My back to work morning train WFH reads:

• In 2020, There Was an Epic Collapse of Demand. Now, the Problem Is Supply. Recent setbacks raise doubt about how quickly businesses can respond to customers who seem intent on spending (Upshot)

• What happens after the stock market is up big? 12 month returns were negative 65% of the time following a gain of 50% or more in a 1-year period. However, there wasn’t a single 3-year period following a 12-month gain of 50% or more that showed a negative return. (Fortune)

• Don’t Be Fooled by This Stock Market’s Newest Magic Trick A quirk in the calendar just did some heavy lifting, causing the market declines from early last year to disappear from a key fund-manager benchmark. (Wall Street Journal)

• A Hidden Bond-Market Problem American savers could once count on bonds to provide meaningful returns with modest risk. Not anymore. (Bloomberg)

• Private Investment Questions and Issues to Consider Interest in Private Equity and Venture Capital investments continues to grow. Institutional investors and family offices are looking to increase allocations to the space. New initiatives are underway to make private investments more broadly available to investment advisors and individual investors. But private investing is illiquid, requires a multi-year commitment, and affords investors limited rights and transparency (Fiduciary Wealth Partners)

• Inside the Fight for the Future of The Wall Street Journal A special team led by a high-level manager says Rupert Murdoch’s paper must evolve to survive. But a rivalry between editor and publisher stands in the way. (New York Times)

• The World’s Wealthiest Countries Are Getting Vaccinated 25 Times Faster Economies with the highest incomes have 40% of the world’s vaccinations, but just 11% of the global population (Bloomberg)

• You Won’t Remember the Pandemic the Way You Think You Will The pandemic has not been a single, traumatic “flashbulb” event like the assassination of John F. Kennedy, the fiery disintegration of the space shuttle Challenger, or 9/11. Starting in March 2020, hundreds of millions of Americans began forming their own impressions of it. As psychologists and anthropologists who study memory will tell you, we tend to lay out our anecdotes almost like short stories or screenplays to give our lives meaning; our plots (do they have silver linings? hopeful endings?) can reveal something about how we handle setbacks (The Atlantic)

• Joe Biden Wants to Put the World’s Corporate Tax Havens Out of Business The administration is vowing to fund a historically ambitious infrastructure and economic modernization plan in part by solving one of the thorniest problems created by global capitalism. “If implemented, such an international agreement would lead to a collapse of the development model of tax havens. A high global minimum tax can change the face of globalization.” (Slate)

• Wobbling muons hint strongly at the existence of bizarre new physics Muons aren’t spinning the way the best physics model predicts. Why not? It may be due to completely unknown subatomic particles popping into and out of existence in the quantum foam. This isn’t some sort of sci-fi technobabble. This is from quite real experimental results, and may very well be the Universe telling us we don’t yet understand everything about it. (Syfy Wire)

Be sure to check out our Masters in Business interview this weekend with John Schlifske, CEO of Northwestern Mutual. The firm underwrites over $2 trillion in life insurance, with $200 billion in client assets. Schlifske joined Northwestern Mutual in 1987 as an investment specialist, and climbed through the ranks, becoming CEO 11 years ago. The firm announced a record $6.2 billion dividend in 2021.

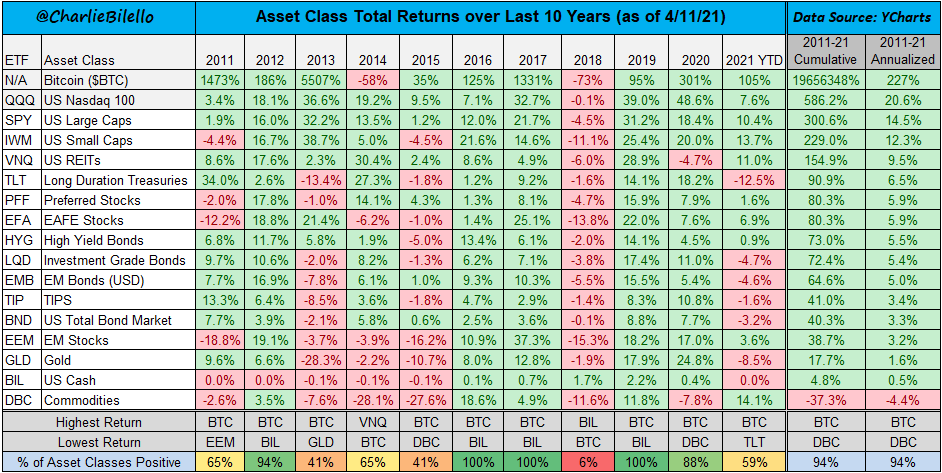

Asset Class returns over the last 10 years

Source: @charliebilello

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.