My back to work morning train WFH reads:

• CEOs Can’t Stay on Society’s Sidelines Anymore They are no longer closely aligned with the Republican Party and face increasing pressure to wield their considerable influence on issues such as voting rights, income equality and climate change. (Bloomberg)

• If You Sell a House These Days, the Buyer Might Be a Pension Fund Yield-chasing investors are snapping up single-family homes, competing with ordinary Americans and driving up prices (Wall Street Journal) see also House Prices Are Inflating Around the World Pandemic-related stimulus, ultralow rates and changes in buyer behavior are turbocharging markets from Europe to Asia (Wall Street Journal)

• One Couple’s Fight to Stop the ‘Gentrification’ of Sneaker Collecting Another Lane’s membership-only platform emphasizes community over the relentless drive for profit. (BusinessWeek)

• Bidenomics, explained The tenor, pace, and scope of Biden’s economic programs proposals, and the muted nature of the ideological opposition, suggest that we’ve entered a new policy paradigm — much as when FDR took office in 1933 or Ronald Reagan in 1981. Every President comes in with a laundry list of initiatives, but once every few decades a President comes in with a new philosophy for what policy should look like. And that is happening now. (Noahpinion)

• Can Clubhouse Kill the Investment Conference? Clubhouse’s value is not in its current investment content, which by and large consists of scores of bitcoin panels with moderators who love to hear themselves speak but who shouldn’t be speaking in front of a live audience; meandering discussions of nonfungible tokens (in which I heard one participant state, “Why does the world have such a problem with dildo art?”); and endless startup pitches (although there are some exceptions, especially in the venture capital, private equity, and ESG and climate investing space).(Institutional Investor)

• Seven Infrastructure Problems in Urgent Need of Fixing The Biden administration has pledged a $2 trillion investment in the nation’s infrastructure. With century-old water systems and schools vulnerable to earthquakes, there is no shortage of need. (New York Times)

• The Fourth Surge Is Upon Us. This Time, It’s Different. We now have an unparalleled supply of astonishingly efficacious vaccines being administered at an incredible clip. If we act quickly, this surge could be merely a blip for the United States. But if we move too slowly, more people will become infected by this terrible new variant, which is acutely dangerous to those who are not yet vaccinated. (The Atlantic)

• Facebook is defending its algorithms. Critics aren’t buying it. The company is on a mission to convince users that it’s listening. (Vox)

• One Republican’s Lonely Fight Against a Flood of Disinformation After losing an ugly congressional race last year, Denver Riggleman is leading a charge against the conspiracy-mongering coursing through his party. He doesn’t have many allies. (New York Times)

• Annie’s Mac and Cheese is based in the Bay Area, but Annie is not. Here’s her story. he more I read about Annie’s, the second-most popular mac and cheese brand in the United States behind Kraft, the more I wanted to know about the mysterious woman behind the brand. Her number isn’t on the boxes of mac and cheese anymore, obviously. So a few weeks ago, I left a voicemail for a number that I figured had a 50-50 shot of being accurate. Then I waited. (SFGate)

Be sure to check out our Masters in Business interview this weekend with Shirl Penny, founder and CEO of Dynasty Financial Partners. Dynasty has 50 RIA offices, 250 advisors + over $60B in assets on their platform. Penny was recently named to Investment News’ 40 under 40 list.

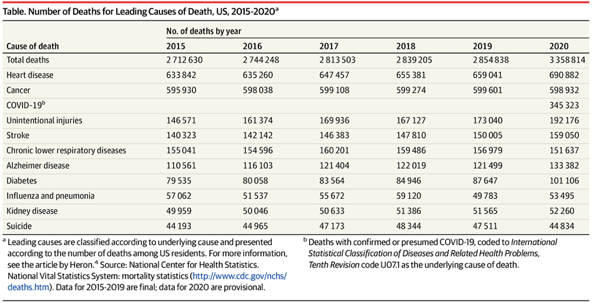

The Leading Causes of Death in the US for 2020

Source: JAMA

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.