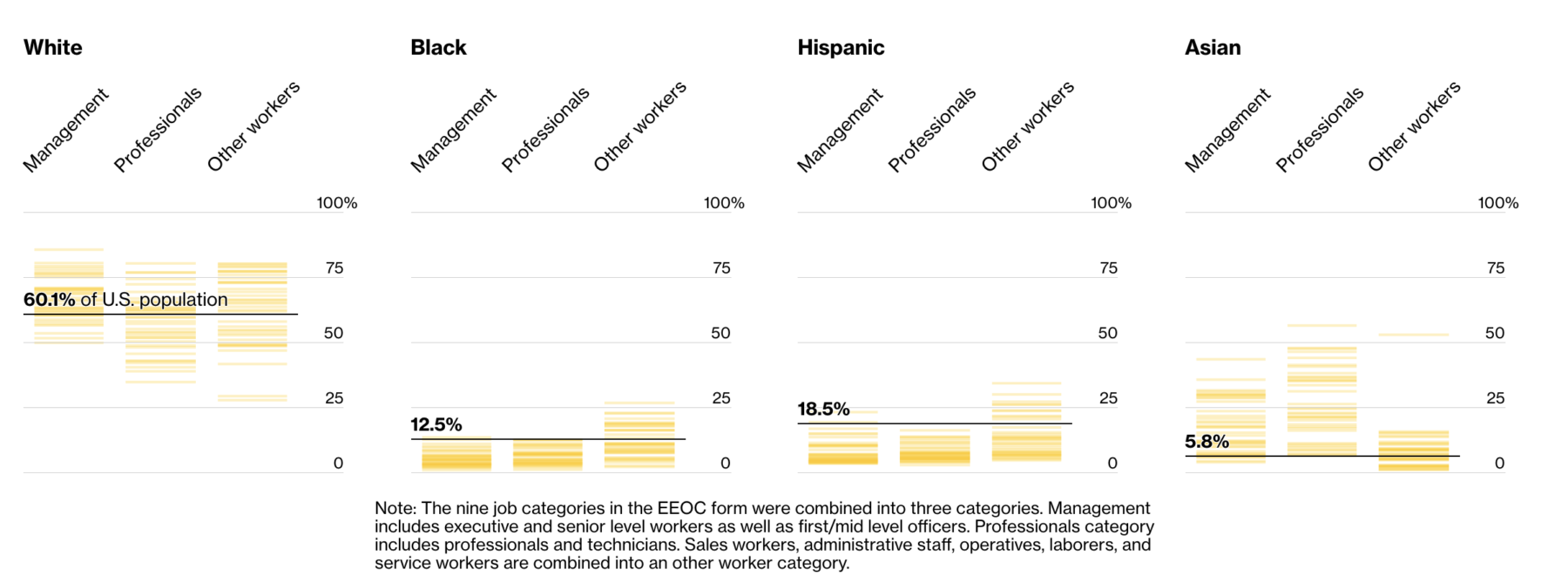

New Data Expose Precisely How White and Male U.S. Companies Are

Source: Businessweek

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.