My end of week morning train WFH reads:

• Coinbase’s Public Listing Is a Cryptocurrency Coming-Out Party With acceptance from traditional investors, a profitable start-up that eases transactions is offering proof of the industry’s staying power. (New York Times) see also These Crypto Bros Want to Be the Guggenheims of NFT Art Perhaps you’ve heard of nonfungible tokens? A handful of collectors already have millions of dollars’ worth. (Businessweek)

• Fast food over fine dining: What spending data tells us about the pandemic recovery Five charts that show how dramatically the pandemic affected our spending (Recode)

• Tactical Shifts: Institutional Investors Are Adjusting Asset Mixes Private credit, real estate, emerging markets. Here are the ways CIOs at HOOPP, the James Irvine Foundation, and two others are solving the allocation puzzle. (Chief Investment Officer)

• How This Chinese Vaping Billionaire Became One Of The World’s Richest Women In Three Years Kate Wang, 39, jumped into the ranks of the world’s richest when her vaping company RLX went public on the New York Stock Exchange in January. Now the Procter & Gamble and Uber veteran faces looming threats from Chinese regulators and skeptical investors. (Forbes)

• Five Superpowers: Restraint, Curiosity, Creativity, Patience & Courage (Reformed Broker)

• Playing Different Games, or why Tiger is eating your lunch (& your deals) We are seeing the emergence of a new velocity-focused strategy in the venture/growth asset class that will fundamentally change the way that venture capital is raised. Tiger’s flywheel that enables them to offer a better/faster/cheaper product to founders while generating more $ gains than their competitors. (The Valley of Dunning-Kruger)

• How a Secretive Family Stash Could Help Pay One of the World’s Biggest Tax Bills When Lee Kun-hee was assembling one of the world’s biggest privately owned art collections, little did he know that it would become embroiled in the Samsung dynasty’s tax woes. His family’s trove includes a portrait of Dora Maar by Pablo Picasso, one of Claude Monet’s water lilies paintings and thousands of other works that together are estimated to be worth $2.7 billion. (Bloomberg)

• The Other Reason the Labor Force Is Shrunken: Fear of Covid-19 Around 4 million adults aren’t looking for jobs, not because they’re scarce but because of worries about catching the coronavirus (Wall Street Journal) see also It’s Not You. It’s a Failed Economy. Why “You Weren’t Hard-Working Enough to Live a Decent Life” is a Self-Destructive Myth(Eudaimonia)

• Is Larry Kudlow Fox Enough for Fox Business? The former Trump official is back in his natural habitat: television. But middling early ratings and the inability — or unwillingness — to go Full Fox suggests that something isn’t right. (Institutional Investor)

• The Redemption of Justin Bieber He made every mistake a child star can make, including the ones that nearly destroyed him. Now—fortified by God, marriage, and a new album, Justice—Justin Bieber is putting his life back together, one positive, deliberate step at a time. (GQ)

Be sure to check out our Masters in Business interview this weekend with Rob Arnott, founder and chairman of Research Affiliates. The firm created & patented a methodology for basing indexes on fundamental metrics instead of market cap weighting, and its strategies runs over $160 billion in assets. Arnott is the author of over 100 academic papers, and is the co-author of the book “The Fundamental Index: A Better Way to Invest.”

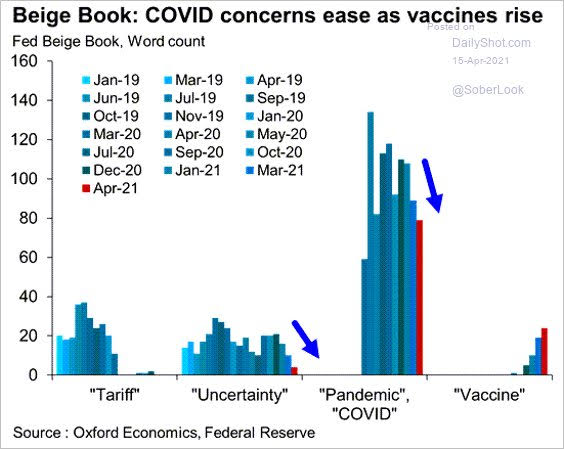

Vaccine optimism offsetting lingering economic damage

Source: @Rob_Hager

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.