My back to work morning train WFH reads:

• “There Was No Money Machine That Could Pay These Returns.” The inside story of how Jim Vos and his team at Aksia helped unspool the mystery of Bernie Madoff. (Institutional Investor)

• Regulated cryptocurrency exchanges: sign of a maturing market or oxymoron? Many cryptocurrency exchanges are now making proud claims about their regulated status, but does “regulated” really mean what investors think? Martin C.W. Walker and Winnie Mosioma review 16 leading exchanges to find out. (LSE Business Review) see also If you believe, they put a Dogecoin on the moon Dogecoin — the crypto token that was started as a joke and that is the favourite of Elon Musk — is having a bit of a moment. At the time of writing this, it is up over 200% in the past 24 hours — tripling in value. Over the past week it’s up more than 550% – almost 7X! (Financial Times Alphaville)

• You Want to Invest Responsibly. Wall Street Smells Opportunity. Investors who hope to do good with their dollars are pouring money into ESG funds. Asset managers are eager to give them what they want—for a price. (Wall Street Journal)

• Shiller: Looking Back at the First Roaring Twenties To understand where the stock market may be heading, a Nobel laureate examines the pop culture of one of the greatest bull markets in history. (New York Times)

• The One Redeeming Quality of NFTs Might Not Even Exist If you look at them closely, NFTs do almost nothing to guarantee authenticity. In fact, for reasons we’ll explain, NFTs may actually make the problem of authenticity in digital art worse. (Slate)

• SPAC Wipeout Is Punishing Followers of Chamath Palihapitiya All six of Palihapitiya’s Social Capital Hedosophia-linked blank-check companies have plunged more than the broader SPAC market since it hit its peak in mid-February. One of them — Virgin Galactic Holdings Inc., a space tourism business that’s backed by Richard Branson — is down more than 50%. All of these losses are greater than the 23% average decline in SPACs (Bloomberg)

• Joining an HOA? There Will Be Hell to Pay All of the downright dreadful things you need know if you’re buying a property governed by a homeowners association (Wall Street Journal)

• GOP attacks on Biden’s plan are imploding. New data will make this even worse. In 2017, Republicans slashed corporate tax rates, which decimated corporate tax receipts. U.S. corporations avail themselves of the benefits of the U.S. economy — infrastructure, workforce and the like — but contribute very little to it. (Washington Post)

• What Octopus Dreams Tell Us About the Evolution of Sleep Understanding how other animals dream could help us figure out why it’s so important to the human brain, and why it may have been preserved throughout history. (Wired)

• The Black Keys Detail Blues Covers Album, Share “Crawling Kingsnake” The duo’s Delta Kream features covers of John Lee Hooker, Fred McDowell, Robert Lee Burnside, and more (Pitchfork)

Be sure to check out our Masters in Business interview this weekend with Rob Arnott, founder and chairman of Research Affiliates. The firm created & patented a methodology for basing indexes on fundamental metrics instead of market cap weighting, and its strategies runs over $160 billion in assets. Arnott is the author of over 100 academic papers, and is the co-author of the book “The Fundamental Index: A Better Way to Invest.”

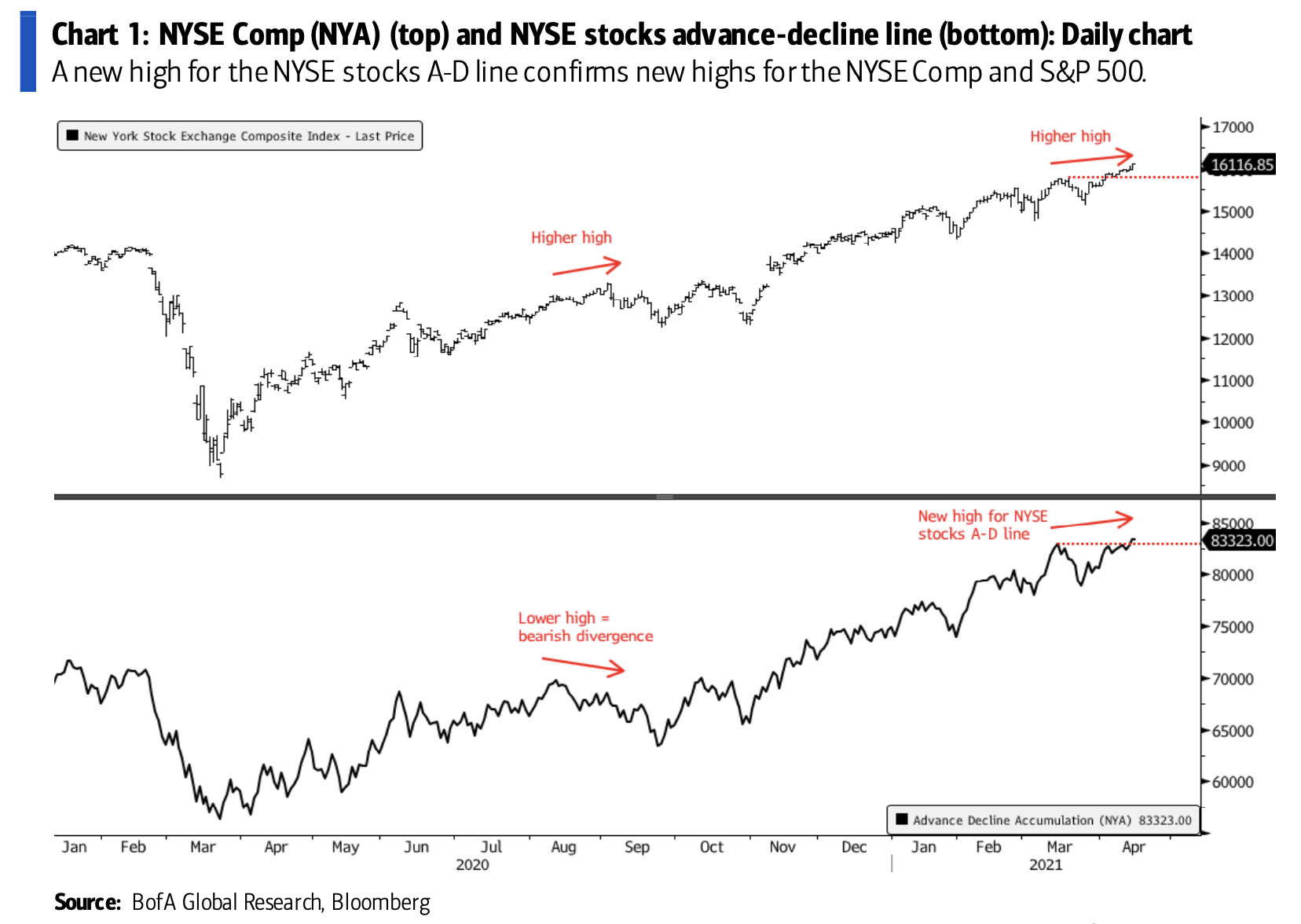

Breadth: NYSE stocks A-D line scores a new high

Source: BofA Global Research, Bloomberg

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.